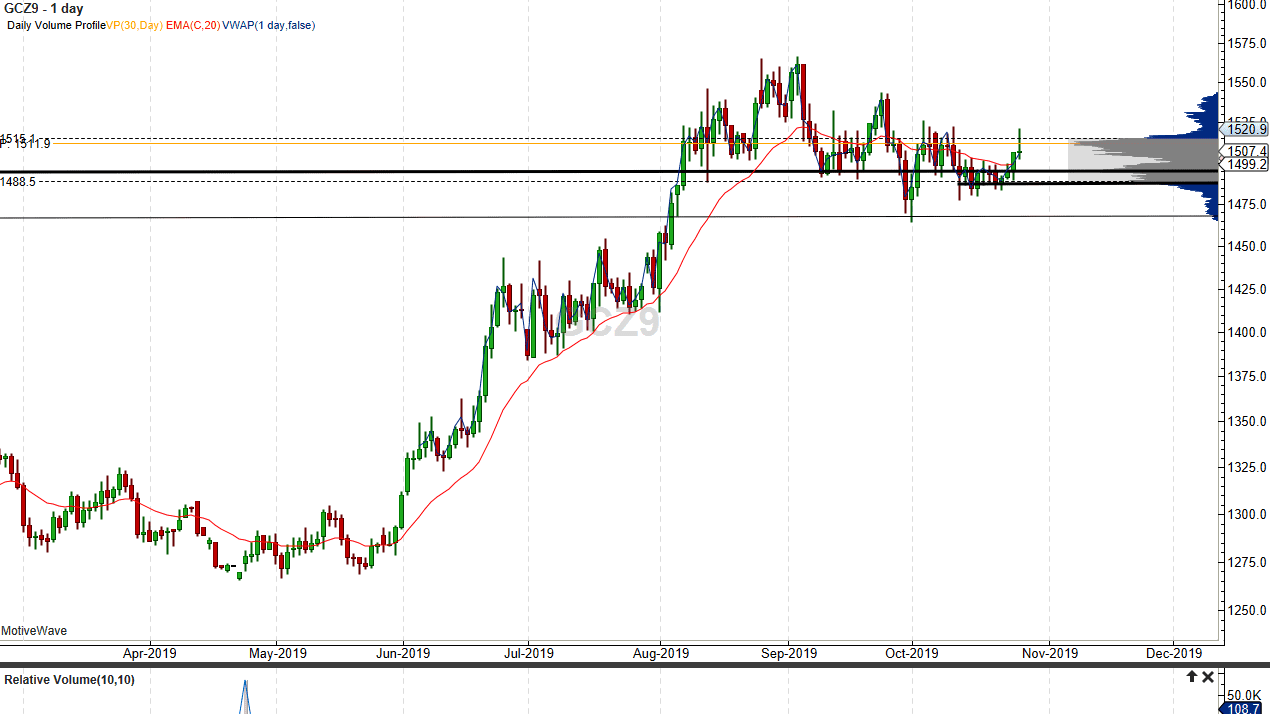

The gold markets rallied during the trading session on Friday, shooting to the $1520.90 level during the New York session, but gave back the gains to end up forming a massive shooting star. This of course is a negative sign, but at this point in time it’s very likely that the market is going to try to break out given enough time. Perhaps some of the reaction later in the day was due to the Federal Reserve having an interest rate statement and press conference on Wednesday. This will attract a lot of attention because it shows what the future outlook for rate policy and monetary policy in the United States might be.

At this point, I believe that short-term pullbacks will continue to be buying opportunities and it doesn’t take a lot of imagination to see that this market could be forming a bullish flag. The bullish flag could send this market looking towards the $1750 level, but obviously that would be a longer-term call. If we can break above the top of the shooting star from the Friday session this would be an extraordinarily bullish sign, as it would not only trapped sellers from the Friday session, it would be a break above multiple candlesticks from a couple of weeks ago.

To the downside I expect to see the $1500 level because a bit of support, as the last 30 days has seen a lot of action around that level. For what it’s worth, the most highly traded level over the last 30 days is actually the $1515 level, so that whole area should offer quite a bit of support. Beyond the technicals, it’s going to come down to what the statement is out of the Federal Reserve. After all, the market is starting to try to price in monetary policy and of course interest rates. While the Federal Reserve is expected to cut interest rates, it’s the statement that will be crucial as it will give us an idea as to whether or not more interest rate cuts are coming. If this statement ends up being a very dovish one, that could be the catalyst to get this market moving to the upside. If the market was to get a relatively hawkish statement, then gold could roll over and go lower. That being said, the markets have recently thrown extraordinarily huge tantrums every time the Federal Reserve didn’t give them cheap money. Don’t for a second think the Federal Reserve is not aware of that.