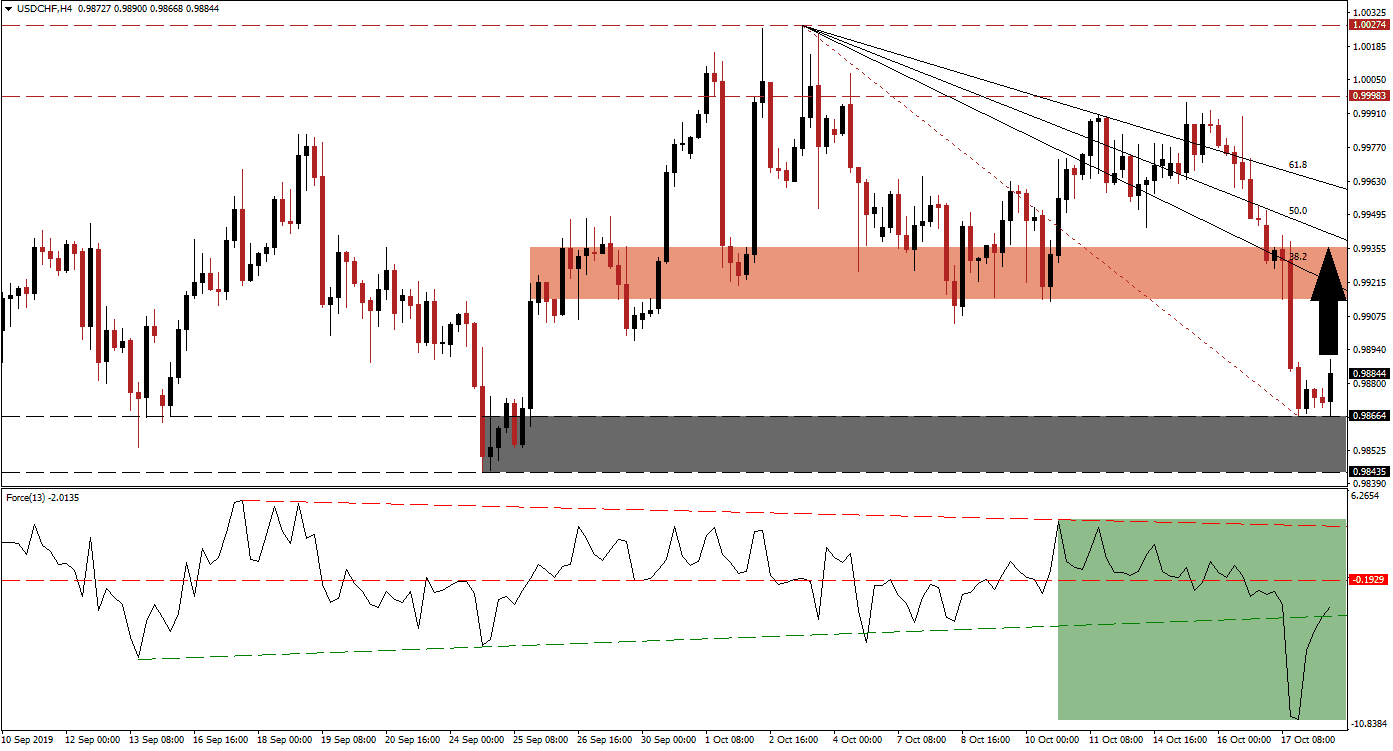

With US economic disappointments picking up in October and doubts about the US-China trade truce on the rise, the US Dollar has been pressured to the downside in a trend which is expected to accelerate moving forward. The USD/CHF plunged from its resistance zone, through its entire Fibonacci Retracement Fan sequence and into the top range of its long-term support zone; this move included a breakdown below a short-term support zone which has been turned into resistance. The sell-off paused at the top range of its support zone and the Fibonacci Retracement Fan sequence was re-drawn as a result.

The Force Index, a next generation technical indicator, confirmed the contraction in the USD/CHF and plunged to a new low of its own following a breakdown below its ascending support level from where it quickly spiked which indicates that bearish momentum is receding. The Force Index remains in negative territory, but managed to push back above its ascending support level while it remains below its horizontal resistance level as marked by the green rectangle. More upside is expected, but the long-term downtrend in this currency pair and confirmed by this technical indicator is likely to remain intact. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Price action started to bounce off of the top range of its support zone, located between 0.98435 and 0.98664 as marked by the grey rectangle. The sharp sell-off which emerged after the USD/CHF broke parity inside its long-term resistance zone, located between 0.99983 and 1.00274, increased the likelihood of a price action reversal on the back of a short-covering rally. This is expected to keep the long-term downtrend intact and a renewed sell-off should carry enough momentum for a breakdown below its support zone.

Upside potential is expected to be limited to its short-term resistance zone which is located between 0.99148 and 0.99299 as marked by the red rectangle; the descending 38.2 Fibonacci Retracement Fan Resistance Level is nestled inside this zone while the 50.0 Fibonacci Retracement Fan Resistance Level has approached the top range of it. A counter-trend reversal into this enforced resistance zone will not violate the long-term trend and should gather enough bearish momentum for a fresh breakdown sequence in the USD/CHF. The safe haven status of the Swiss Franc is additionally keeping downside pressure on price action. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

USD/CHF Technical Trading Set-Up - Price Action Reversal Scenario

Long Entry @ 0.98850

Take Profit @ 0.99350

Stop Loss @ 0.98700

Upside Potential: 50 pips

Downside Risk: 15 pips

Risk/Reward Ratio: 3.33

A breakdown in the Force Index below its ascending support level is expected to lead the USD/CHF into a breakdown below its support zone. Volatility is expected to remain elevated and while the fundamental scenario suggests more long-term downside in this currency pair, the technical picture points towards a short-term advance before resuming its sell-off. The next support zone is located between 0.97756 and 0.97978.

USD/CHF Technical Trading Set-Up - Breakdown Scenario

Short Entry @ 0.98350

Take Profit @ 0.97900

Stop Loss @ 0.98550

Downside Potential: 45 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 2.25