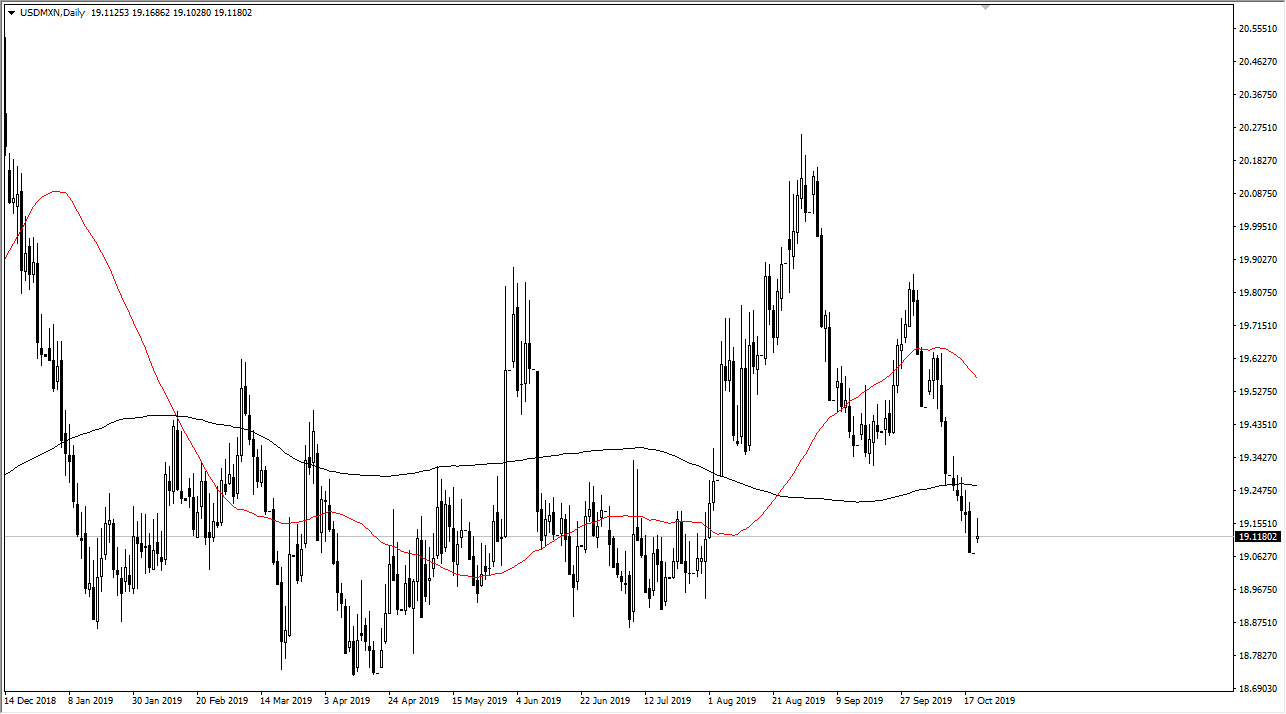

The US dollar gapped higher to kick off the trading session on Monday, showing signs of bullish pressure but gave back the gains rather early. By doing so it shows that we are still trying to build up some type of bullish pressure in the market but are quite ready to do so. Remember that the Mexican peso is very sensitive to the oil markets, which course are raining sideways. That being the case, the market looks very likely to bang around in this area, as we are just below the 200-day EMA. That is obviously something to be paying attention to, as the 200-day EMA suggests a longer-term attitude in one direction or the other. With that being the case, the market is at an area that people are going to be paying quite a bit of attention to, and therefore we could see a bit more volatility come into this currency pair.

Taking a look at this chart, it’s pretty easy to see that the market has been selling off quite drastically as of late. In fact, you can make a bit of an argument for a head and shoulders pattern above, but at the end of the day what really matters is that we are now closer to the 19 pesos handle again. That is an area that has a certain amount of psychological significant pressure attached to it as it was not only a large, round, psychologically significant handle, but it is also where the market had shot straight up in the air at the end of July, kicking off the last move to the upside.

That being said, if the market is going to turn itself around it will more than likely consolidate in the struggle in this general vicinity. The real sign of bullish pressure will be if we can get a daily close above the 200-day EMA, because it would show that the momentum is starting to shift to the upside. It would break through a lot of wicks at the top of several candlesticks, which in and of itself is a bullish sign. With that being the case, I believe that the market will continue to go higher after that move. To the downside, there is a lot of noisy trading below the 19 pesos level that will probably come into support the market.