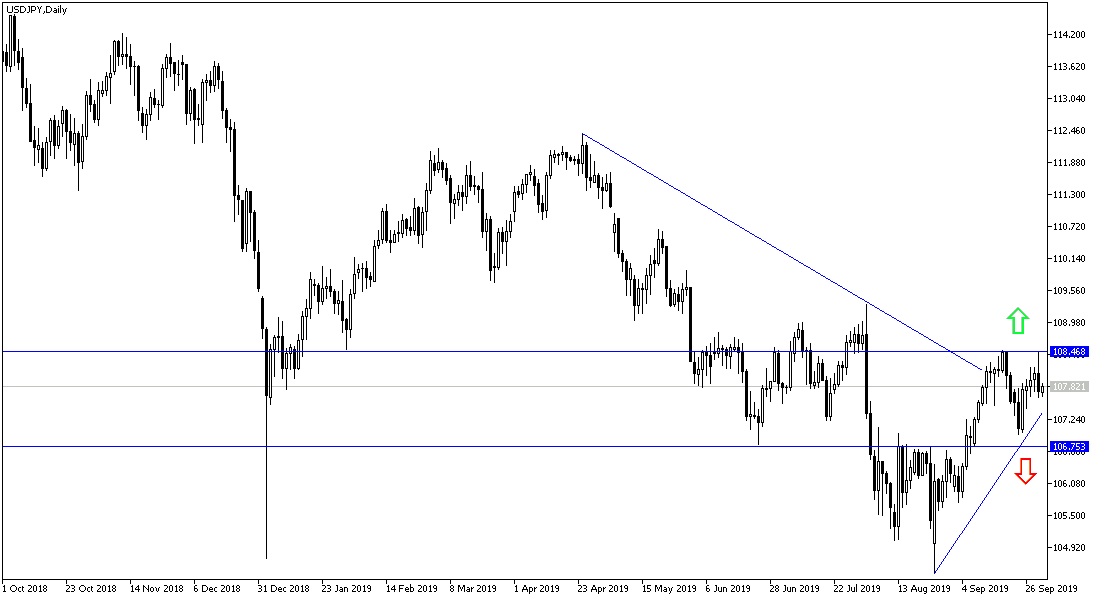

During Tuesday’s trading, the USD/JPY jumped to the 108.47 resistance, and didn’t have a lot of celebration with the gains, as it dropped back to the 107.62 support, in light of disappointing data from the US Manufacturing Sector. A week ago, we recommended to sell this pair from the 108.30 resistance, as the trade and political tensions around the world are still standing, and therefore pushes investors to safe heavens, led by JPY.

As for the economic news, the Tankan survey results were mostly a bit better than expected, but still reflects a slowdown from the last survey. Capital investment plans for all sectors have been reduced by more than the expected (6.6% vs 7.4% previously, and 7.0% expectations). Japanese manufacturers expect that the USD average price will reach 108.68 Yen. The Manufacture PMI for September was confirmed down at 48.9 from 49.3, marking the 5th consecutive month below the 50 threshold that separates growth from contraction.

The new sales tax hike took place starting yesterday (08% to 10%) and it may affect the already week economic performance. While the unemployment rate was around 2.2%, the new jobs dropped by 5.9%, which could be a heads-up as well. Bank of Japan will meet at the end of the month, and if the economy showed negative effects of the new sales tax, we suspect that the bank will reduce rates on deposits.

On the other hand, the US Manufacturing PMI from ISM dropped to 47.8 in September from 49.1 in August. Any reading below 50 indicates contraction in the sector. With the unexpected drop, the index is down to its lowest level since the last month of recession in June 2009, with a reading of 46.3.

For the pair’s Technical Analysis: The USD/JPY still lacks the momentum to confirm the upward correction. This might happen by moving towards the 110.00 psychological support. This can’t happen without investor’s optimism and the return of risk-on sentiment. On the contrary, hopes for an upward correction can be erased with the price returning to support levels at 106.00, 106.80 and 107.35 respectively.

As for the economic calendar today: From Japan, the Japanese Family Confidence index data will be released. From the US, the ADP employment change and Crude Oil inventories data.