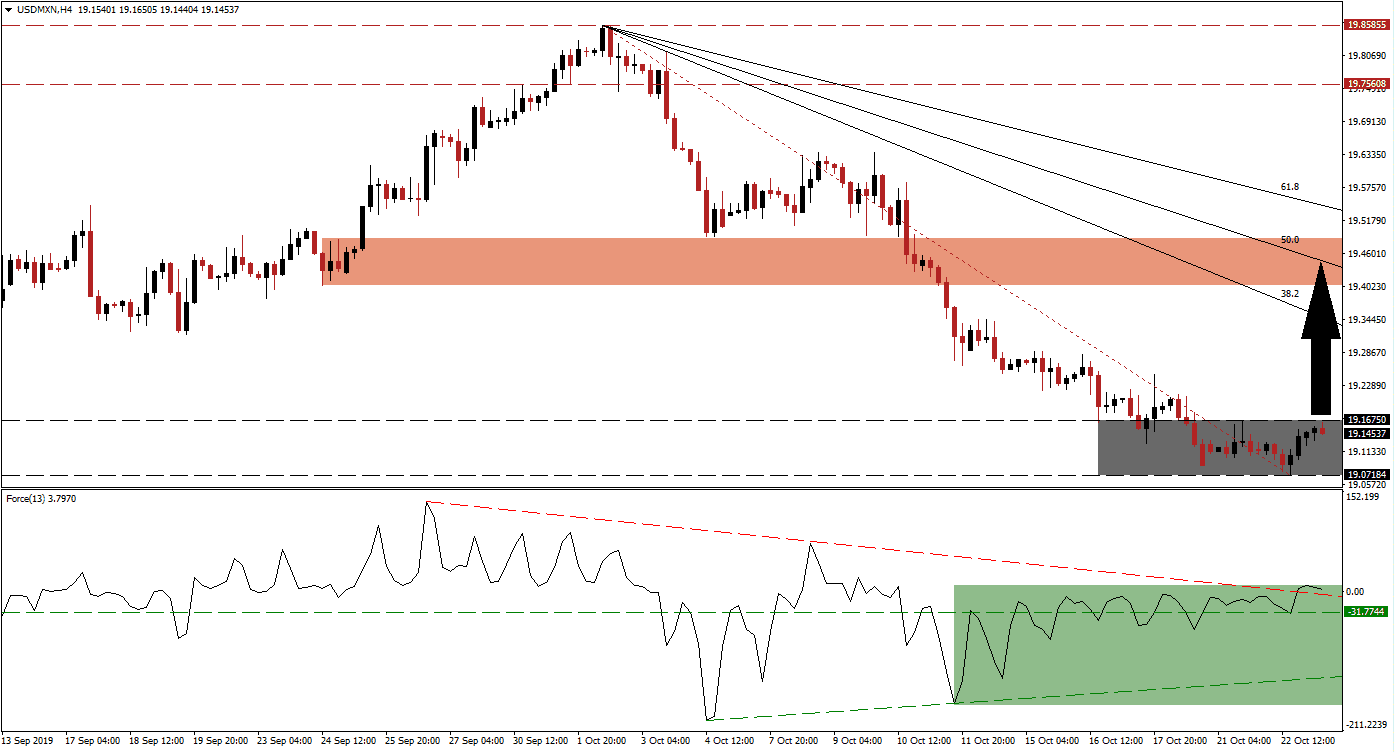

As price action has reached its support zone, bearish momentum is depleting and the likelihood of a breakout has increased. The USD/MXN has accelerated to the downside following the breakdown below its short-term support zone which has been now turned into resistance. While the long-term fundamental scenario suggests more downside for this currency pair, the short-term technical picture favors a price action reversal which will keep the overall bearish trend intact.

The Force Index, a next generation technical indicator, points towards a breakout in the USDMXN as it completed a double breakout; first above its horizontal resistance level which turned it into support and then above its descending resistance level as marked by the green rectangle. Price action is expected to follow suit and the advance by the Force Index into positive territory has placed bulls in charge of this currency pair, further confirming that a short-term price action reversal should be expected. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

This currency pair has drifted to the top range of its support zone which is located between 19.07184 and 19.16750 as marked by the grey rectangle. The Force Index may retrace back down into its descending resistance level, the breakout has turned it into a descending support level, from where a new push higher is expected to force a breakout in the USD/MXN. Forex traders should monitor the intra-day high of 19.21418, the previous high following a push above the support zone and the Fibonacci Retracement Fan trendline, a move above this level is likely to close the gap to the Fibonacci Retracement Fan sequence.

With the new trade deal between the US and Mexico stuck in the US Congress at the same time the lack of clarity in the US-China trade truce remain, the USD/MXN is expected to face an increase in volatility. The next short-term resistance zone is located between 19.40338 and 19.49039 which is marked by the red rectangle; the 50.0 Fibonacci Retracement Fan Resistance Level is nestled inside this zone, with the 38.2 Fibonacci Retracement Fan Resistance Level below it and the 61.8 Fibonacci Retracement Fan Resistance Level closing in from above. An advance into this zone will keep the long-term downtrend healthy and alive. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

USD/MXN Technical Trading Set-Up - Breakout Scenario

Long Entry @ 19.14500

Take Profit @ 19.43000

Stop Loss @ 19.07200

Upside Potential: 2,850 pips

Downside Risk: 730 pips

Risk/Reward Ratio: 3.90

In case of a breakdown in the Force Index below its horizontal support level, the USD/MXN is likely to follow suit with a breakdown below its support zone and extend its contraction without a short-term reversal. Given the magnitude of the current sell-off, supported by the existing technical scenario, a breakout remains the base case scenario in order to ensure the longevity of the long-term bearish trend. The next support zone is located between 18.86176 and 18.92620.

USD/MXN Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 19.05250

Take Profit @ 18.90000

Stop Loss @ 19.11750

Downside Potential: 1,525 pips

Upside Risk: 650 pips

Risk/Reward Ratio: 2.35