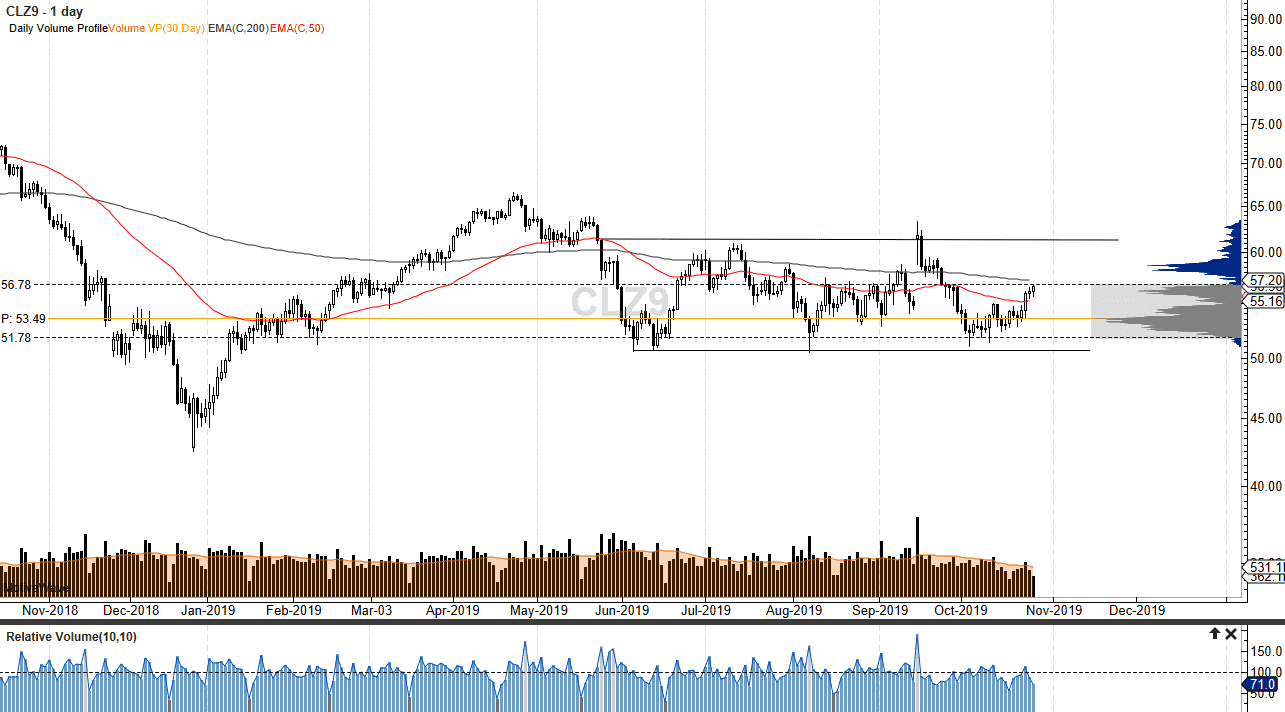

The West Texas Intermediate Oil market has rallied a bit during the trading session on Friday as we continue to see a bit of a bullish move to the upside. Underneath, there is the 50 day EMA and potential support but when you look at the 30 day volume profile, we have several spikes that extend near the $59 level, $56 level, and then the $53.50 level which is also the point of control for the last month. At this point, I suspect that the market is looking to try to grind to the upside and perhaps reach towards the top of the overall consolidation as marked upon the chart.

This makes sense, because the crude oil markets do tend to enter $10 ranges from time to time, as participants get used to kicking it back and forth. There is a certain amount of demand being picked up out there due to the US/China trade talks supposedly going a little better, but at the end of the day the reality is that markets are essentially trapped between two levels as there isn’t much in the way of a catalyst to break out one way or the other.

Looking at the market, I do think that we continue to try to grind higher but overall, I still think it’s good to be as easy to rally from here as it was a few dollars ago. We are essentially near the “fair value” level, so I like buying dips more than anything else as crude oil would start to get “cheap.” The rumors of OPEC cutting production during the December meeting have been part of what has been driving the market higher as well, but right now that is simple conjecture. Beyond that, OPEC has a long history of cheating on production cuts as some countries will put a little bit more out there in order to bring more cash into their economies. That is one of the major weaknesses of OPEC, most of the countries involved desperately need oil revenue to function. On the other side of the spectrum, we have the US that’s throwing oil out as quickly as it can produce it, which is throwing global supply into disarray and out of whack compared to historical norms. The United States is showing no signs of slowing down when it comes to production, so one would have to think that OPEC has a bit of an issue on its hands.