Investors' risk appetite increased as financial markets were optimistic about the US-China trade agreement that helped to extend the USD/JPY gains, which successfully breached the important 108.50 resistance and completed the rise to 108.90 before settling around 108.65 at the time of writing. The release of important US retail sales figures, through which consumer confidence, and their appetite for spending is measured, as the US economy relies heavily on consumers. For the second week in a row, the pair continues to correct higher and focus now on the 110.00 psychological top, which may change the direction of the pair for a long time. The dollar gained support during Tuesday's trading session due to fresh doubts about the feasibility of the US-China trade agreement on Friday. The details remain vague and the remaining points of contention are far from being resolved.

The Japanese yen is one of the most important safe havens for investors in the event of increased trade and political tensions around the world, and is ready to go again and at any time. The US trade deal with China may be temporary and did not convince the markets that the global trade war has ended as a truce, and that the dispute is re-inflamed with any retaliatory measures taken by one of the parties, which is always happening. Thus, the pair's recent gains may be collapsing at any time. US President Trump wants America first and does not care in the rest of the world. It is a policy that will not satisfy the world's second largest economy.

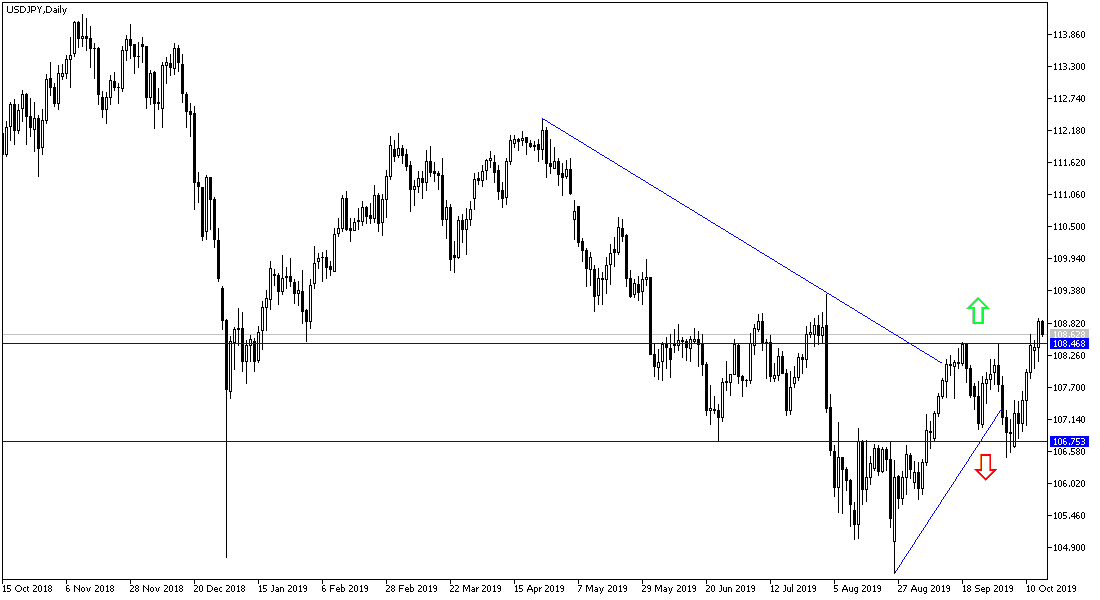

According to the technical analysis of the pair: on the daily chart, and with the success of the USD / JPY price to overcome the108.50 resistance, the bullish correction got a momentum and will strengthen the reversal of the trend by testing the 110.00 psychological resistance. On the downside, if the pair returns to test the support levels 108.10, 107.55 and 106.90, the hopes of a bullish correction will collapse again and the pair will start moving inside its bearish channel, which is still valid in the long term.

As for the economic calendar today: There are no significant Japanese economic data today. From the US, this important retail sales figures will be released along with the NAHB housing index.