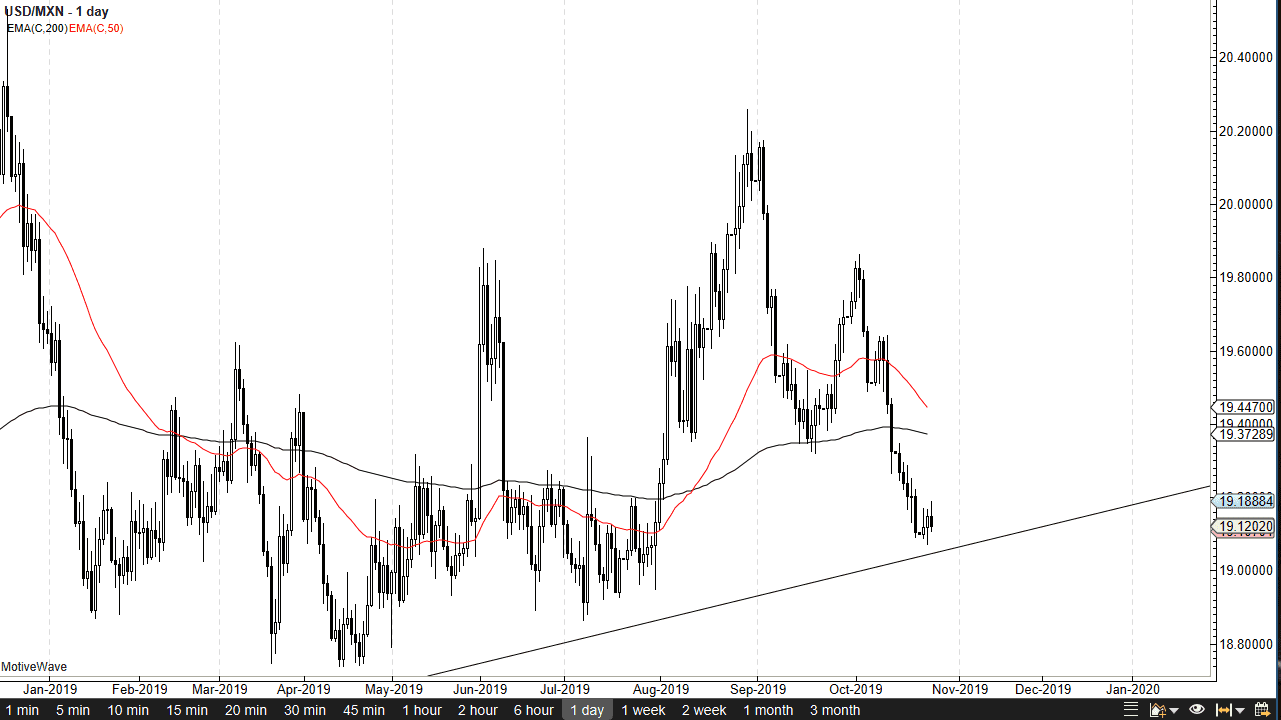

The US dollar has initially tried to rally during the trading session on Wednesday, but then pulled back against the Mexican peso again. However, what should be noted is that the last couple of days have seen a complete reversal every 24 hours. What I mean by this is that we formed a shooting star or “inverted hammer” during the trading session on Monday, followed by a hammer on Tuesday, followed by what could be thought of as another inverted hammer on Wednesday. At this point, it will be interesting to see whether or not the market pays attention to a handful of candlesticks or perhaps the uptrend line.

When you zoom out on the chart, you can see that the uptrend line goes back several years, so that of course is something to pay attention to. In fact, you can make a bit of an argument for a massive wedge over the last several years and therefore all things being equal this market should bounce. That means that the Mexican peso should lose a bit of value, which of course would be more of a “risk off” situation. The Mexican peso is considered to be an emerging market currency, so therefore it carries a certain amount of risk with it. However, you should also pay attention to the crude oil markets that are showing signs of strength that can work in favor of the Mexican peso, although not necessarily against the US dollar per se. Remember, the United States is now the world’s largest producer of crude oil.

Because of this, we may be paying more attention to interest rate differentials and emerging market interests, as this market will be a bit of a proxy for Latin America as well. As money flows towards the United States, it generally means that we are looking at traders running away from adverse risk. I think at this point there are plenty of reasons to suspect that the markets will continue to look to safety, especially as we have so many geopolitical issues going on around the world and an overall economic slowdown. If that’s going to continue to be the case, it’s only a matter time before the US dollar picks up a bit of interest. However, if we were to break down below the 19 pesos level, this market could break down rather significantly for a multi-year move.