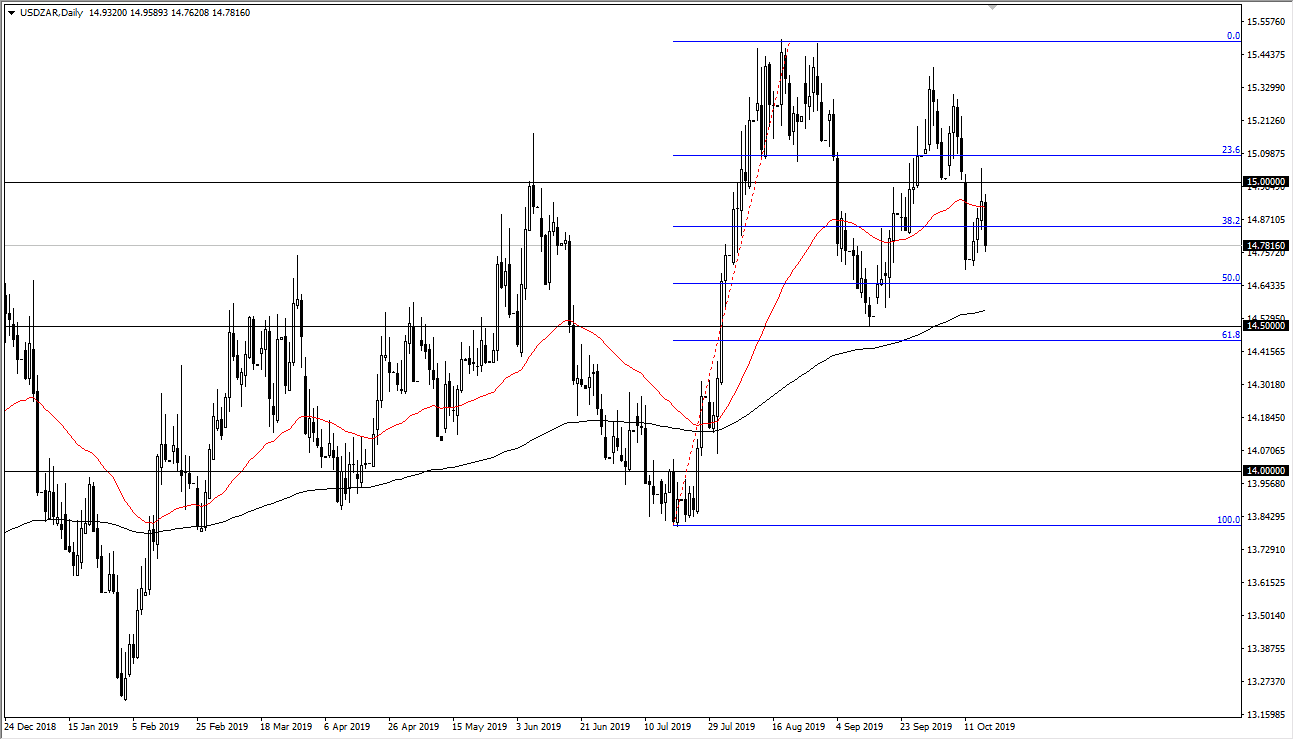

The US dollar has fallen significantly during the trading session on Thursday, using the 50 day EMA as resistance against the South African Rand. However, the market has plenty of support underneath, especially as the 200 day EMA comes into the picture, just above the 14.50 Rand level. Recently, we have seen the US dollar fall against the South African Rand as there has been a little bit more of a “risk on” type of attitude around the world. That being said though, I see plenty of structural support underneath and we are still very much in an uptrend.

While I do think that the next couple of days could be somewhat negative for this pair, the reality is that the 14.50 Rand level should cause some issues. It is an area that has caused issues in the past, the 61.8% Fibonacci retracement level is just below it, and of course that 200 day moving average is sitting there as well. In other words, there’s a lot of structural technical support there. In the past it has been significant resistance, so you also have to throw “market memory” into the mix as a potential cause of trouble also.

To the upside I would anticipate that the market is probably going to run into a little bit of noise at the 15 Rand level, as it is a large, round, psychologically significant figure, and then of course there is a significant amount of noise above there but it does have the ability to reach towards the 15.40 Rand level on a rally. That being said, we should look into the alternate scenario, which could come into play.

If we were to break down below the 61.8% Fibonacci retracement level, which is extensively the 14.45 Rand level, then the market is probably free to drop down to the 14.18 Rand level, the 14.00 Rand level, and then eventually the 100% Fibonacci retracement level which I currently have marked as 13.83 Rand. Obviously, that would be more of a “risk on” move, as the South African Rand is an emerging market currency, and as it rallies it would show the investors are willing to step out on the risk spectrum to take advantage of global assets. In this environment though, that seems to be very unlikely for any significant amount of time. While Brexit has made significant progress, there is still a multitude of issues around the world that will continue to have people looking for the safety of the US dollar.