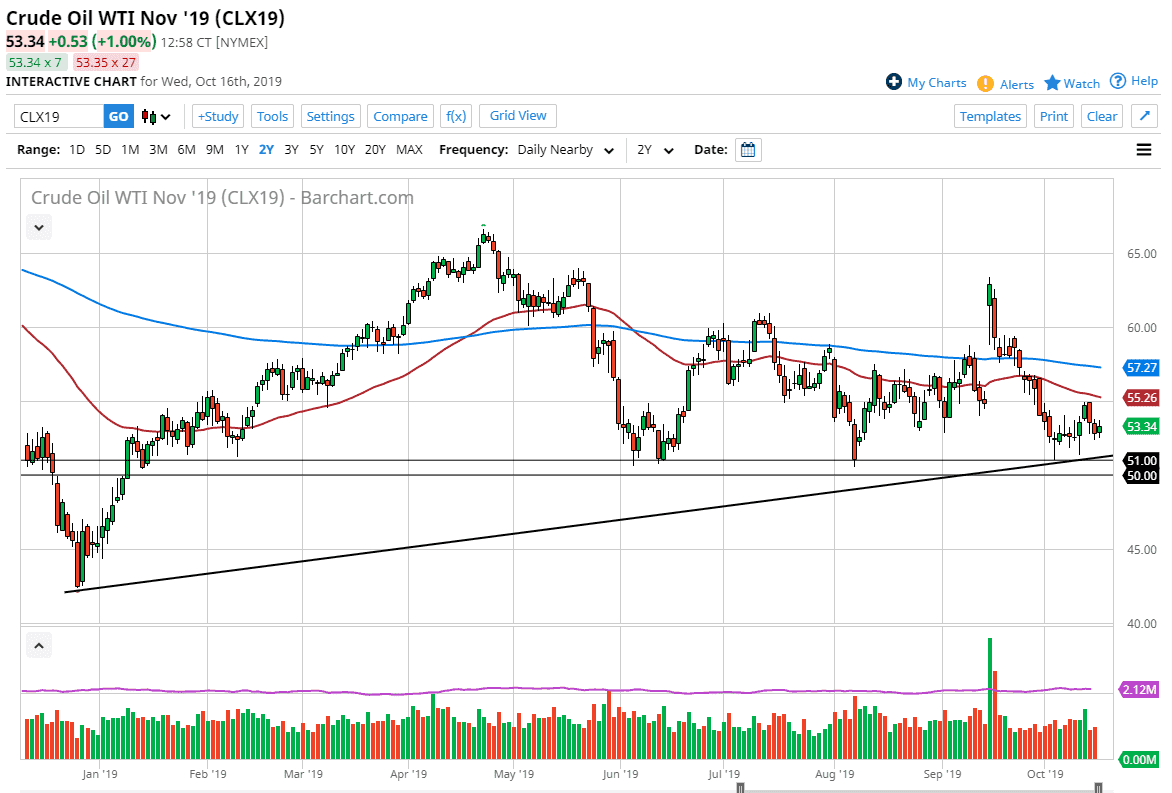

The WTI Crude Oil market rallied slightly during the trading session on Wednesday as we continue to see significant amounts of support underneath, and at this point it’s likely that there will continue to be support underneath, as the uptrend line underneath continues to offer significant support below. Beyond that, the $51 level extends down to the $50 level as a support range. With that being the case, the market is very likely to continue to find plenty of interest underneath. Beyond that, there are a lot of issues around the Middle East right now, and that of course will potentially throw a lot of volatility into the crude oil markets as well.

Above current pricing, the 50 day EMA is starting to rollover, as it offers a bit of resistance at the $55 level. In other words, we are being squeezed in this area, as there is a lot of confusion at this point. At this point, I suspect that the back-and-forth choppy behavior will continue going forward as the volatility picks up. The inventory number of course will come out during the day and will throw this market back and forth. If we were to break above the 50 day EMA though, then the market is likely to go looking towards the 200 day EMA which is painted in blue on the chart.

That being the case, the market looks likely to show a lot of opportunities for short-term traders in both directions. Ultimately though, we will find some type of explosive or impulsive candle stick to give us directionality. Looking at the chart from the longer-term standpoint, we could be trying to form some type of range between $50 and $60. If that’s going to be the case, then obviously we are closer to the bottom than the top. Ultimately, when you look at the short-term charts, the $52.50 level is also crucial, and seems to attract a lot of momentum to the upside. With that being the case, I like the idea of buying short-term dips in that area unless of course the inventory number comes out horribly. Once we get through that news, it’s very likely that we will continue to bounce around between that $52.50 level and the $55 level on the short-term charts. From a longer-term standpoint, I do believe we will eventually break to the upside.