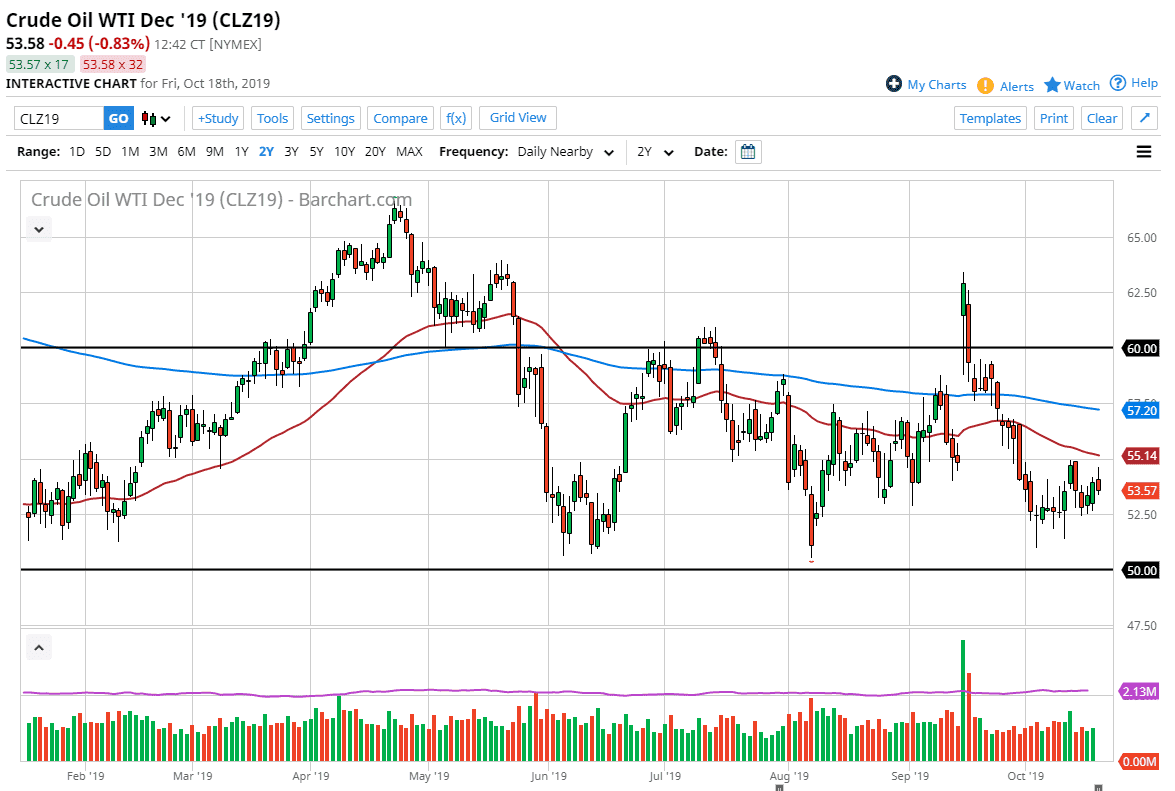

The West Texas Crude Intermediate contract for December initially tried to rally during the trading session on Friday but gave back the gains as we approached the $55 level. Just above there, we have the 50 day EMA which should also come into play as well. With that being the case it’s likely that we will continue to see selling pressure in that general vicinity. However, to the downside we have quite a bit of resiliency near the $52.50 level, so I believe that we are going to trade in this $2.50 range for the short term.

Underneath, there is massive support starting at $51 that extends down to the $50 level, and I consider that to be the “floor” of the market. If the market were to break down below there then I think that crude oil would suddenly be in a lot of trouble. It’s difficult to imagine that happening though, because quite frankly there is so much nonsense going on in the Middle East in any given moment, it’s only a matter of time before somebody says or does something to freak the oil markets out.

However, we have an extraordinarily large amount of supply coming out of North America these days, as the world starts to decouple from Middle Eastern oil. As America goes looking towards more internal supply, this is the world’s second-largest consumer of crude oil suddenly leaving the picture for Middle Eastern crude. This could have a stabilizing effect in the WTI grade, as it is North America produced. Granted, there’s always a bit of a knock on effect depending on what’s going on in other markets but at the end of the day this one is somewhat insulated from some of the other issues around the world.

If we were to break above the $55 level and extensively the 50 day EMA, then it’s likely that we could go looking towards the $57.20 level which is the 200 day EMA currently. A break above there opens up the door to the $60 level which I feel is basically the top of the range that the overall longer-term traders are dealing with. Crude oil does tend to be very technical so attend dollar range would fall right in line with historic norms, as attend dollar levels tend to be paid quite a bit of attention to by traders.