Investor risk appetite has increased especially after the EU agreed to extend the Brexit date by another three months after the British government failed to pass the Brexit agreement through the British House of Commons to enable Johnson to exit earlier than Oct. 31. Therefore, USD/JPY moved towards the 109.03 resistance, the highest level in nearly three months. In addition, the recent optimism about the US-China trade talks and the possibility of a larger agreement could provide some support to the global economy, which has been negatively affected by the prolonged trade conflict. The US-China tariff war has weakened the manufacturing sector around the world and global exports have seen a recession foreshadowing a global financial and economic crisis.

Investors remain in a wait-and-see position for the US Federal Reserve's monetary policy first, amid firm expectations that they may cut US interest rates for a third time to counter the recent weakness in the US economy. Then the Bank of Japan will announce its monetary policy as well and almost 60% of respondents in the Bloomberg survey do not expect the Bank of Japan to provide more stimulus this week. However, those who expect the Bank of Japan to cut interest rates in the coming months pushed expectations to around 75% from just below 66% the previous month. However, many expect the bank to change its direction forward to future rate hikes.

China reported that industrial profits fell 5.3% year on year in September, its biggest decline in four years.

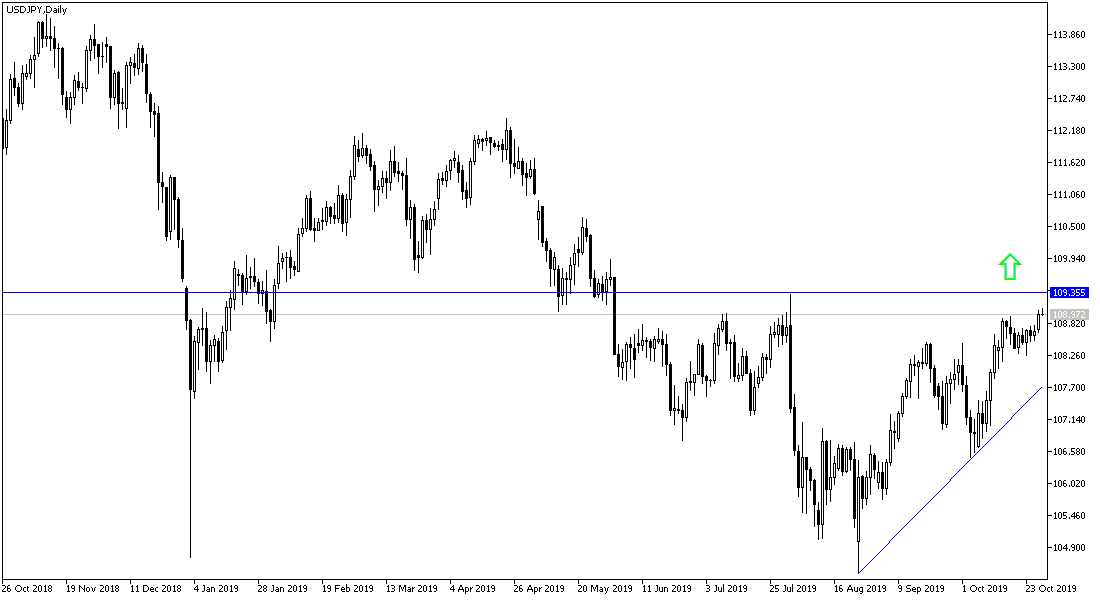

According to the technical analysis of the pair: stability of USD/JPY above 109.00 resistance will increase the bullish momentum to rush towards 110.00 psychological resistance, which is still the key for the pair to test stronger bullish levels. On the downside without moving around and below the 108.00 support level, the bullish correction for the pair will remain the best for the short term. Taking into account the reaction of important US economic data for the week.

As for the economic calendar data today: From Japan the CPI will be released. From the US, consumer confidence and pending home sales will be released.