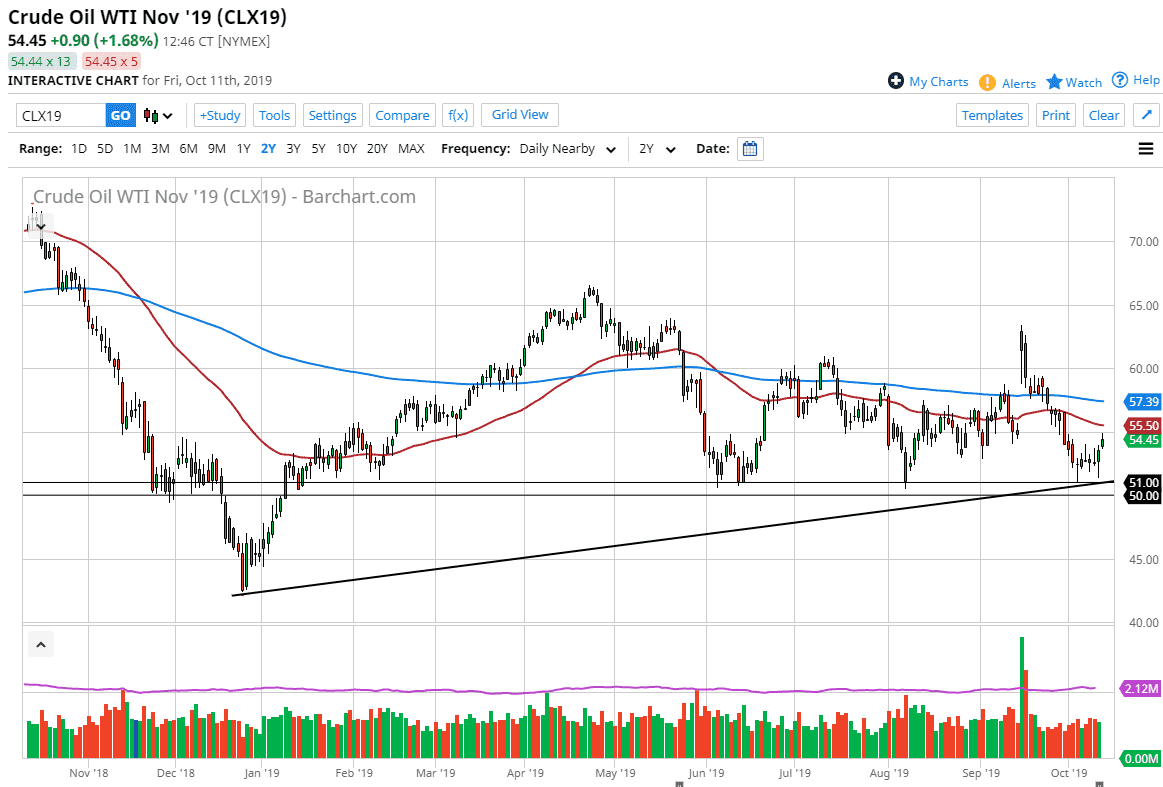

The West Texas Intermediate Crude Oil market has rallied a bit during the trading session on Friday, as word got out that the Iranian tanker had been hit by a couple of missiles in the Red Sea. This obviously has a lot of tension flowing into the crude oil market, but I am the first person to admit that the rally has been a little lackluster. At this point though, I think a lot of it comes down to the fact that the $55 level is a large, round, psychologically significant level, and an area where we previously had seen quite a bit of support as well as resistance.

That being said though, we have pulled back a bit and showed signs of exhaustion. I think part of this probably comes down to the US/China trade situation as they are still talking and Washington DC and therefore the idea of demand in crude oil could move up and down with that as well. Regardless, when you look at the chart you can see that there is a ton of support underneath so it makes sense that we would at least attempt a breakout.

Just above the $55 level we have the 50 day EMA which will of course attract a certain amount of attention as well. If we can break above that, then it opens the door to the 200 day EMA. In the short term though, I would not be surprised at all to see this market bounce around and try to build up the necessary momentum to finally break above the $55 level, meaning that a pullback could happen. With that being the case, it’s very likely that the action will be choppy but with the massive amount of support underneath it’s very likely that this market will eventually reach higher. Beyond that, tensions in the Middle East are always good for oil prices, and as a result that should continue to propel the situation higher as well. All of that being said though, if we were to break down below the uptrend line and perhaps even more important to the $50 level, then the market could unwind and go looking towards the $45 level. In the short term I don’t think that’s happening, and it’s very likely that you simply continue to bounce until we get the overhead resistance.