After two consecutive weeks of gains for USD/JPY, and for three trading sessions in a row, the gains are capped at the 108.86 resistance level, where it is stable around at the time of writing. On the daily chart, the pair has formed a consolidation area that is foreshadowing a strong move ahead, and with the pressure on the dollar, it is expected to retreat with a sell-off in which the pair may give up most of its recent gains. Despite investors' risk appetite and abandonment of safe havens, the US currency has been subjected to successive pressure factors, starting from the weakness of the results of important economic indicators, mainly weak employment figures and low inflation rates, that are far from the Federal Reserve's target, and yesterday’s announcement of a decline in retail sales to the lowest Its level in seven months.

In a regular report from the Federal Reserve Bank released yesterday, the bank explained that US economic growth had seen a modest growth rate last month, reinforcing expectations that the US central bank may have to cut interest rates for the third time at its meeting this month to protect the longest economic growth in the nation's history from the fallout from the trade war between the world's two largest economies.

Amid much debate over the looming recession in the United States, actual US corporate earnings are still above expectations, suggesting that consensus may be very negative, with potential positive effects on the US dollar. The start of Wall Street's third-quarter earnings season showed that the results were unexpectedly good. Among the companies whose earnings exceeded analysts' estimates are Citibank, Johnson & Johnson, J.P Morgan, Prologis and UnitedHealth.

The data suggests that fears that the US economy as a whole is heading for recession may be premature. The slowdown may remain confined to manufacturing and trade-related sectors, and the contagion that is feared to occur throughout the economy, particularly the consumer and service sectors, is still limited.

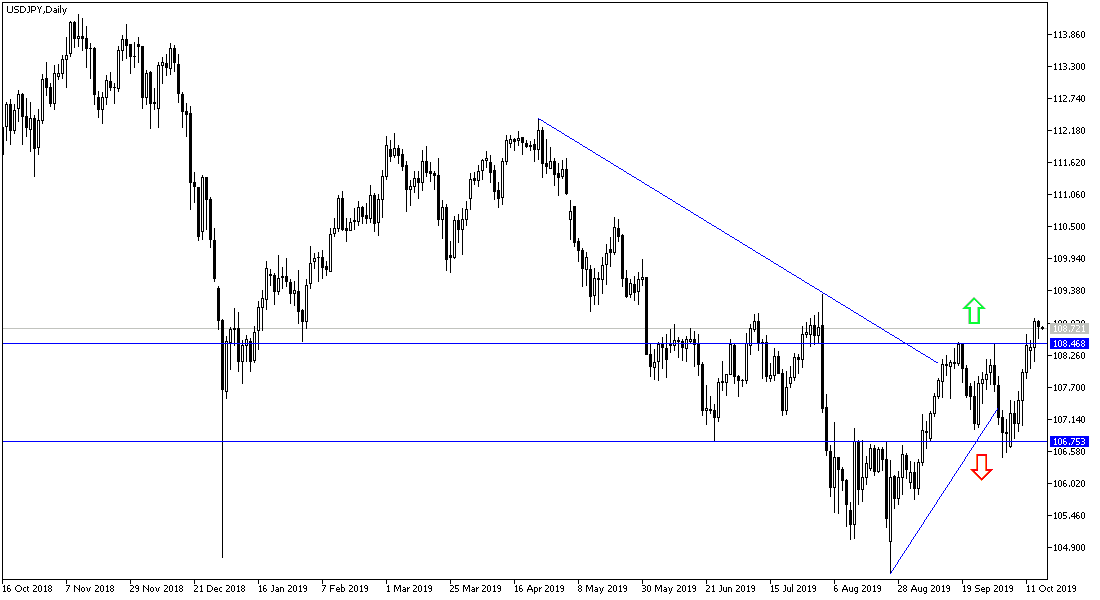

According to the technical analysis of the pair: So far, the USD / JPY performance is in the range of upward correction. As mentioned in recent technical analysis, the pair needs to move towards the 110.00 psychological resistance to confirm the strength of the upward correction. On the downside, the closest support levels for the pair are currently at 108.25, 107.60 and 106.45 respectively, and the last level represents a new strength for the downtrend and a breakdown of the opportunity for the current upward correction.

As for today's economic data: There are no significant economic data coming out of Japan today. From the United States, the Philadelphia Industrial Index, building permits, housing starts, industrial production, jobless claims and oil inventories will be released.