After USD/CAD correction attempts down to the 1.3200 threshold of support, the pair bounced back up strongly in the same general trend to the 1.3347resistance, the highest in a month, before closing transactions around 1.3302. The influence on pair by the mixed results of US jobs was limited, and the decline in crude oil prices contributed to support the upward trend again.

In terms of economic news. From Canada, the raw material price index recorded a -1.8% reading in August, its third decline in four months. The country's GDP was steady around (0.0%) in July, hitting a 5-month low. In contrast, there was some good news, with Canada's trade deficit reaching CAD 1.0 billion, less than expected.

From the USA, the ISM manufacturing PMI for September indicated a contraction for the second consecutive month. In contrast, the Services PMI pointed to continued growth, despite falling to 52.6, the lowest reading for the sector since August 2016. By the end of the week's trading, employment data was disappointing. The US economy succeeded in creating a total of only 136,000 jobs in the non-agricultural sector, below expectations of 145,000. Meanwhile, wage growth was reported to have fallen to 0.0%, down from 0.4% the previous month. A positive US unemployment rate fell to 3.5%, its lowest level in 50 years.

Learn about the most important data and events that will affect the Canadian dollar this week:

The beginning from Tuesday with the announcement of Canadian housing starts. Housing starts improved to 227,000 in August, up from 222,000 the previous month. The number is expected to drop to 217,000 in September. On the same day, building permits will be announced, which usually show sharp fluctuations from month to month. After two consecutive declines, permits increased in August with a rise of 3.0%, above expectations of 2.1%. Further gains are expected in September, with expectations of 2.3%.

On Thursday, the New Homes Price Index will be released in Canada. The new homes price index recorded three consecutive declines of - 0.1%, suggesting weakness in the housing sector. The forecast for August is 0.0%.

By the end of the week, Canadian employment data will be released, and the Canadian economy succeeded in creating a total of 81,100 jobs in August, a strong increase after two consecutive declines. This type of rise is unlikely to be repeated. Meanwhile, the country's unemployment rate for August remained steady at 5.7%, matching expectations.

Learn about the most important data and events that will affect the USD this week:

At the beginning of the week, the US dollar will be on an important date with the first remarks by Federal Reserve Governor Jerome Powell. Powell is expected to confirm his statement on recent occasions that the bank will monitor economic developments and external risks to determine appropriate monetary policy. Emphasizing the independence of the Bank's decisions away from the political management of the country.

On Tuesday, the US producer price index (PPI) will be released, and it is a measure of inflation with expectations of a drop in prices, confirming that US inflation will continue to fall despite tow US rate cut decisions this year. Later, there will be new remarks by Federal Reserve Governor Jerome Powell.

Wednesday will be the most important and most influential on the US dollar with comments by US central bank governor Powell and the release of the last Fed meeting minutes, in which, as expected, they cut US interest rates for the second time in 2019. Any pessimistic signals on the minutes of a split will increase expectations of a third rate cut before the end of the year.

Thursday, there will be a release of US consumer price figures, and falling as expected will increase downward pressure on the US dollar as it reinforces expectations that US interest rates could be cut soon.

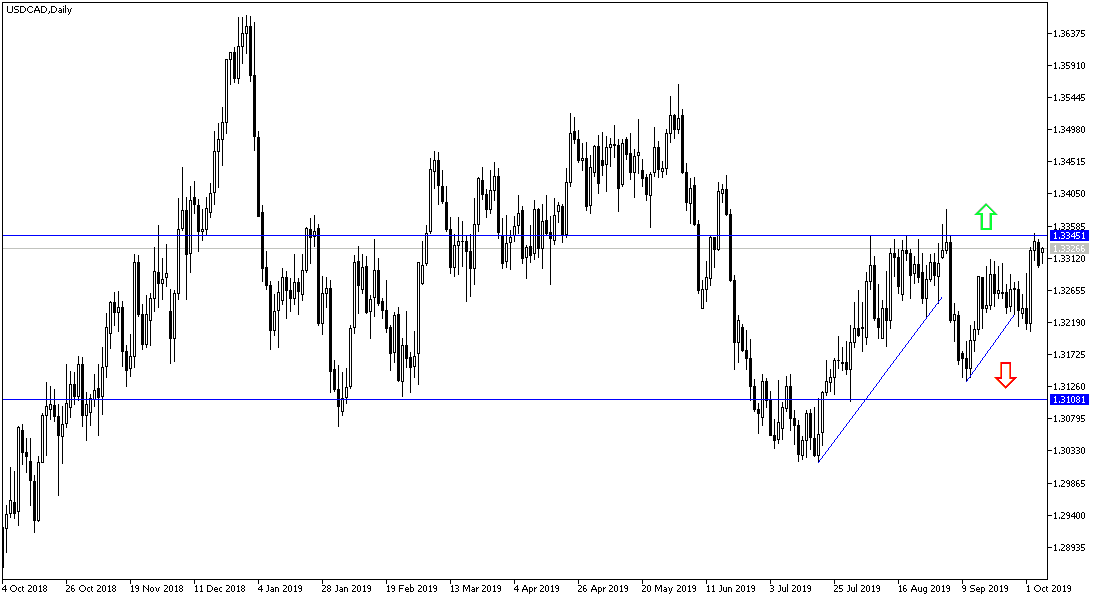

USD / CAD technical outlook for this week:

The general trend for the USD/CAD will remain supported by the upside stability above 1.3300 resistance. At the same time, this momentum faces a strong threat from the slowdown in services and manufacturing PMI in the US as in September, and there are concerns that the US is heading towards recession. At the same time, the slowdown in the United States is bad news for the Canadian economy, which is heavily dependent on its southern neighbor. Oil prices are also under pressure, which could affect Canada's important energy sector.

The most important support levels for the USD/CAD for this week: 1.3265 and 1.3125 and psychological support 1.3000 respectively.

The most important resistance levels for USD/CAD for the week: 1.3350, 1.3445 and 1.3630 respectively.