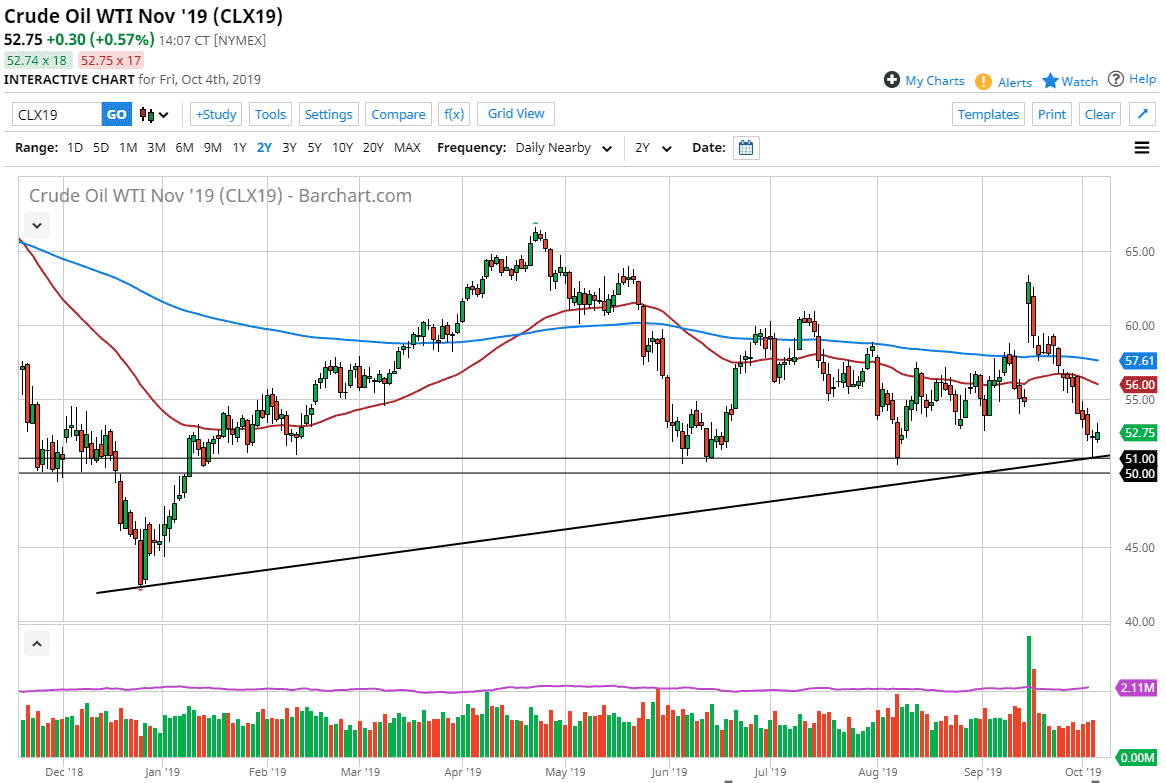

The West Texas Intermediate Crude Oil market has rallied a bit during the trading session on Friday, breaking above the top of the hammer from the Thursday session. On the surface, this is exactly what a buyer would want to see as it is at an intersection of both support in several forms. Because of this, it’s likely that we could get a little bit of a bounce in the short term, but there are still a lot of longer-term issues out there coming into play as well.

The hammer that formed on Thursday of course is one of the first things that should stand out. Breaking above the top of the hammer for the Friday session was technically a long signal, but we have given back quite a bit of that to show signs of hesitation. This is a market that has recently gapped higher after a Saudi drone strike, but then wiped out that gap rather quickly. It is because of this that I feel the $55 level above will offer significant resistance, especially if the 50 day EMA gets close to it. To the downside, the uptrend line did offer support right at the bottom that hammer so it makes a lot of sense that we bounced. Beyond that, the $51 level is the beginning of a “zone of support” down to the psychologically important $50 level. It is because of this that if we break down below the $50 level, the market is a massive sell, and should send this market down to the $45 level.

In the short term, I would expect a lot of volatility and it does look like we are trying to build up inertia for one of the two possible moves. I don’t necessarily think that we are going to simply shoot in one direction or the other, but the fact that we are trying to build up enough momentum to do so could change things. With the demand out there being a bit soft, it’s very unlikely that the market will take off to the upside for anything significant. The 50 day EMA should also cause quite a bit of resistance on looking to fade rallies but do recognize that if you are particularly quick you may be able to pick up a little bit in the way of gains on this potential bounce. A break down below the $50 level, I would be aggressively short for the next five dollars.