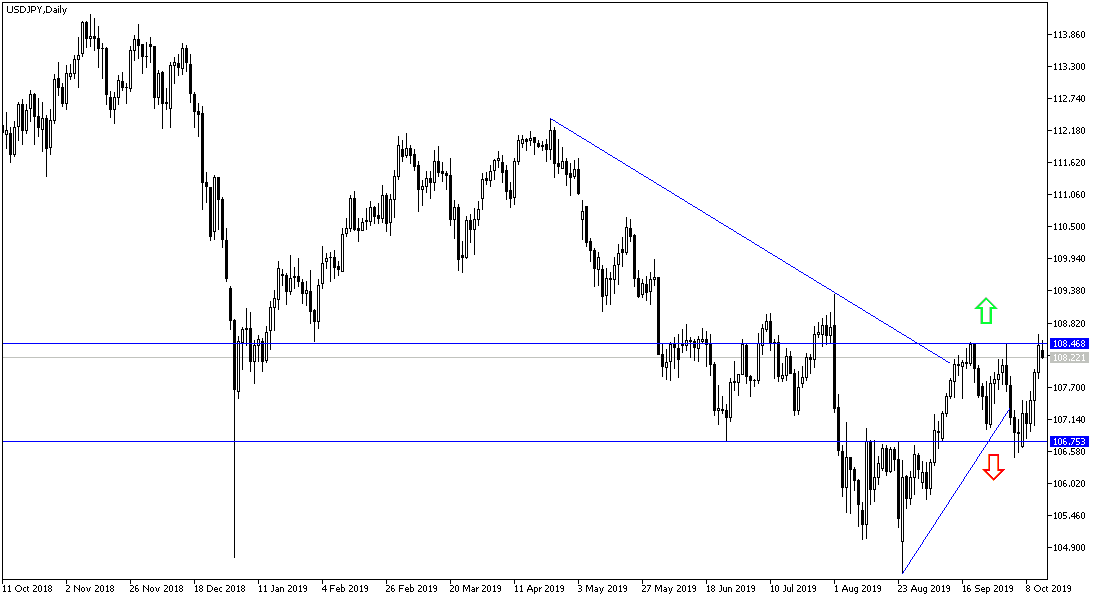

During last month's trading, and in October’s first trading session, the USD/JPY failed to breach the 108.50 resistance level, from which the pair bounced back strongly amid technical selling. At the end of last week's trading, as investors’ risk appetite increased, and investors abandoned safe havens, the pair moved up breaching that resistance by testing 108.62 before settling around 108.30 at the beginning of this week. Investors risk appetite increased due to recent optimism of the possibility of reaching a trade agreement, albeit limited, between the United States and China to avoid the continuation of their trade dispute, which threatens to stagnate the global economy. Investors are also optimistic about the recent positive steps to reach a Brexit agreement. The US dollar suffered a setback from weak US inflation figures last week, which supports expectations that the Federal Reserve will have to cut US interest rates for the third time this year and may do so when it meets at the end of this month.

The most important economic indicator for the US dollar this week is US retail sales data. Retail sales are expected to show a 0.3% rise in September from 0.4% in August on a monthly basis, and the data will be released on Wednesday at 13.30 GMT. Core retail sales are expected to rise 0.2% from 0.0% the previous month.

The results may be important to assess the impact of the US economic slowdown on consumers who have so far been safe and optimistic. If retail sales fall short of expectations, this may indicate that the slowdown is also moving towards the consumer, increasing the alarm bells that are more dangerous for the outlook. This will also have a more pronounced bearish effect on the USD. At the same time, the data may lose some relevance given the generally upbeat outlook for the US economy after last weekend's trade deal between the US and China.

Weak US inflation figures have reinforced expectations that the US central bank will cut US interest rates for the third time in 2019.

According to the technical analysis of the pair: USD/JPY price need to stabilize above 108.60 resistance and the momentum to complete the upward correction, which will not strengthen without moving towards the 110.00 psychological resistance. Should it fail to do so, the bearish momentum may return to the pair, especially if it moves towards support levels 107.70 and 106.90 respectively. The US-China trade agreement will set the course for the pair in the coming period. We still prefer to buy the pair from every bearish level.

As for the economic data today: Today is a public holiday in the Japanese and US markets and thus the pair will react to the extent of investor risk appetite. The JPY is one of the most important safe havens for investors in times of uncertainty.