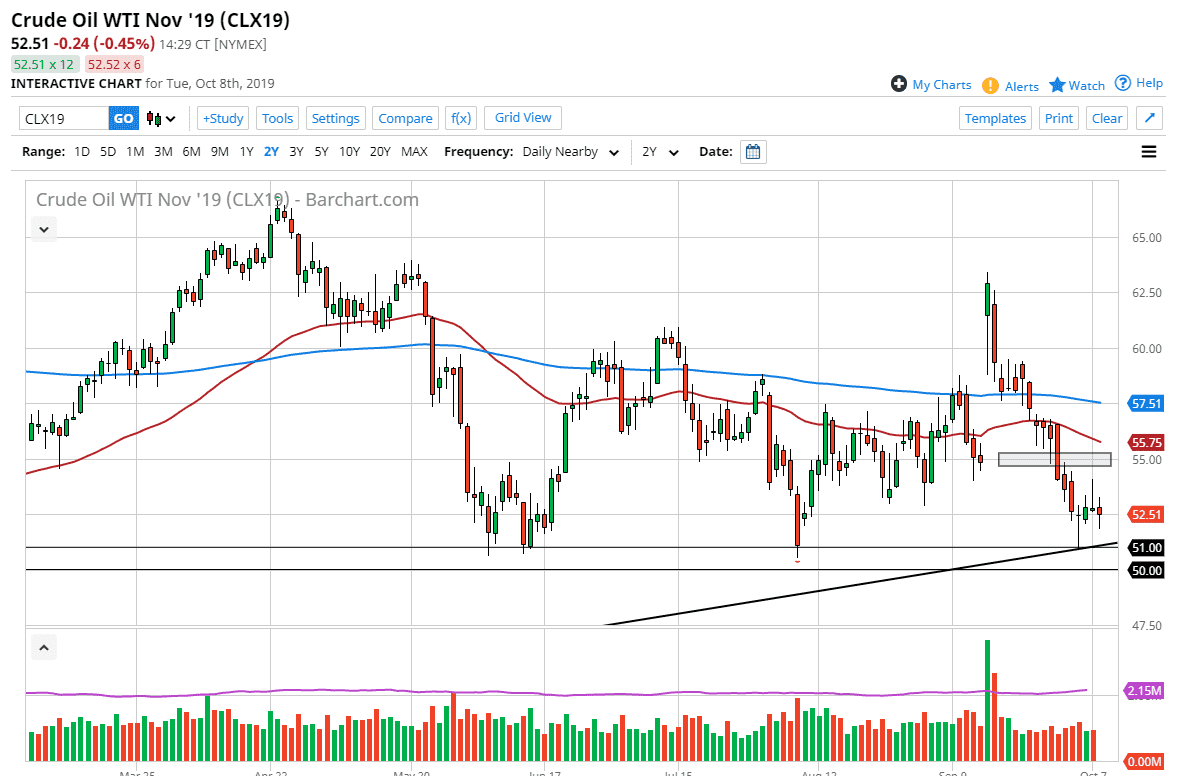

West Texas Crude Oil markets have fallen a bit during the trading session on Tuesday, breaking below the $52.50 level. The market has been consolidating over the last couple of days, with the shooting star on Monday showing resistance, the hammer on Tuesday showing support, and the Thursday candle stick showing support as well. All things being equal it looks as if we are trying to form some type of consolidation area, which of course could launch the next move. Typically, you will see these conflicting candlesticks formed just before inertia gets released, and the market takes off in one direction or the other.

Looking at the chart, the uptrend line that crosses through the $51 level of course is something that should be paid attention to, just as the $51 level itself should be as it has offered quite a bit of support extending down to the $50 handle. It is because of this that I believe plenty of buyers are to be found in this market, and that breaking down through this area is going to be very difficult. However, if we were to break down below the $50 level, it most certainly opens up the door to the $47.50 level, and then eventually the $45 level underneath there which is significant support based upon longer-term structural charts.

Looking at the chart, if we were to break above the top of the consolidation area, which is the shooting star, it’s likely that the $55 level will offer quite a bit of resistance. A break above there, and perhaps even the 50 day EMA could open up the door to higher levels, maybe even as high as $57.50. While that is possible, I think it’s going to take a significant amount of momentum to make that happen. I anticipate that the easiest and more likely scenario is going to be somewhat consolidated.

Looking at the chart, it’s probably more likely that we go back and forth between the $51 level underneath, and the $54 level above as the market continues to show quite a bit of choppiness and this area should be rather difficult to overcome. However, once we do it’s very likely that we will get an explosive an impulsive candle stick, but until then I think short-term back and forth trading probably is the most likely of scenarios that we will see.