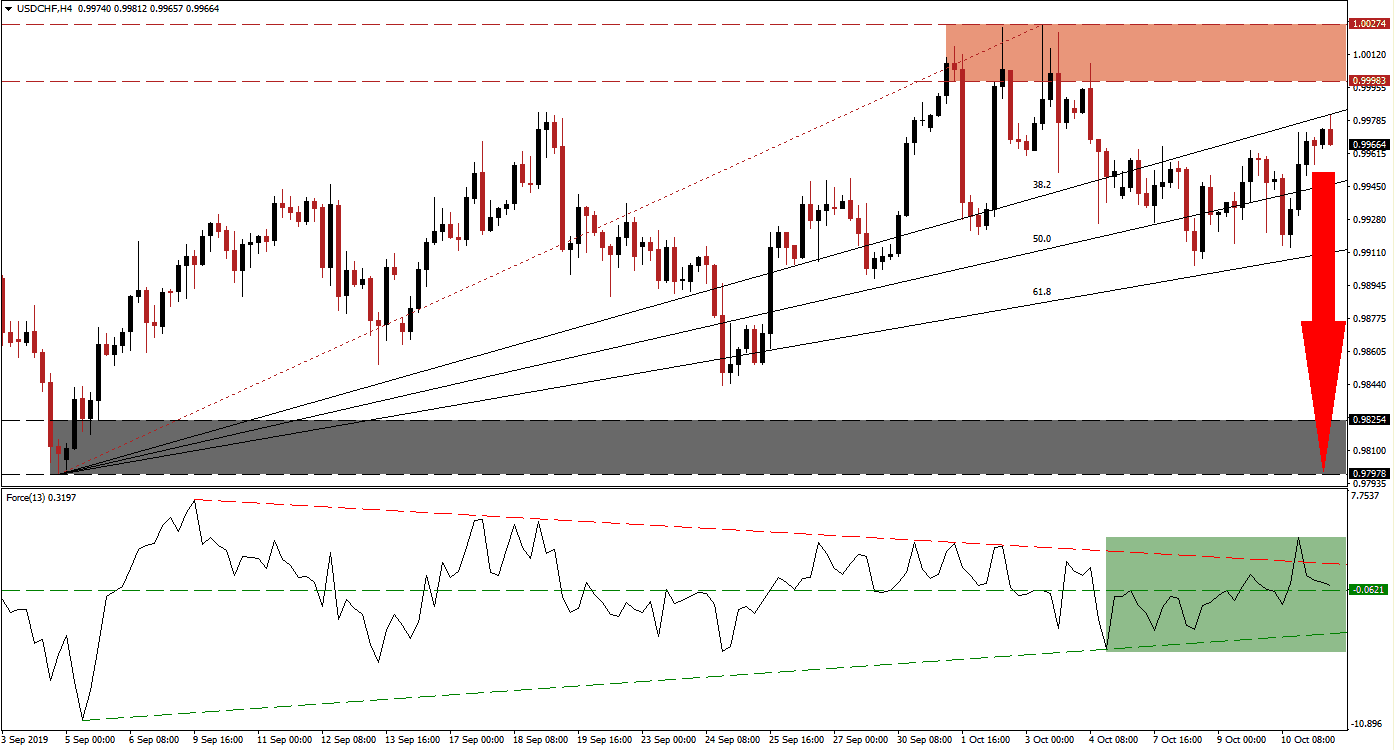

As the second and final day of US-China trade talks will be followed closely, safe haven currencies such as the Swiss Franc were under selling pressure. This trend is showing signs of exhaustion and could be reversed. The expected final deal, which may be limited to a currency pact negotiated in February before talks broke down, is likely to be nothing more than a face-saving announcement for both sides which will bridge the gap to the next round of talks. The USD/CHF stretched its advance into its ascending 38.2 Fibonacci Retracement Fan Resistance Level, which is closing in on the bottom range of its resistance zone, from where bearish pressures are on the rise.

The Force Index, a next generation technical indicator, briefly spiked above its long-term descending resistance level; this move was quickly reversed as marked by the green rectangle. The USD/CHF started to reverse as the uptrend is exhausted and the Force Index may be pressured below its horizontal support level, turning it into support. This would also place it into negative territory and bears in charge of price action which is expected to further accelerate a move to the downside. The ascending support level should be monitored closely as a breakdown below it may initiate a longer term downtrend in this currency pair. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

With the Fibonacci Retracement Fan sequence approaching the resistance zone, located between 0.99983 and 1.00274 which is marked by the red rectangle, an extension of the advance is highly unlikely. The key psychological 1.00000, or parity, is nestled inside the resistance zone and enforces it further. The fundamental picture favors a weaker USD/CHF and forex traders should monitor the intra-day high of 0.99654 which represents the peak of a previously reversed breakout above its 38.2 Fibonacci Retracement Fan Resistance Level; a move below this level is expected to attract fresh sellers to this currency pair and profit taking may further accelerate bearish momentum.

Due to the steady advance in the USD/CHF, well supported by the Fibonacci Retracement Fan sequence, a breakdown below the ascending 61.8 Fibonacci Retracement Fan Support Level will clear the path for a sell-off into its next support zone. The Force Index is expected to lead a breakdown in price action with one of its own below its horizontal support level. The next support zone is located between 0.97978 and 0.98254 which is marked by the grey rectangle. Any disappointment out of today’s trade talks should provide a fundamental catalyst to the downside as positive news have already been priced in. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

USD/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.99650

Take Profit @ 0.98000

Stop Loss @ 1.00200

Downside Potential: 165 pips

Upside Risk: 55 pips

Risk/Reward Ratio: 3.00

Any short-term price spike into parity should be considers an excellent short selling opportunity as a sustained breakout in the USD/CHF above its resistance zone is not expected. A major fundamental catalyst would be required which remains absent. Another major resistance zone awaits price action, in the unlikely event of a breakout, between 1.00978 and 1.01212 from where a previous sell-off accelerated to the downside. Fundamental factors point towards a weaker currency pair which is supported by technical factors.

USD/CHF Technical Trading Set-Up - Limited Breakout Scenario

Long Entry @ 1.00450

Take Profit @ 1.01100

Stop Loss @ 1.00150

Upside Potential: 65 pips

Downside Risk: 30 pips

Risk/Reward Ratio: 2.17