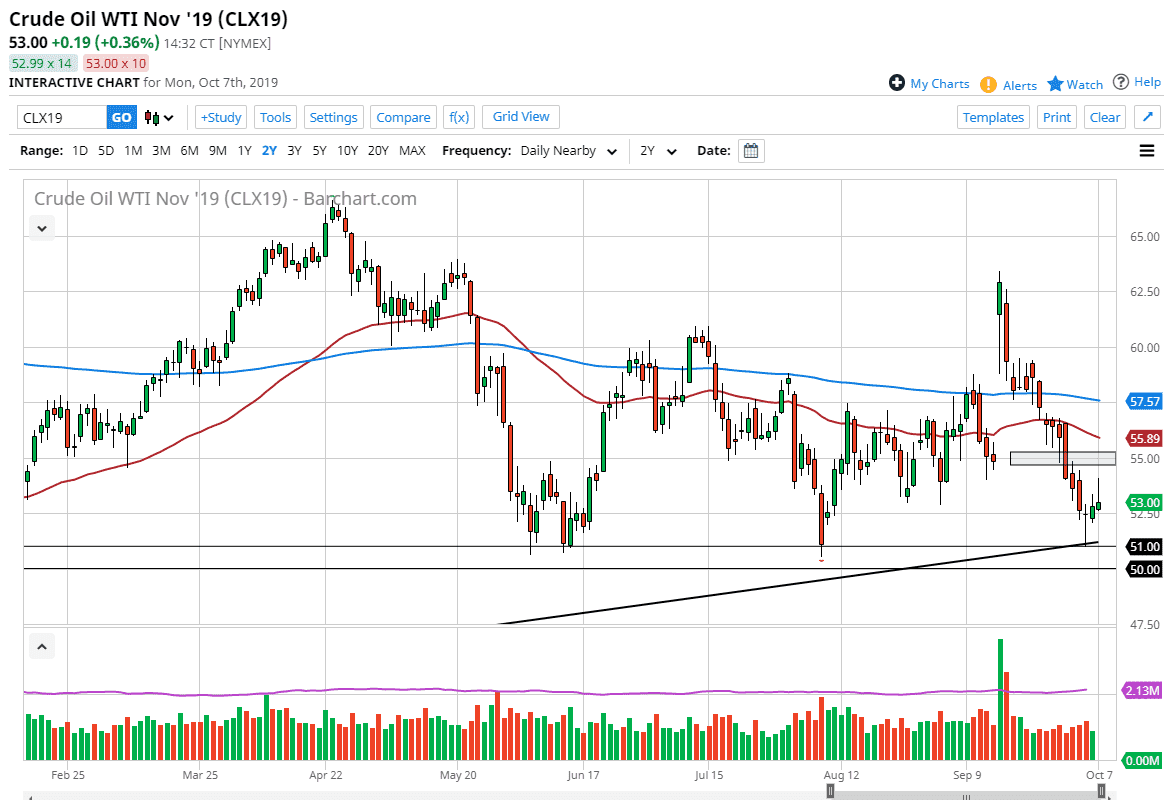

The WTI Crude Oil market initially shot higher during the trading session on Monday, breaking above the top of the shooting star shaped candle stick from the Friday session, and more importantly the top of the hammer from the Friday session. While this is a very bullish sign, we have failed at the first signs of resistance, even though I still think there is a good shot that this market tries to grind towards the $55 level. Because of this, I believe that the market is going to be very noisy, but I still think that we are at extremely oversold conditions, and therefore a bit of a bounce makes quite a bit of sense.

If we did break down below the uptrend line underneath, and more importantly the $51 level, we have significant support all the way down to the $50 level. If we break down below the $50 level, then the market is very likely to go looking towards the $47.50 level after that. All things being equal, it’s very likely that we will continue to see a lot of volatility as global demand is going to be a major issue, as well as the US dollar. The US/China trade talks also have their say as to what happens with petroleum demand, so all things being equal I think that it is going to be difficult to hang onto a longer-term move. If we were to somehow break above the $55 level, it’s very likely that the 50 day EMA which is painted in red could also cause issues. Although I think that we probably continue to see buyers on dips, there is a significant amount of noise above.

If we did somehow break down, I suspect that this would kick off a major move to the downside that would be explosive. I don’t necessarily expect to see that, as we now have a conflicted market in the form of a hammer followed by a shooting star within three candles. That typically means that you are going to bounce around in grind sideways before making an impulsive move in one direction or the other. For what it’s worth, I have not found a statistical advantage as to which side wins, so that’s worth paying attention to. As there is more longer-term support underneath, I would assume a bounce makes more sense going forward.