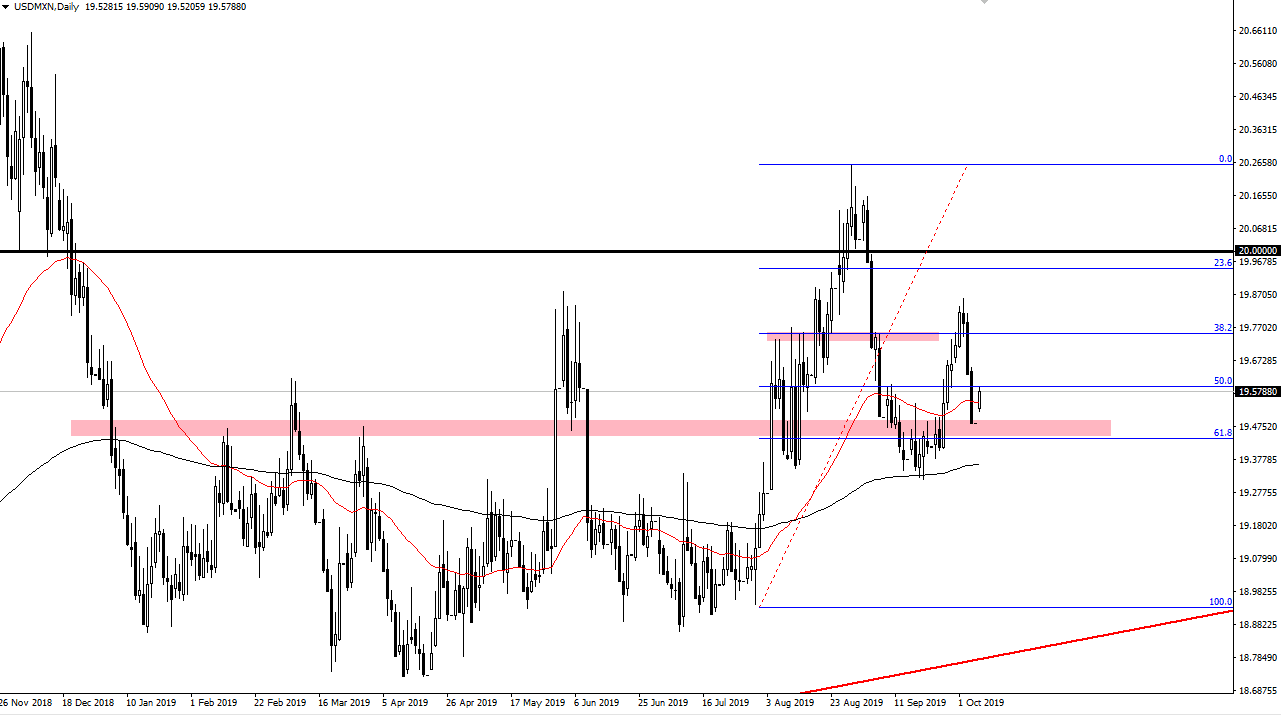

The US dollar has gapped higher to kick off the week against the Mexican peso, and then broke above the 50 day EMA. That’s obviously a very bullish sign, and it seems very likely that the market is ready to go higher. The 61.8% Fibonacci retracement level underneath has offered significant support, and it also has the 200 day EMA underneath it. With that being the case, the market is very likely that we continue to see buyers in that general vicinity. Beyond that, it makes sense considering that this pair may rally as there are a lot of concerns out there when it comes to global growth.

Looking at the last several sessions, we had a couple of negative candles that were rather large, but by gapping higher it looks as if we are going to try to take those out. The 19.77 level is basically where the market is probably going to head towards, and therefore could give us an opportunity to make profit on the upside. Remember, the Mexican peso is essentially a proxy for Latin America and the Third World in general. Emerging market currencies get hit when people are a bit concerned, and that might be the case right now.

Beyond the 19.77 level, it’s very likely that the market could go to the 20 pesos level, perhaps even the 20.25 level. It is a long way to go from here, so obviously it’s likely going to be more of a grind to the upside and we may get the occasional pullback. Ultimately, for short-term pullbacks should be thought of as buying opportunities, as long as we can stay above the 61.8% Fibonacci retracement level which is closer to the 19.40 pesos level. Now that we are above the 50 day EMA, one would have to think that shorter-term traders are probably going to start piling then as well. If we get some type of negative attitude in the markets overall, that should send this market higher as well.

Alternately, if we were to break down below the 200 day EMA, that could send this pair crashing towards the 19 pesos level, but at this point that is not my base case scenario. I suspect that we are going to continue to see more upward pressure than down but we should always keep the other picture in the back of our minds.