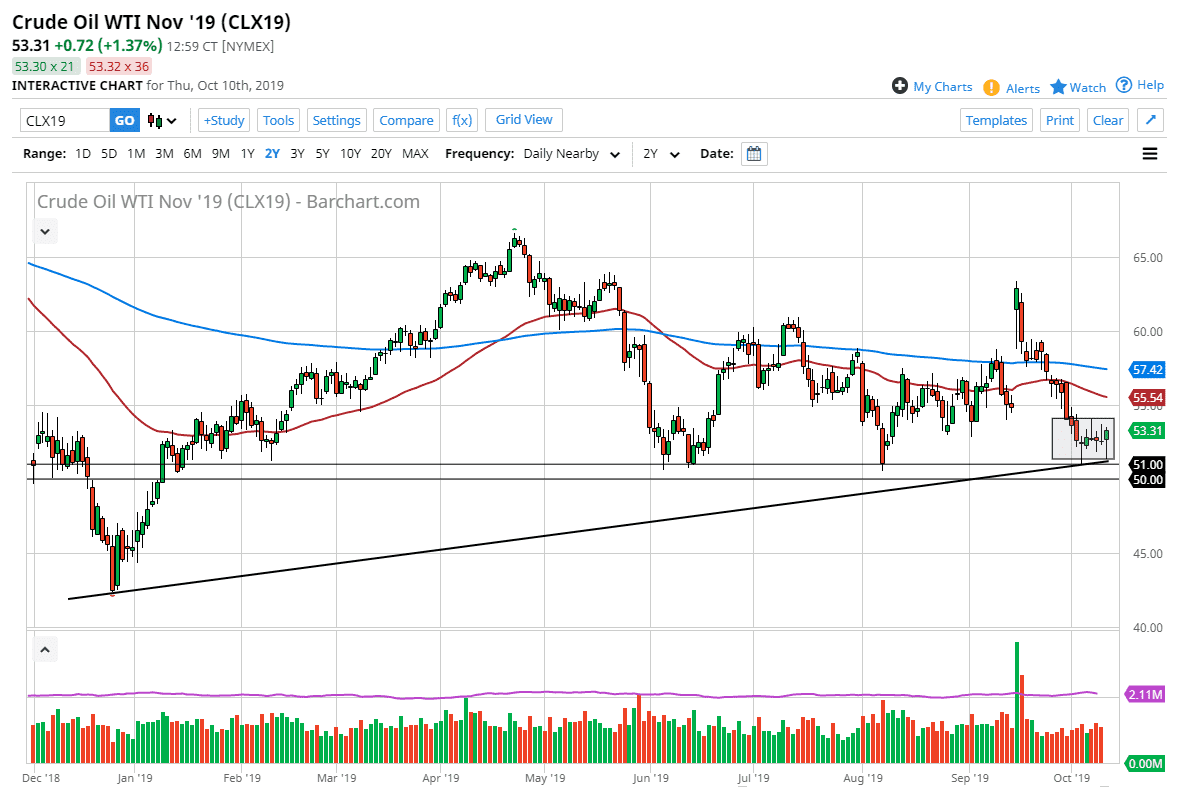

The West Texas Crude Oil market is likely to find sellers above after a very positive session on Thursday. Don’t be wrong, I do think that eventually we are more likely to break out to the upside than break down, but at this point there is a thick “zone of resistance” that starts at the $54 level an extensive the $55 level. Given enough time, I believe that we will roll over in this area and back into the gray box that I have drawn. At this point, the $51 level underneath shows signs of support that extends down to the $50 level. That is a “zone of support” that is rather thick as well. Beyond that, there is also an uptrend line that offers quite a bit of support.

Needless to say the nonsense it’s coming out of the US/China trade talks will for the markets around as well, so keep in the back of your mind that there is a significant amount of headlines coming and of course rumors that will try to trick traders in the marketplace. At this point, this is a market that will continue to go back and forth. Overall, the market continues to grind back and forth but certainly has made a bit of a statement during the day on Thursday as we are hanging on the some of the gains. Because of this I believe that we will find sellers above for the short term but given enough time we will probably break out to the upside based upon the structural support underneath.

That being said, there is always the possibility that we get the exact opposite, and if that happens the break down below the $50 level would be crucial and could send this market down to the $45 level. This would probably coincide with some type of disaster coming out of the US/China trade talks, which although I’m not expecting much, I do not think that it is going to necessarily implode either. Think of it like Brexit: it’s a never ending drama that isn’t going to be solved anytime soon. So far, that has served me well when dealing with all things between the United States and China. Expect volatility, I think a short-term pullback will probably come, but eventually we could break out on the right catalyst.