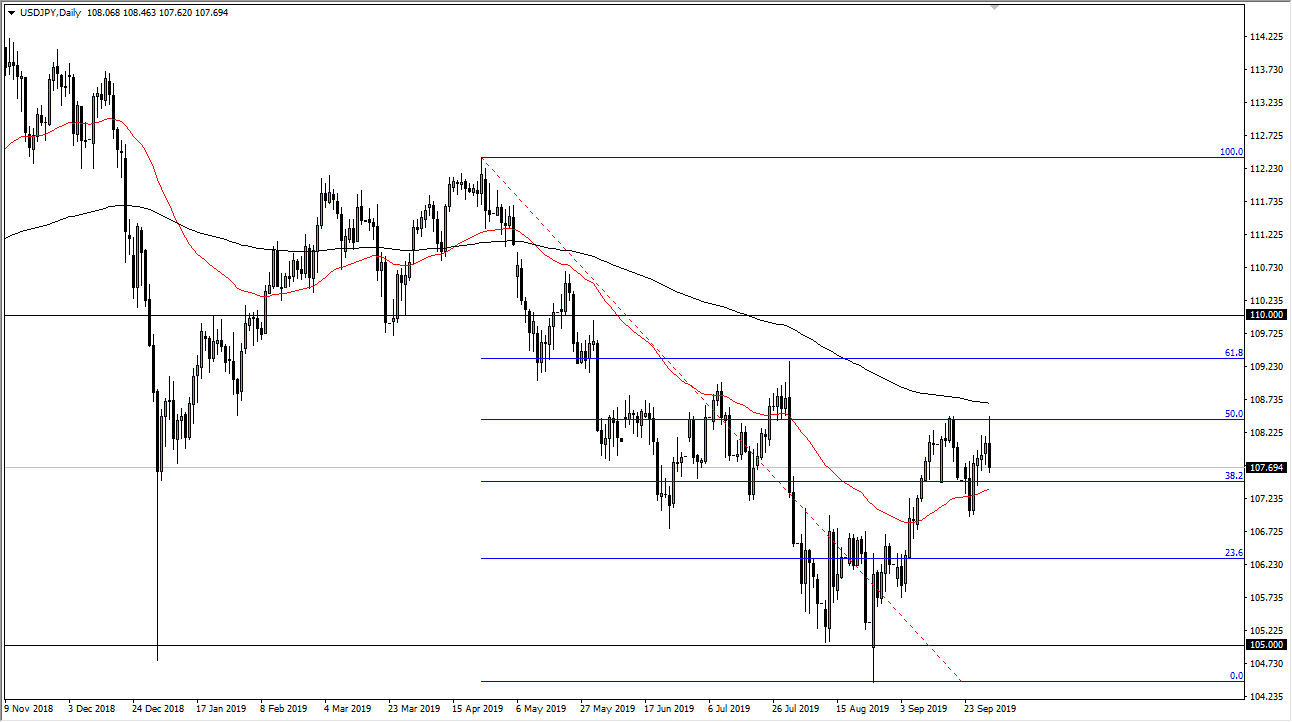

The ISM figures in the United States on Tuesday were very shockingly low, and therefore it’s not a huge surprise that the US dollar pulled back against the safety currency known as the Japanese yen. The market is trying to break out to the upside but it had been dangerously close to a major resistance barrier in the form of the 50% Fibonacci retracement level, the breakdown candle from July, and of course the 200 day EMA.

All of this isn’t to say that the market is going to suddenly break down drastically, but it does suggest that there is a little bit more in the way of downside. If that’s going to be the case, then the market will probably go looking towards the ¥107 level underneath, which is just below the 50 day EMA and at the most recent bounce. I think at this point it makes sense to go back towards that area and then perhaps find buyers again. It wouldn’t be very surprising to see this market chop around sideways and without any serious directionality to it as there are a lot of moving pieces around the world that can affect risk appetite which is the main driver of this pair.

The S&P 500 looks like it is a bit exhausted and probably will continue to be very noisy so therefore I think this market will be noisy. I am not overly bullish or bearish and believe that between the 200 day EMA and the ¥107 level we are going to try to carve out some type of short-term trading range. I think that’s a proxy for the S&P 500 as well, so as that market rises and falls, I would fully anticipate that this market will do the same. Short-term charts will be needed to trade this market as the volatility will probably only get worse from here.

If we were to break down below the ¥107 level, then it’s possible we could drop down to the 100 ¥105 level which was the scene of a major bounce recently. Longer-term, that is my outlook but I also recognize that the market looks very congested at this point and therefore it’s difficult to put a lot of money to work for a longer-term play. With that in mind a certain amount of patience will be needed but eventually we will get the breakout for a bigger trade.