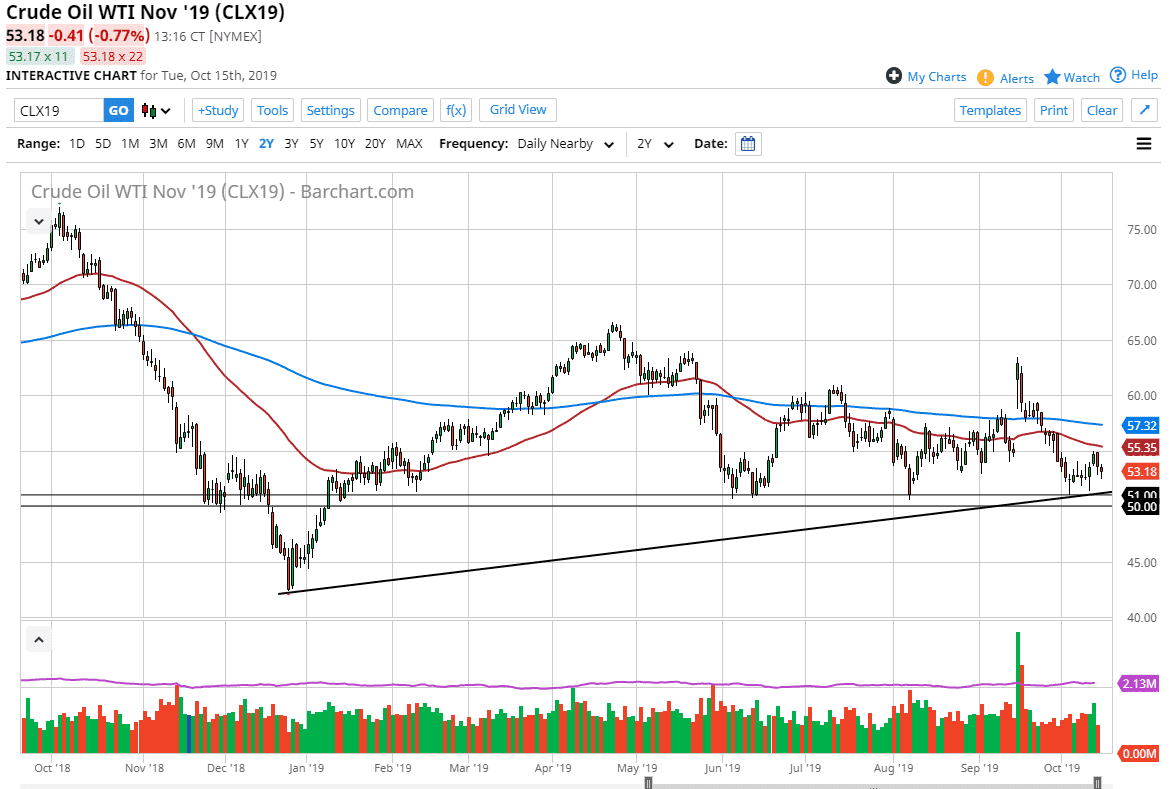

The West Texas Intermediate Crude Oil market has fallen again during the trading session on Tuesday, but then turned around to show signs of support just below the $53 level. The $52.50 level has also offered support, and therefore I think we will continue to see buyers on these dips. When I look at the technical analysis, although things have been relatively flat for some time, you can see that there is an uptrend line slicing through the $51 level, which is the top of the support range that extends down to the $50 level.

The shape of the candle stick is similar to a hammer, touching the hammer from Thursday of last week which was a sign of strength as well. Above here you have the 50 day EMA which is painted in red and sloping a little bit lower. The $55 level has offered resistance, and now that the 50 day EMA is reaching towards that level, it’s likely that we would see a bit of a fight there. Having said that, if we can break above that level it’s likely that we could go towards the 200 day EMA which is closer to the gap that has yet to be filled near the $57.30 level.

To the downside, I believe that the buyers will continue to come in and pick up value every time it’s offered. Crude oil markets have been beaten down rather significantly lately, but in the end it’s getting a bit oversold at this point and therefore it’s probably only a matter time before value hunters come back and try to take advantage of cheap pricing. At this point in time it looks as if the $50 level is the bottom of a massive support barrier that should continue to keep this market higher for the longer-term. If we were to break out to the upside, the next move higher could be a bit difficult, but I think given enough time we could grind above the 200 day EMA and reach towards the $60 level which is the top of the overall range that the market still finds itself in, regardless of the recent selloff. A break down below the $50 however would send this market down to the $45 level which has been important more than once, and it’s very likely that it could give there rather quickly as resistance gives way.