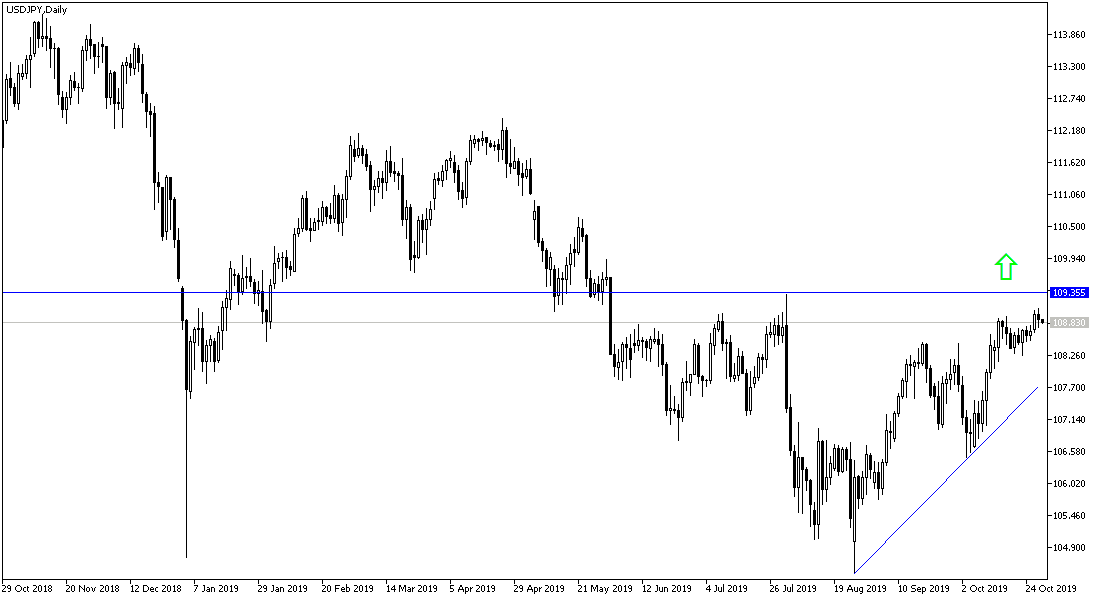

USD/JPY rally attempts stopped at the 109.06 resistance, pending US economic growth figures and the announcement of Federal Reserve decisions. The pair is stable around 108.82 at the time of writing. With weakening US economic indicators, US consumer confidence fell for the third consecutive month, and with a positive US housing market, the National Association of Realtors announced that the Pending Home Sales Index rose 1.5% from August to September to 108.7, the highest level since December 2017. Year on year, pending home sales rose 3.9%.

Purchase of affordable homes has increased thanks to the continuous decline in mortgage rates, where the average interest rate on a 30-year fixed rate mortgage is 3.75, according to Freddie Mac. This was almost a full percentage point lower than November 2018. However, rising house prices, supported by a persistent shortage of real estate in the market, have limited potential sales growth. The gap between house prices and average wages has been narrowing until recently, but there are signs that lower mortgage rates are now starting to accelerate prices.

The house price figures from Case-Shiller released on Tuesday showed that the value of homes rose only 2% in the 12 months until August, about 3% lower than year-on-year price growth. Pending sales for the month rose in the Midwest and the South, but fell in the more expensive Northwest and Western regions.

Pending home sales are a measure of home purchases that are usually completed after one or two months.

According to the technical analysis of the pair: On the daily chart, USD/JPY still has a good opportunity for a bullish correction, especially as it approaches the 110.00 psychological resistance. In contrast, if it moves below 108.00 support, there will be a strong threat to the bullish expectations. The correction up depends on the return of global trade and geopolitical tensions, which are usually in favor of the Japanese yen, one of the most important safe havens for investors in times of uncertainty.

As for the economic calendar today: After the release of Japanese retail sales, the focus will shift to the US data, as the Q3 GDP growth rate and the Fed's monetary policy decisions will be announced amid strong expectations of a quarter-point US rate cut. Later, a press conference by Governor Jerome Powell to explain why the bank has taken action. Decisions today.