Global crude oil prices rise ahead of US-China trade talks scheduled to begin later this week, contributed to the pressure on the USD / CAD pair to pull back to the 1.3290 support before returning to test the 1.3306 resistance early Tuesday. Crude oil rose to $53.45 a barrel. The trade talks will resume on Thursday and Friday, with Chinese Vice Premier Liu He meeting with US Trade Representative Robert Lightitzer and Treasury Secretary Stephen Mnuchin in Washington.

US President Donald Trump said on Friday that his administration had a "very good opportunity" to agree on a trade deal. Chinese officials are reluctant to approve a major trade deal with US President Donald Trump, Bloomberg reports, citing people familiar with the talks. Specifically, Prime Minister Liu Kha is said to rule out commitments to reform Chinese government subsidies or industrial reform.

Some argue that the current optimism of investors is premature, especially after reports that the Chinese want to narrow the scope of the issues under discussion considerably. The Chinese delegation would therefore not be open to discussing the following issues: government subsidies, intellectual property theft and technology transfer. The exception is the key issues Trump will want to include in any negotiations on a comprehensive trade deal.

The trade war between the United States and China remains a major factor affecting global manufacturing growth, which has also affected Canadian manufacturing, so prolonging the war will continue to affect the future of the country's domestic economy strongly. The success of the trade talks could also affect the price of oil and thus reflect positively on the Canadian dollar because oil is the country's main source. When oil prices rise, overall demand for the Canadian dollar to buy oil rises, supporting the currency and vice versa when it falls.

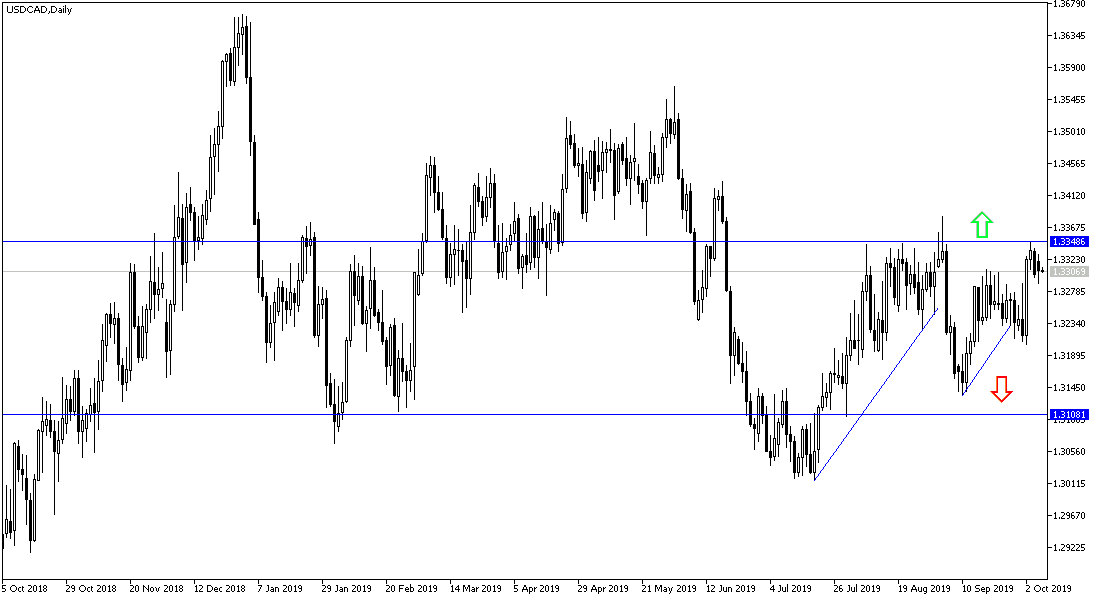

From a technical perspective: USD / CAD continues to have a strong upward momentum with stability around and above 1.3300 resistance, triggering it to test stronger levels followed by 1.3375, 1.3445 and 1.3600 respectively. The return of the Canadian strength may push the pair towards the support levels of 1.3255, 1.3180 and 1.3090 respectively. The latter level consolidates the idea of reversing the current trend.

The Canadian dollar will be affected by the release of Canadian housing data. From the US, there will be producer price index and remarks by US central bank governor Jerome Powell.