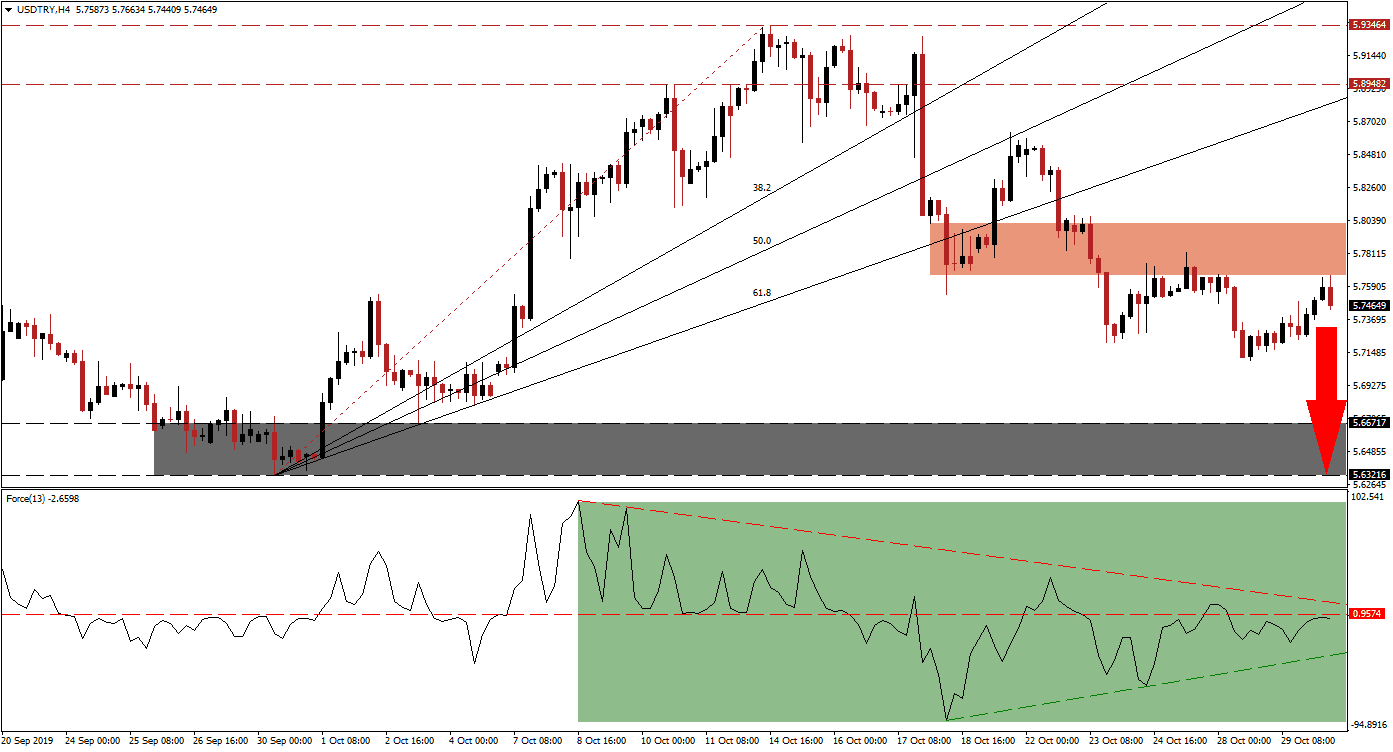

Turkey’s military operation into northern Syria, intended to create a 30 kilometer safe zone for refugees to return and to crack-down on US-allied YPG fighters the country labeled a terrorist organization, has now moved from active fighting to a joint Turkey-Russian policing mission. During the short military operation, the Turkish Lira advanced against the US Dollar which was further powered by disappointing economic reports out of the US. Price action started its breakdown sequence from its long-term resistance zone which turned the Fibonacci Retracement Fan from support to resistance. As a result of the corrective phase, a series of lower highs and lower lows was formed which confirms the long-term downtrend in the USD/TRY.

The Force Index, a next generation technical indicator, indicates the dominance of bearish momentum as it has contracted steadily with price action since the USD/TRY started its sell-off. Following the breakdown in this currency pair below its long-term resistance zone located between 5.89482 and 5.93464, the Force Index recorded its current low and started to drift higher and a positive divergence emerged. As price action drifted higher, this technical indicator failed to confirm the upside and remains below its horizontal resistance level in negative territory; its descending resistance level is additionally applying downside pressure as marked by the green rectangle. You can learn more about the Force Index here.

While the positive divergence in the Force Index allowed price action to recover, the USD/TRY has approached its short-term resistance zone which is located between 5.80190 and 5.76662 as marked by the red rectangle from where bearish momentum started to increase. This resulted in a reversal and another lower high, in-line with the long-term downtrend which has been established. Forex traders should now pay close attention to the Force Index which may be pressured lower by its double resistance level, this is expected to lead price action to the downside.

Another key level to watch is the intra-day low of 5.70946 which marks the current low of the sell-off; a move lower is likely to attract more net sell positions in this currency pair. The US Federal Reserve may provide another fundamental catalyst to the downside during the press conference following the FOMC interest rate announcement while US GDP data will be released prior to it. This may clear the path for the USD/TRY to extend down into its support zone which is located between 5.63216 and 5.66717 as marked by the grey rectangle from where another breakdown may materialize. You can read more about a breakdown here.

USD/TRY Technical Trading Set-Up - Price Action Reversal Scenario

Short Entry @ 5.74600

Take Profit @ 5.63250

Stop Loss @ 5.77750

Downside Potential: 1,135 pips

Upside Risk: 315 pips

Risk/Reward Ratio: 3.60

In the event that the Force Index can push above its horizontal resistance level and complete a breakout above its descending resistance level, the USD/TRY may attempt to move into its short-term resistance zone. While a breakout remains unlikely given the current fundamental scenario, the post FOMC press conference could provide a short-term catalyst for a breakout. The next long-term resistance zone is located between 5.89482 and 5.93464, but any short-term price spike may be limited to its intra-day high of 5.86269; the last time this currency pair was rejected by its ascending 50.0 Fibonacci Retracement Fan Resistance Level.

USD/TRY Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 5.81750

Take Profit @ 5.86250

Stop Loss @ 5.79750

Upside Potential: 450 pips

Downside Risk: 200 pips

Risk/Reward Ratio: 2.25