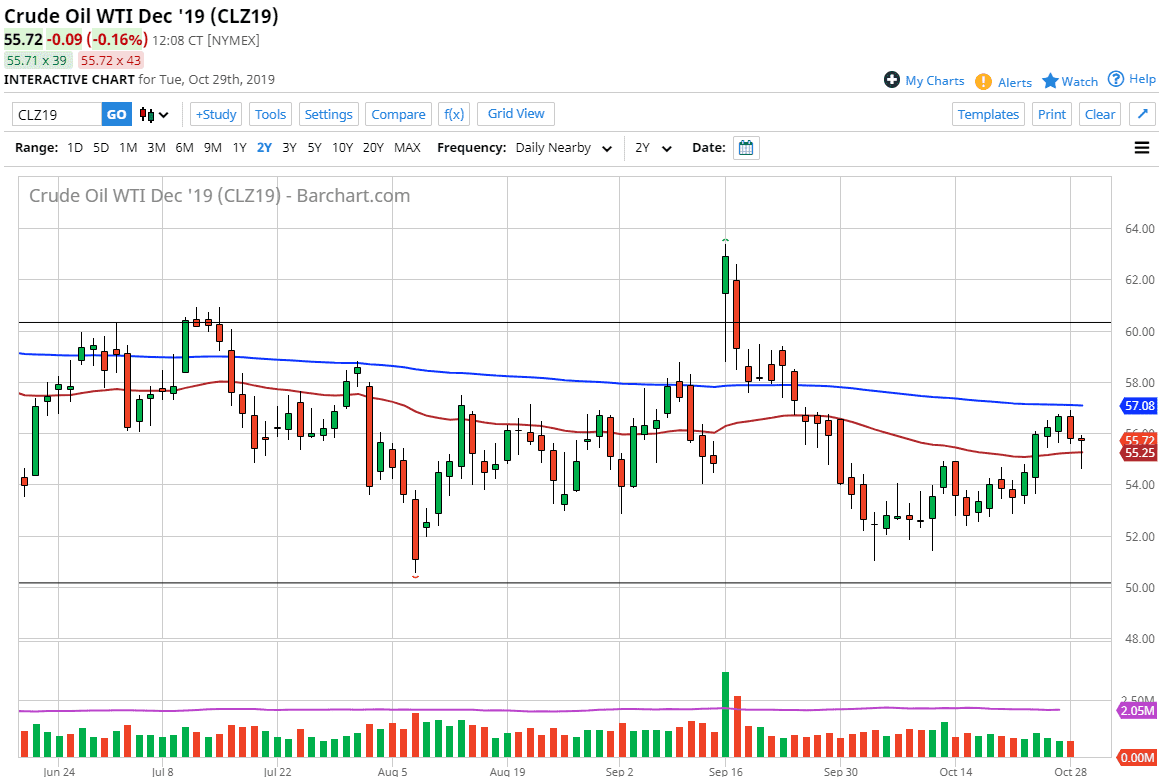

The West Texas Intermediate Crude Oil market has initially fallen during the trading session as we dipped towards the $55 level and even below it initially but bounced enough to form a hammer. The hammer sits just above the 50 day EMA which is a very bullish sign, as we are trading below the 200 day EMA but above that significant 50 day EMA.

Looking at the market, it looks as if we are trying to build up the necessary momentum to go much higher, and of course a break above the 200 day EMA which is substantively at the $57 level, could send this market much higher and perhaps even as high as the $59 level before reaching towards the $60 level. With that, the market should then start to see a lot of bearish pressure.

The market breaking down below the bottom of the hammer would be a negative sign, perhaps even the $54 level would be even worse. At that point, the market is likely to go down towards the $52 level. Overall, this is a market that continues to be bouncing back and forth between the $50 and $60 level longer-term, showing just how choppy back and forth this market is. At this point, the market is likely to bounce between those areas with smaller time frames of consolidation. If you have been trading crude oil for any length of time, you know that the market does tend to move in these massive consolidation areas, but it also has small consolidation areas as well.

Looking at this chart, I fully anticipate that the FOMC will have a significant effect on crude oil, as it will have a significant effect on the US dollar. Ultimately, this is a market that shows a lot of choppy action, so looking at short-term charts is probably the best way to trade this market. In this environment, it’s all about day trading, and not so much about longer-term charts unless of course you have the ability to trade CFD markets or perhaps even options. All things being equal, this is a market that is highly sensitive to the Federal Reserve, and of course the potential of OPEC to cut production at they have been threatening. Ultimately, this is a market that has far too many headlines to make it easy to trade for a bigger move.