As unrest in Hong Kong intensifies, capital continues to rotate into Singapore which is benefiting the economy long-term. Together with the economic disappointments printed out of the US and a global manufacturing sector which is already in recession, the USD/SGD was able to accelerate to the downside. While the long-term trend favors more downside, especially with a US central bank expected to cut interest rates again this week in a move many analysts believe will be the last in the mid-cycle adjustment, a short-term counter-trend move is likely to unfold on the back of a short-covering rally.

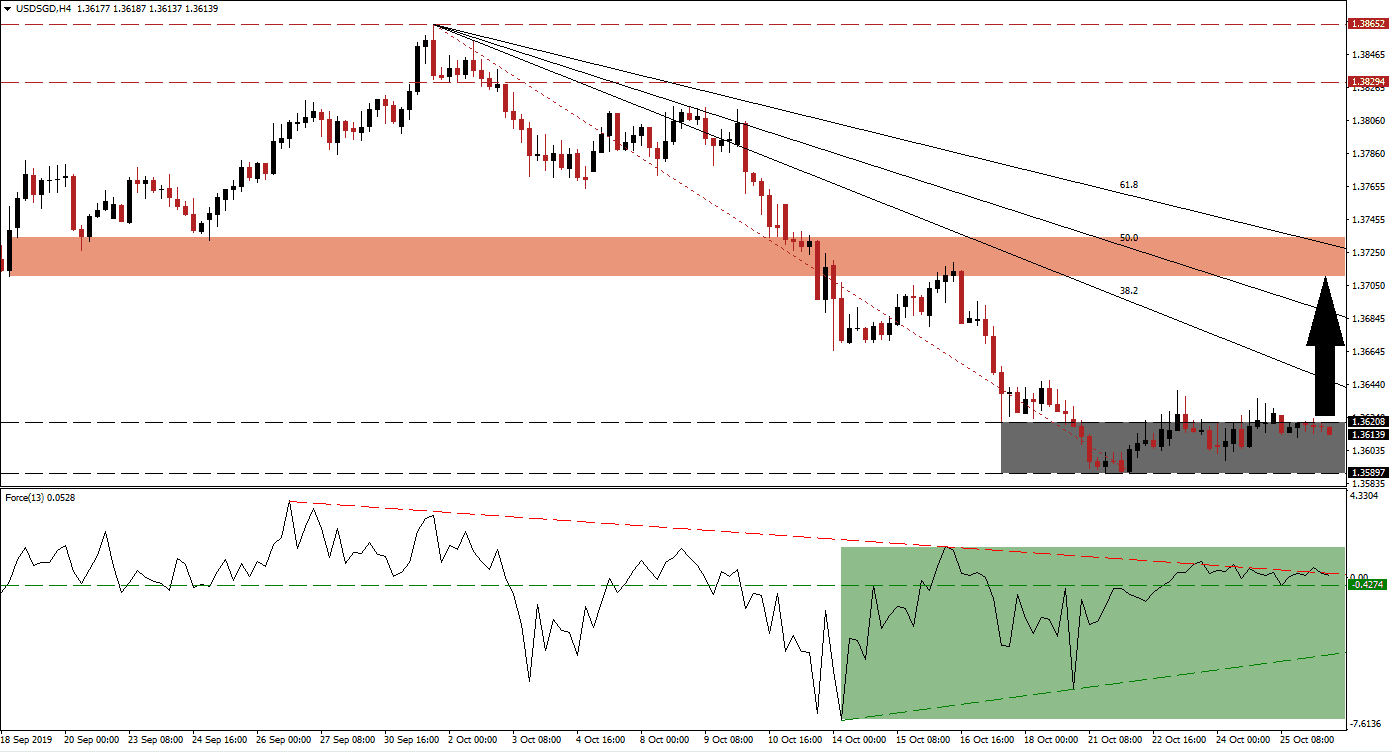

The Force Index, a next generation technical indicator, points towards the build-up in bullish momentum and a positive divergence formed; this represents a bullish trading signal and occurs when price action contracts while the underlying technical indicator advances. As the USD/SGD recorded its most recent intra-day low, which also marks the end-point of its Fibonacci Retracement Fan as well as the bottom range of its support zone, the Force Index advanced. A sideways trend with a bullish bias followed and this technical indicator pushed above its horizontal resistance level, turned it into support and is now expected to sustain a move above its descending resistance level where it currently trades as marked by the green rectangle. You can learn more about the Force Index here.

Bearish momentum is being depleted inside the support zone which is located between 1.35897 and 1.36208 as marked by the grey rectangle. The 38.2 Fibonacci Retracement Fan Resistance Level is closing in on the top range of this zone which is increasing pressure for the next move. A sustained advance in the Force Index above its descending resistance level is expected to lead the USD/SGD higher and forex traders should monitor the intra-day high of 1.36409 which marks the peak of a previous breakout attempt which was reversed. A move above this level is expected to lead to the addition of fresh net long positions in this currency pair and elevate price action above the 38.2 Fibonacci Retracement Fan Resistance Level.

An advance is expected to be limited to its next short-term resistance zone which is located between 1.37106 and 1.37345 as marked by the red rectangle; the descending 61.8 Fibonacci Retracement Fan Resistance Level is passing through this zone right now. Additionally, the peak of a previous pause in the sell-off which led to a lower low is near the bottom range of this zone at an intra-day high of 1.37189. The long-term downtrend in the USD/SGD will remain intact if price action pushes into its resistance zone from where a fresh sell-off is possible. You can learn more about a resistance zone here.

USD/SGD Technical Trading Set-Up - Breakout Scenario

Long Entry @ 1.36150

Take Profit @ 1.37150

Stop Loss @ 1.35850

Upside Potential: 100 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 3.33

Fresh fundamental data could provide a spark which will lead the USD/SGD into a breakdown below its support zone. The Force Index may confirm this with a push below its horizontal support level, turning it back into resistance which will also take this technical indicator into negative conditions and place bears in charge of this currency pair. The next support zone is located between 1.34915 and 1.35106.

USD/SGD Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 1.35700

Take Profit @ 1.35150

Stop Loss @ 1.35950

Downside Potential: 55 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 2.20