USD/SGD: Has the Rally Lost Momentum?

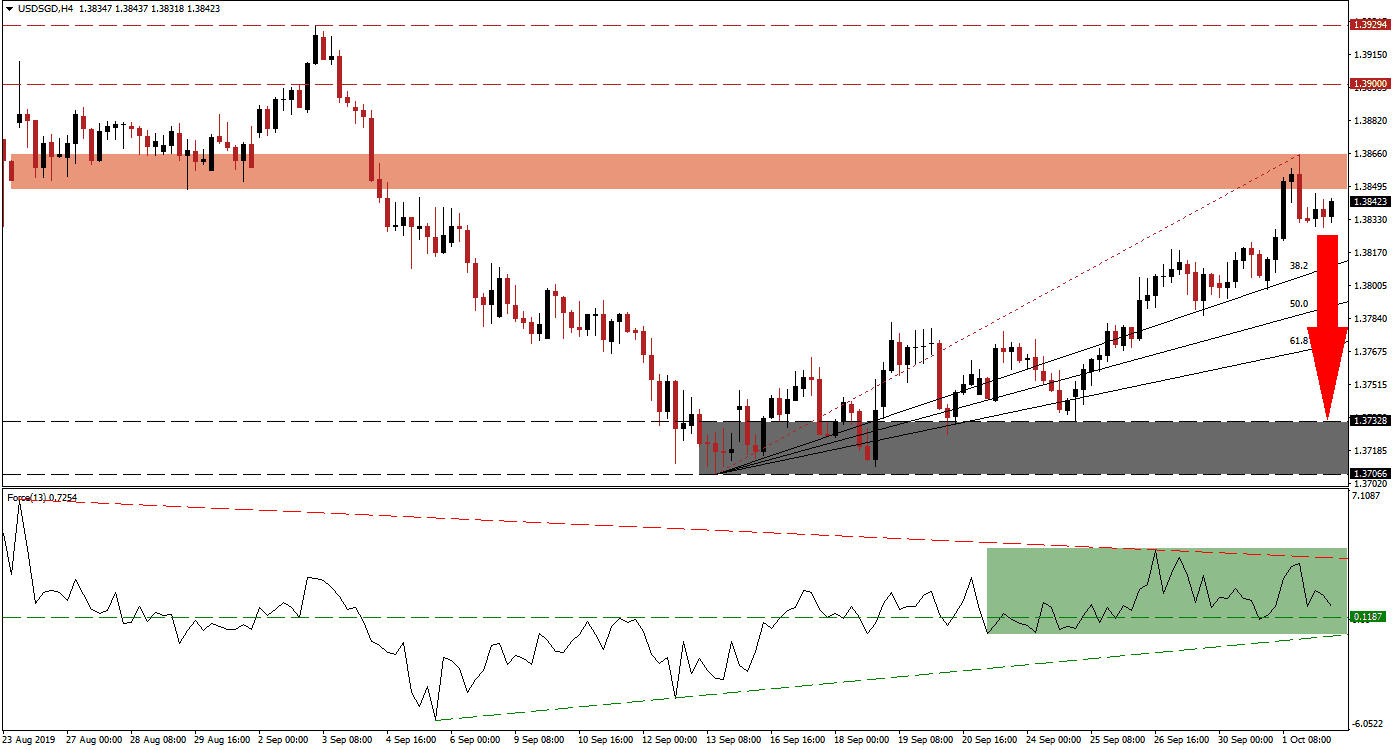

Yesterday’s US ISM Manufacturing Index for September clocked in at the worst reading in a decade which deflated bullish momentum in the US Dollar. The rally in the USD/SGD was partially fueled by disappointing economic data out of Singapore following a collapse in industrial production; today’s Manufacturing PMI is expected to show a reading just below 50.0 which indicates contraction. The sharp reversal in this currency pair from an intra-day high of 1.38652, which marks the end point of the current Fibonacci Retracement Fan sequence, is expected to extend to the downside with a series of breakdowns.

The Force Index, a next generation technical indicator, issued an early warning signal that the rally is losing upside momentum as a negative divergence formed. This occurs when price action extends to the upside as the technical indicator records a lower high which is considered a bearish trading signal. The Force Index has now reversed and is approaching its horizontal support level; this is marked by the green rectangle. A breakdown below it will turn it into resistance, push the indicator into negative territory placing bears in control of the USD/SGD and challenge its ascending support level. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Price action has taken a breather following the breakdown below its narrow, short-term resistance zone which is located between 1.38480 and 1.38652 as marked by the red rectangle. This can be partially attributed to the launch of what appears to be a submarine-launched ballistic missile test by North Korea which landed in Japan’s Exclusive Economic Zone (EEZ). It is also normal for price action to retrace its breakdown into its resistance zone before accelerating to the downside. The Force Index should be monitored as a breakdown below its horizontal support level is expected to lead the USD/SGD into a sell-off.

As bearish momentum is expected to increase, this currency pair is likely to complete a breakdown through its entire Fibonacci Retracement Fan sequence; this will turn it from support into resistance. A move below the intra-day low of 1.37984 should result in the addition of new net short orders in the USD/SGD. This level represents the last time price action touched its ascending 38.2 Fibonacci Retracement Fan Support Level which led to advance into its resistance zone. The next support zone is located between 1.37066 and 1.37328 which is marked by the grey rectangle. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

USD/SGD Technical Trading Set-Up - Breakdown Extension Scenario

Short Entry @ 1.38450

Take Profit @ 1.37300

Stop Loss @ 1.38700

Downside Potential: 115 pips

Upside Risk: 25 pips

Risk/Reward Ratio: 4.60

In case the ascending support level in the Force Index holds, a price action reversal may follow. This could lead to a breakout in the USD/SGD above its short-term resistance zone and extend the advance. A fundamental catalyst would be required in order for this event to unfold. The next resistance zone is located between 1.39000 and 1.39294 which represents a good long-term short opportunity.

USD/SGD Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.38850

Take Profit @ 1.39250

Stop Loss @ 1.38700

Upside Potential: 40 pips

Downside Risk: 15 pips

Risk/Reward Ratio: 2.67