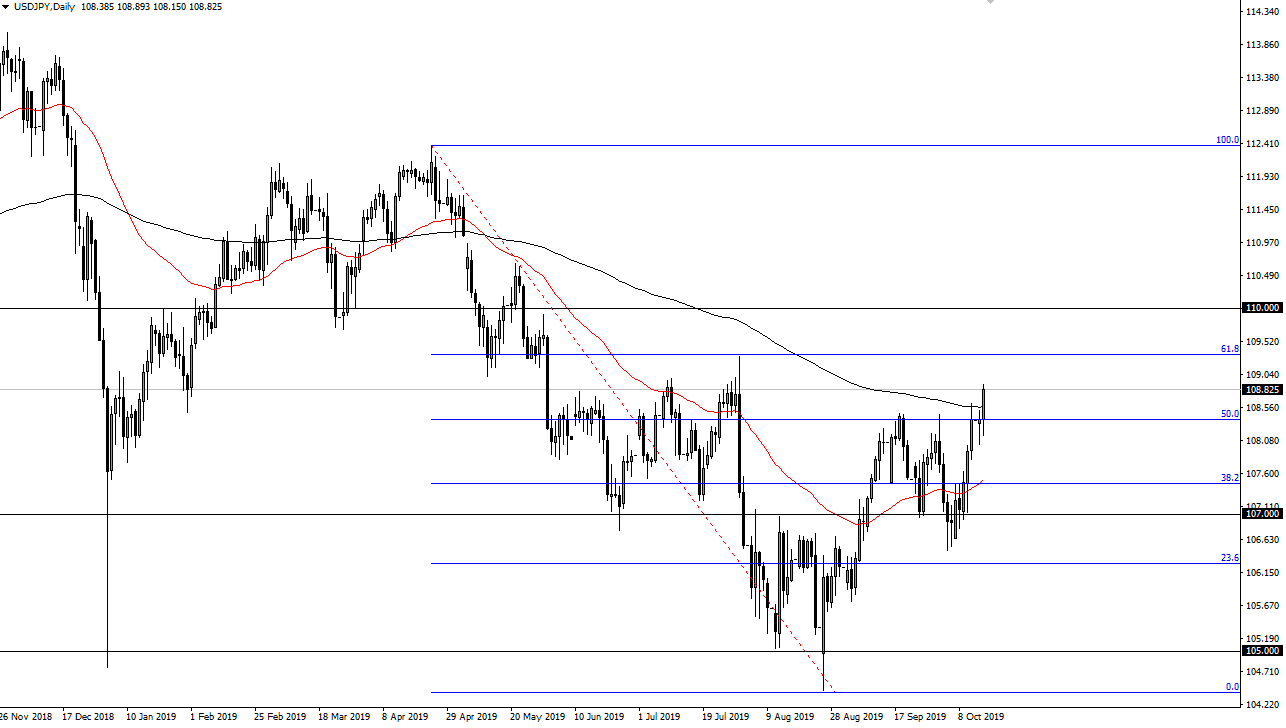

The US dollar has initially pulled back a bit during the trading session on Tuesday, reaching towards the bottom part of the hammer from the previous session before rallying again. Keep in mind that this pair is highly sensitive to risk appetite, and of course as the stock markets had rallied a bit it makes sense that the Japanese yen get sold off. Banks offered a strong earnings report, and that of course help the S&P 500. All things been equal though, this market does have a lot of resistance just above.

The 200 day EMA being broken above as handily as it has, it’s likely that we should continue to go higher. Ultimately, the ¥109 level will be a difficult thing to overcome, and if we can break above there it’s likely that we could go towards the ¥110 level. Pullbacks should continue to be thought of as value unless of course we can break down below the bottom of the trading session from Monday. That of course would show a significant amount of negativity that could break this market down but now that we are well above the significant resistance that we been dealing with for a few weeks. Now that we have broken out, it’s likely that we will go looking towards the ¥110 level as the consolidation area measures for that move.

Looking at this chart, it’s obvious that we have shown quite a bit of bullish pressure, and I think that will probably continue to be the case but keep in mind that we have the US/China trade situation that can throw headlines into the mix at any moment, so volatility is something that we need to be aware of, as a sudden headline could throw algorithms into the mix and start causing major issues. With that, it’s likely that although we are bullish, you are probably going to be better off buying little bits and pieces along the way on dips, trying to take advantage of what looks to be the beginning of a bigger trend. If we can break above the ¥110 level, this market is going to take off, probably with some type of really good economic announcement or earnings possibly, because the US/China trade situation will not be solved in the short term would be my guess based upon the recent headlines and actions.