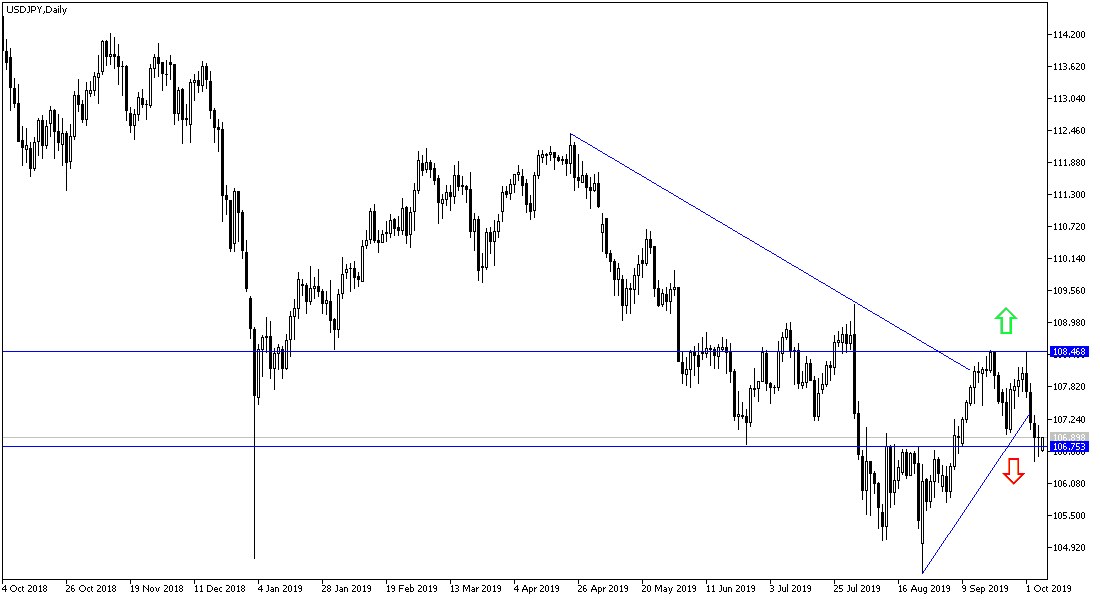

There were technical sell-off in USD/JPY, as it failed again to breach the 108.50 resistance level and for four trading sessions in a row, after the pair fell down to the 106.48 support a month ago before closing the week around 106.90, and is expected to complete the pace of correction if investors prefer safe havens, including the Japanese yen.

The US Dollar is on an important date this week with the outcome of the US-China trade talks, the release of the minutes of the Federal Reserve's policy meeting on Wednesday and the CPI data on Thursday. A new round of trade talks between the United States and China is scheduled to begin on Thursday with the possibility of reaching an agreement. This is supported by Trump's desire to please his base in the run-up to next year's presidential election; the Chinese may want to prevent any further decline in the country's economic growth. If there is a deal, the US dollar is likely to rise as it will signal better growth for the US economy and less likelihood of the Fed cutting interest rates to spur growth - a negative dollar policy.

The recent negative economic figures of the US economy, most notably the weak readings of the purchasing managers' indexes and ISM, especially in the industrial sector, as well as lower-than-expected new job numbers, negatively impacted the performance of the US dollar against other major currencies. The dollar was supported only by the announcement that US unemployment fell to a 50-year low.

The Japanese yen will be on a date with the economic reaction from the Japanese sales tax increase, which was approved at the beginning of this month.

According to the technical analysis of the pair: On the daily chart below, it seems clear that there is a strong break of the uptrend, a move towards and below the 106.00 support level will consolidate the strength of this trend, and at the same time, investors will consider then to return to buy the pair, as the technical indicators reached oversold areas after the last profit taking. Increased global trade and geopolitical tensions will continue to support the yen's strength. A correction up will again depend on a break above 108.50 resistance again.

As for the economic calendar data today: From Japan, the Leading Indicators Index will be released with a weak impact on the Yen. From the United States, there will be remarks by Federal Reserve Governor Jerome Powell.