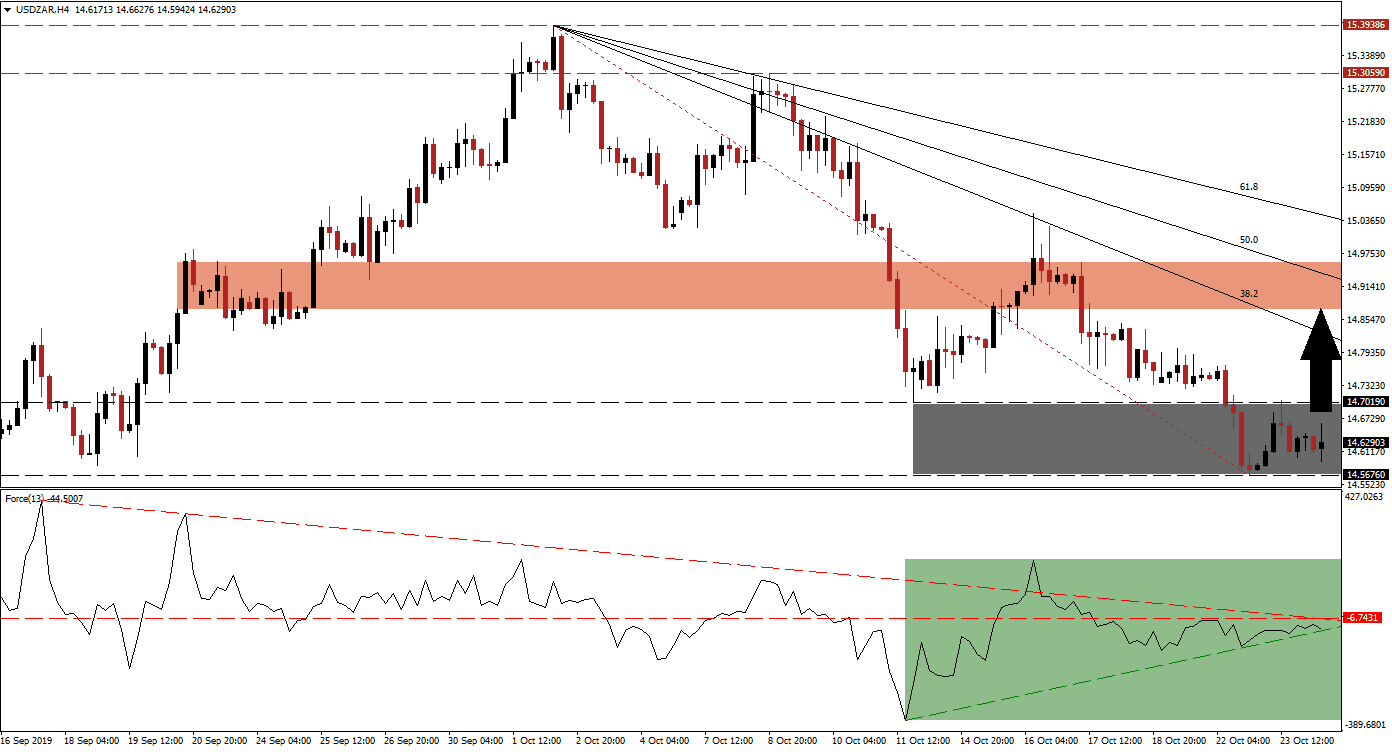

Bearish momentum in the USD/ZAR is being depleted inside its support zone which halted the sell-off. While the South African economy is facing headwinds of its own, the US economy has performed weaker than expected and overshadowed domestic issues in South Africa. A long-term downtrend has now been clearly established by a series of lower highs and lower lows which is likely to remain intact; price action is expected to enter a short-term reversal which will lead to another lower high.

The Force Index, a next generation technical indicator, points towards the rise in bullish momentum and a positive divergence formed; this represents a bullish trading signal and further confirms the likelihood of a counter-trend advance. A positive divergence emerges when an asset descends while its technical indicator ascends. The Force Index remains in negative territory below its horizontal resistance level and the descending resistance level just crossed below it as marked by the green rectangle. The ascending support level is expected to elevate this technical indicator above its twin resistance level which is likely to pressure the USD/ZAR into a breakout. You can learn more about the Force Index here.

A sharp rally unfolded the last time price action trades inside its support zone which is located between 14.56760 and 14.70190 as marked by the grey rectangle. The preceding rally has now been completely reversed and more downside is expected follow in the USD/ZAR long-term, supported by its descending Fibonacci Retracement Fan sequence. Given the confirmed trading pattern, the next move in this currency pair should be to the upside and a breakout in the Force Index is expected to lead to a price action reversal which will keep the long-term downtrend intact.

After the 38.2 Fibonacci Retracement Fan Support Level rejected the previous advance in the USD/ZAR, and price action reversed to a lower low, forex traders are advised to monitor this level closely. Any advance in this currency pair could extend into its next short-term resistance level which is located between 14.87262 and 14.95925 as marked by the red rectangle. The descending 50.0 Fibonacci Retracement Fan Support Level is currently passing through this zone from where a further breakout is unlikely to materialize given the fundamental picture. You can learn more about a breakout here.

USD/ZAR Technical Trading Set-Up - Breakout Scenario

Long Entry @ 14.62500

Take Profit @ 14.88000

Stop Loss @ 14.55000

Upside Potential: 2,550 pips

Downside Risk: 750 pips

Risk/Reward Ratio: 3.40

In case the Force Index is pressured into a breakdown below its ascending support level, the USD/ZAR will be vulnerable to a breakdown below its support zone. Economic data out of the US may provide the next short-term fundamental catalyst; a weaker-than-expected reading on key releases today could contribute to breakdown pressures. The base case remains for a short-term breakout which is required in order to maintain the currently established long-term downtrend. The next support zone is located between 14.13542 and 14.27210.

USD/ZAR Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 14.51000

Take Profit @ 14.27250

Stop Loss @ 14.59500

Downside Potential: 2,375 pips

Upside Risk: 850 pips

Risk/Reward Ratio: 2.79