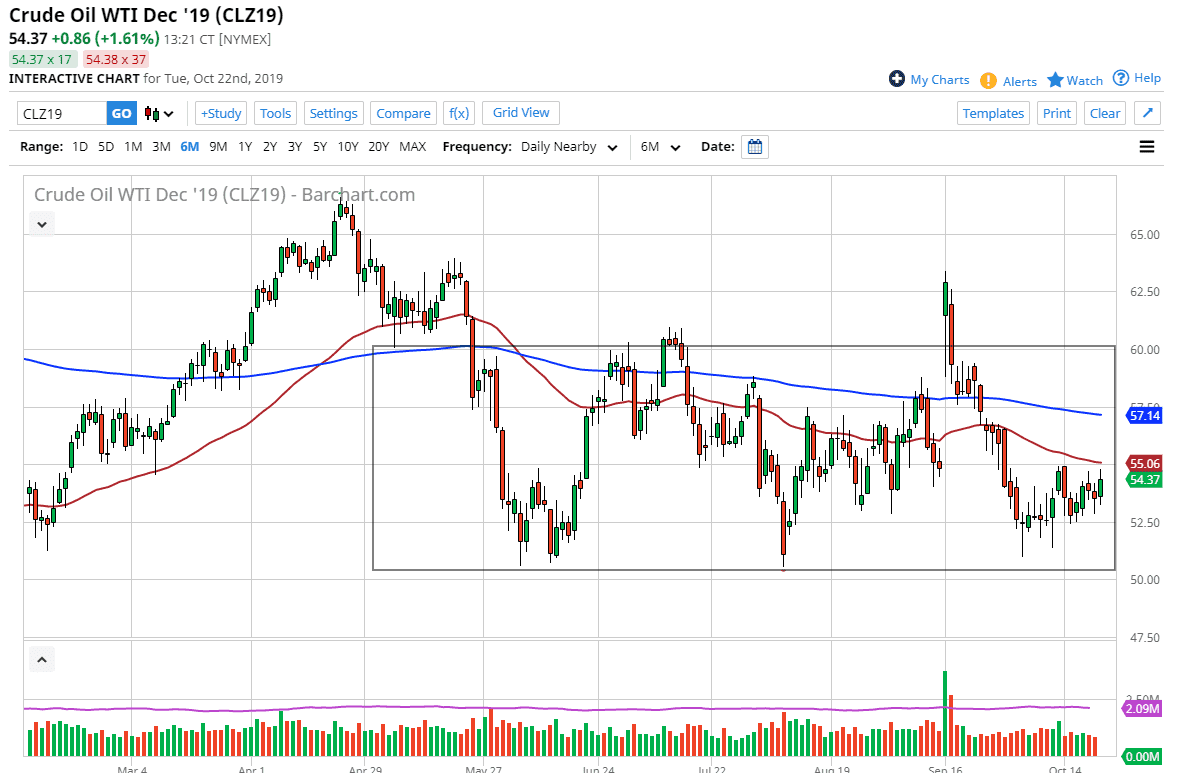

The West Texas Intermediate Crude Oil markets have rallied a bit during the trading session on Tuesday, as we continue to build a bit of a base between the $52.50 level and the $55 level. This is an area that can cause quite a bit of noise, as seen on the short-term charts. That being said though, it’s very likely that the market will eventually find a catalyst to break higher. During the Tuesday session, we did start to see the first rumblings of something that could in fact come into the picture.

At this point, it’s still just a rumor but people are talking about OPEC cutting production. If that’s going to be the case it could drive up the value of crude oil temporarily, but at this juncture I believe that it will simply be another reason to continue the overall consolidation that is marked on the chart between the $50 level in the bottom and the $60 level on the top. Overall, it looks as if as we are simply trying to find enough strength to bounce to the upside and play out the overall rectangle that I have marked on the chart. Obviously the 50-day EMA above could cause some issues but once we clear that which is extensively at the $55 level, the market will be free to go to the $57 level next which is the 200-day EMA. In the meantime, I like the idea of buying pullbacks and I think that the $52.50 level will offer a bit above short-term “floor”, but obviously there will be even more support at the $50.00 level.

At this point, I am bullish, but I recognize that looking for value will probably be the best way going forward, so look to short-term charts to pick up a little bit of a pullback. Signs of support on a short-term chart is the way to get involved, and as a result I have no interest in trying to short this market. All things being equal, I am bullish, but I recognize that a breakout below the $50 level would be catastrophic. With rumors of production cuts out there, it will probably continue to push the market higher. It will be somewhat limited though, because the United States of course is a major producer of crude oil and has changed the overall outlook.