From today, Japan will increase sales tax, a move that could affect consumer spending and confidence in the world's third largest economy. It was natural for the Japanese yen to be negatively affected against other major currencies. Besides risk appetite, the USD/JPY pair moved higher to reach 108.17 resistance, extending gains for the fourth consecutive day. However, it should be borne in mind that the recent pressure on the JPY will not deter it from the return of gains. The Japanese currency is one of the most important safe havens for investors. Global stock markets fell after Bloomberg News reported last week that US officials were considering restricting investment ties with China. The United States will have other options including a ban on investment in Chinese companies by state pension funds.

Negotiators from the United States and China are due to meet next week in Washington for the 13th round of talks aimed at resolving their trade dispute, removing tariffs imposed due to US complaints about trade surplus and countering Beijing's technological ambitions. A senior Chinese official said China's top trade negotiator would lead the next round of talks with the United States. Vice Premier Liu He will travel to Washington for the negotiations, said Vice Minister of Commerce Wang Xuen.

Investors were optimistic about the improvement in China's manufacturing sector. Data from the IHS Markit survey showed on Monday that China's manufacturing sector grew at the fastest pace since early 2018 in September despite continues trade differences with the United States.

It is the United States. Chicago business activity returned to contraction unexpectedly in September, with the Chicago PMI falling to 47.1 in September after bouncing back to 50.4 in August. A reading below the 50 level, according to data, indicates a decline in business activity in the Chicago area. The index pointed to a contraction for the third time in four months, while economists had expected a more modest decline to 50.2. The production index led the decline, dropping 7.6 points to 40.4 in September, its lowest level since May 2009.

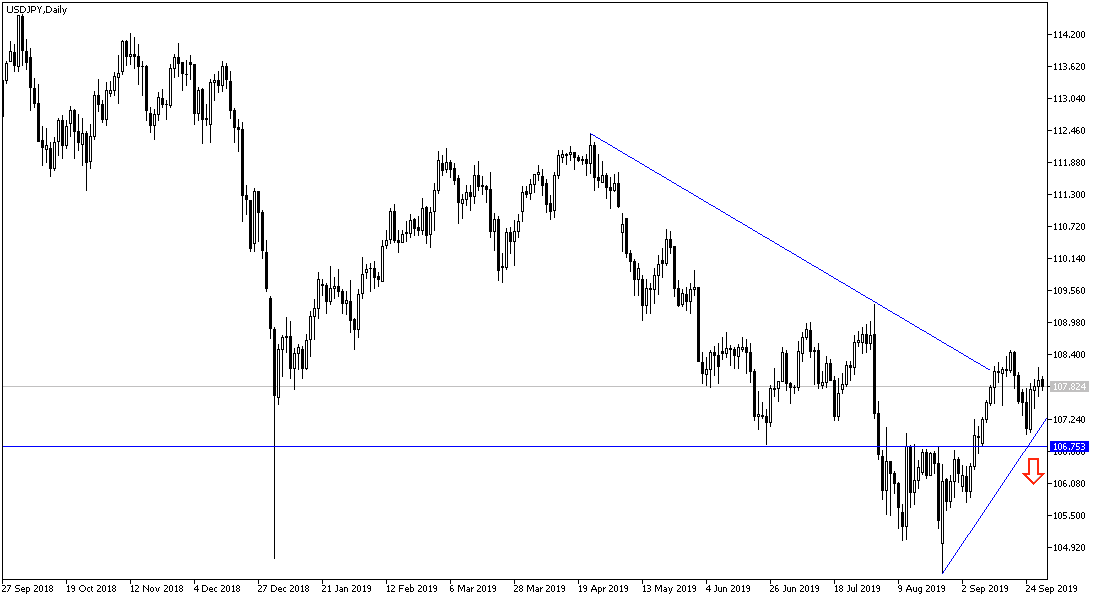

According to the technical analysis of the pair: USD/JPY still has a lot of obstacles to confirm the strength of the correction up. Bulls should push the pair towards resistance levels at 108.85 and 109.30 and 110.00 psychological top to be able to break the downtrend strongly and may happen as investors continue to take risks. In return, the bears may take control again if the pair returns to the support levels at 107.65, 106.80 and 106.00 respectively.

As for today's economic data: Today's economic calendar will highlight the first announcement of the Japanese Tankan survey of industrial and non-industrial companies and then the unemployment rate in the country. From the US, the ISM Manufacturing PMI and Construction Spending Index will be released