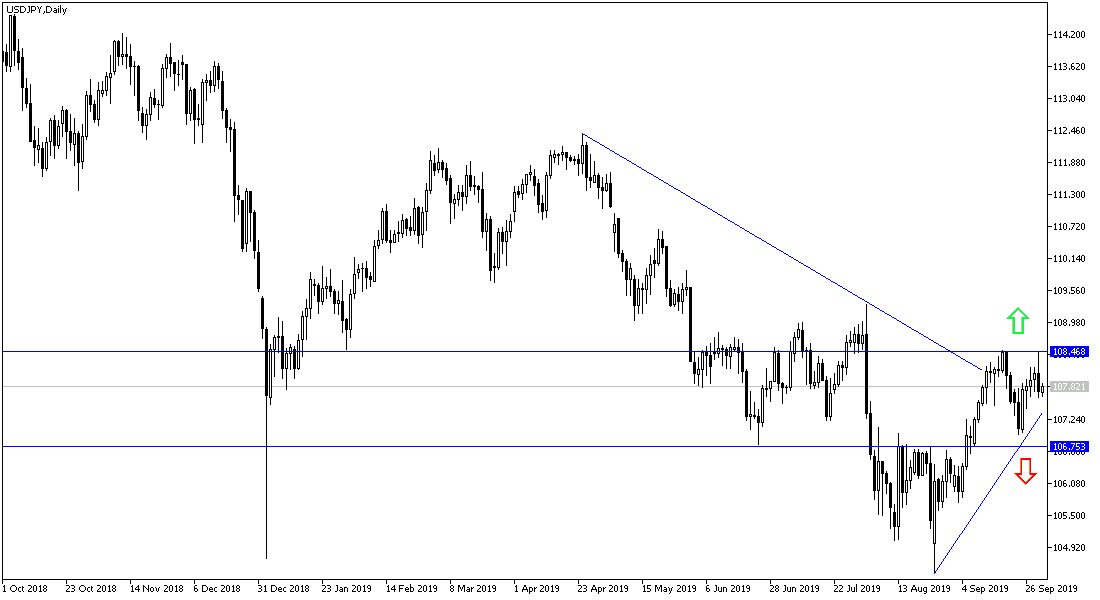

By checking the USD/JPY, we note that the bullish correction faces a difficult resistance at the 108.47 level, which the pair attempted to break through during yesterday's trading session and failed, and then returned to 107.75 support at the time of writing. Last week, the pair tried to break it for two straight sessions, and did not succeed. This performance confirms that the downtrend still has a chance to be stronger. The pair's success in breaching this resistance will support the move towards the 110.00 psychological resistance, which is key to the strength of bullish correction. Approaching the 107.00 support will add further bearish momentum.

From a basic perspective. A limited trade agreement has been reached between the United States and Japan, and both sides insist on continuing to work towards a more comprehensive agreement. Japan essentially granted the US conditions similar to those agreed in a trans-Pacific partnership after the US withdrawal from it. In contrast, the United States dropped tariffs on some Japanese consumer products and machine tools.

Agreement on digital trade may be an element that could serve as a model for future trade agreements. The United States and India are moving to a short-term agreement. There is a risk that US attention will shift to Europe as the WTO approves retaliatory measures to compensate for inappropriate Airbus subsidies. There are some risks that limited short-term agreements violate WTO principles and may be challenged.

Japan increased the sales tax to 10 percent from 8 percent, which could mainly affect the extent of Japanese consumer spending and confidence. Tankan's monthly survey by the Bank of Japan is still at its lowest level in six years. Economists believe that the decline in sentiment among major manufacturers in Japan to this level is due to the impact on Japan from the slowdown in global economic growth and the negative effects of the US-China trade war.

The most important support levels for the USD/JPY today are: 107.65, 106.90 and 106.00 respectively.

The most important resistance levels for the USD/JPY today are: 108.35, 109.00 and 109.85 respectively.