Earlier in the week, the USD/JPY fell to the 108.29 support as pressure on the US dollar from expectations for a US rate cut next week by the US Federal Reserve continued to show weakness in recent economic performance. The pair has stabilized around 108.70 at time of writing as it tries to capitalize on investor appetite for risk and away from safe havens. Investors will keep an eye on the results of economic indicators until the final announcement of US monetary policy decisions. The pair's current performance is on hold until a new momentum is completed to complete the bullish correction. The pair benefits from optimistic comments from US President Donald Trump and other US officials about the status of trade negotiations with China.

Trump told reporters that he hoped to sign a trade deal with China next month at a summit in Chile, “or whenever possible. “. Once again, talks on resolving a dispute over China's trade and technology policies continued for more than a year, with the two sides imposing tariffs on billions of dollars of each other's goods. The latest round, held earlier this month in Washington, helped thwart a new round of tariff increases on Chinese imports that could escalate tensions. Talks are expected to take place this week, and Vice Premier Liu Hu, China's envoy in charge of the negotiations, said over the weekend that significant progress has been made. In the same context, Trump administration economic adviser Larry Kudlow said that if the current talks take place well, Trump may cancel more tariffs planned in December.

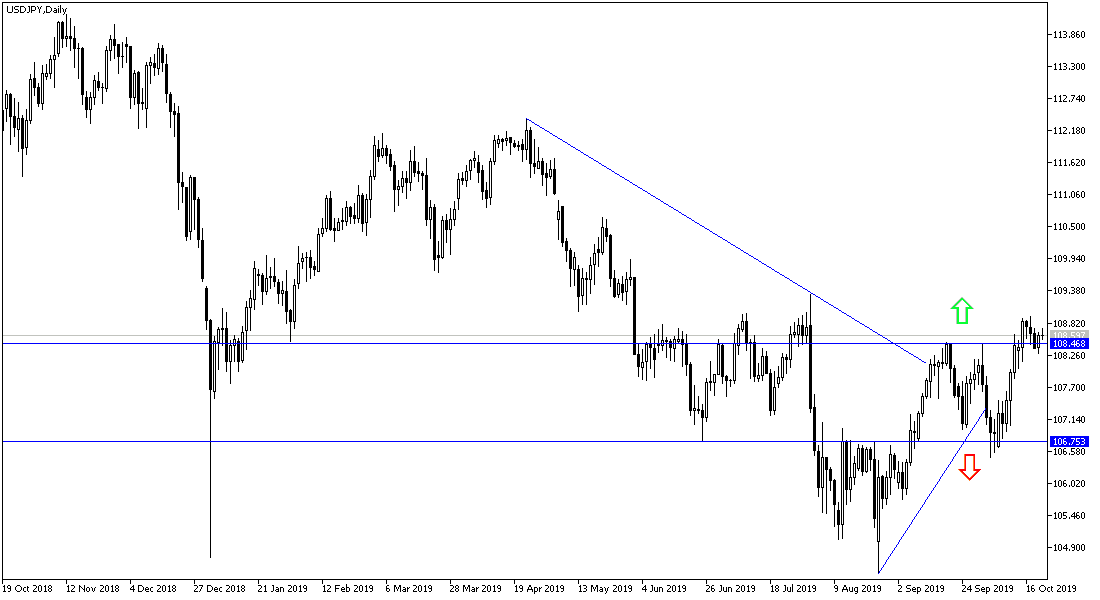

According to the technical analysis of the pair: The opportunity for an upward correction of the USD / JPY is still valid, and if the pair moved towards 110.00 psychological resistance, it may strengthen this trend. And the opposite will take place if the pair moves towards support levels at 108.00, 107.45 and 106.90 respectively. As the JPY is one of the most important safe havens, the return of global trade and geopolitical tensions is a strong and direct threat to the pair's recent bullish performance.

The US dollar will be affected today by the announcement of existing home sales.