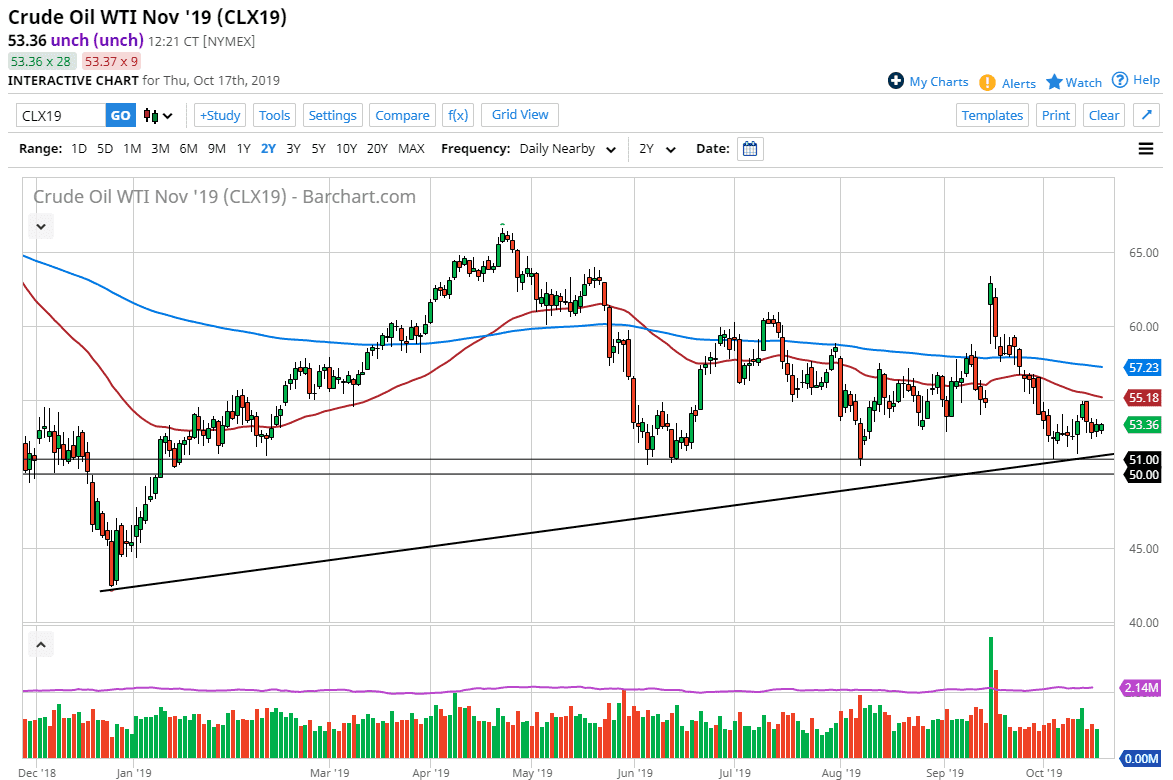

Looking at the West Texas Intermediate market, you can see that we have rallied a bit during the trading session. At this point in time, it’s a very bullish candle stick considering that the inventory number has come out extraordinarily bearish but we still find the market rallying. This was mainly due to the fact that gasoline inventories shrank, suggesting that perhaps there is more demand coming down the road.

Beyond that, there is an uptrend line underneath, that coincides nicely with the $51 level that it shows support that extends down to the $50 level. At this point it makes quite a bit of sense that the market should continue to flow from here, because when you look at the longer-term charts, you can see that there is a significant amount of support at the $50 level just as there is significant resistance at the $60 level. All things being equal, it looks as if we are going to continue the overall consolidative action. Looking at this chart, you can make a significant argument for a return to balance, which would make quite a bit of sense to see as the market tends to be very technically driven anyway.

The 50 day EMA above at the $55.18 level should offer resistance, so if we can break above that then I think the next target would be the 200 day EMA at the $57.23 level. Overall, I believe that the market should continue to see a lot of choppiness and volatility, but I do have more of an upward bias at this point, especially considering that the headline numbers couldn’t sink the market for more than a few minutes during the Thursday session, and that suggests that we will continue to see a return to normalcy. Beyond that, we also have a lot of political headwinds in the Middle East as violence is flaring up again. It is only a matter of time before something happens to fire off oil markets to the upside. At the other side of the coin, there is the fact that there is plenty of supply out there. Ultimately, this is a bit of a balancing act and crude oil does tend to find areas the balance from. At this point, I believe the we are starting to find that, and I don’t think we will leave this $10 range anytime soon.