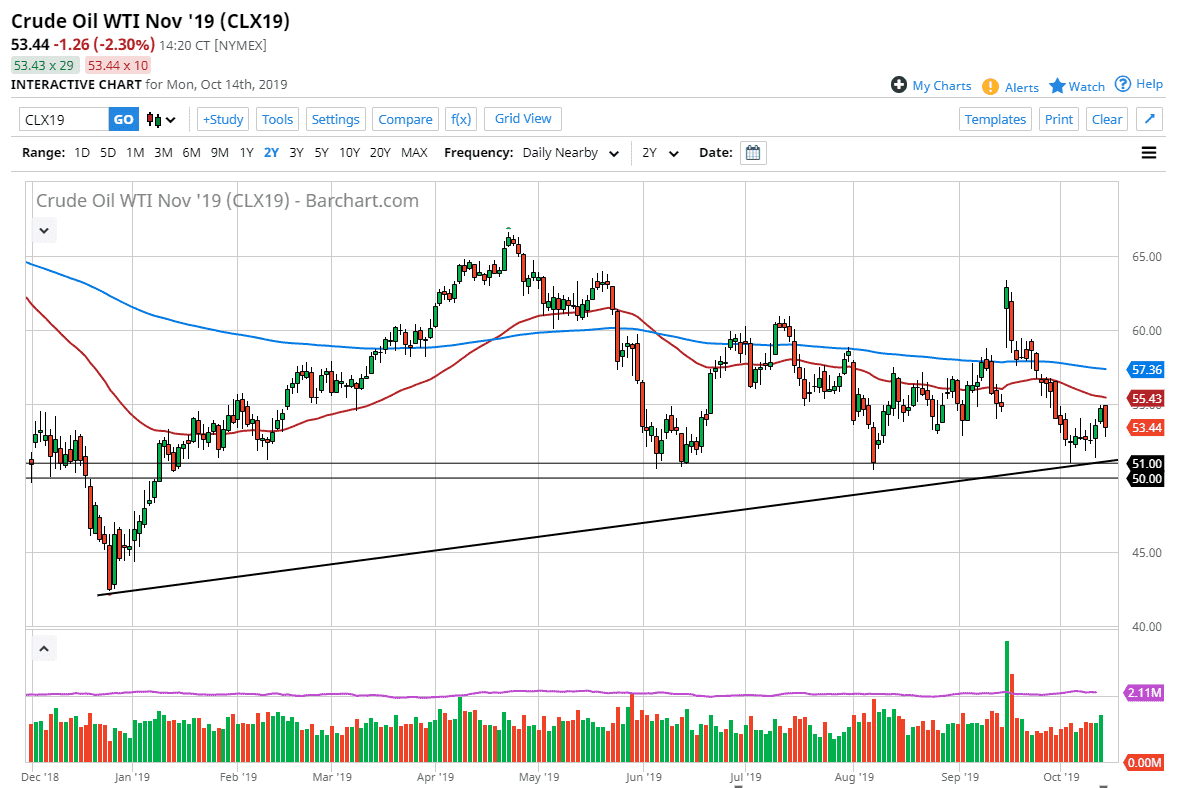

The West Texas Intermediate Crude Oil market has broken down a bit during the trading session on Monday, as the $55 level has offered a significant amount of resistance. The 50 day EMA is starting to reach towards that area, as the market will continue to pay attention to the major moving averages. Having said that, the market is reaching towards the support level underneath that the market had been bouncing around in, which is also supported by several other factors.

The uptrend line that is slicing through the $51 level should continue to be a massive amount of bullish pressure, just as we have plenty of support below the $51 level that extends down to the $50 level. All things being equal, a pullback from here should continue to find buyers underneath and perhaps offer a “buy on the dips” type of scenario. If we were to break down below the $50 level, this market will unravel and go down to the $45 level. However, it seems very unlikely to happen based upon what we have seen recently. At this point, a break above the 50 day EMA could open up the move to the 200 day EMA which is currently trading near the $57.25 level. A break above that level could come, driving the market towards the $60 level.

With the Turkish entering Syria, there could be more concerns about crude oil, and the supply of it. That being the case, it’s likely that we have more upward pressure than down, as the fear factor has to be taken into account. At this point, it’s very likely that the markets will continue to find buyers underneath so I’m looking at the dips at this point as an opportunity to pick up a bit of value. Whether or not we can continue to go higher is a completely different question, but to me it looks likely to form another range bound market, perhaps extending as high as $60. This will continue to be very noisy, and you should look at this as a larger battlefield between the $60 level and the $50 level underneath. There are multiple miniature support and resistance areas, but at this point it makes sense that we are going to continue to see noisy action and therefore short-term trading. I still favor the upside though, a least at this point.