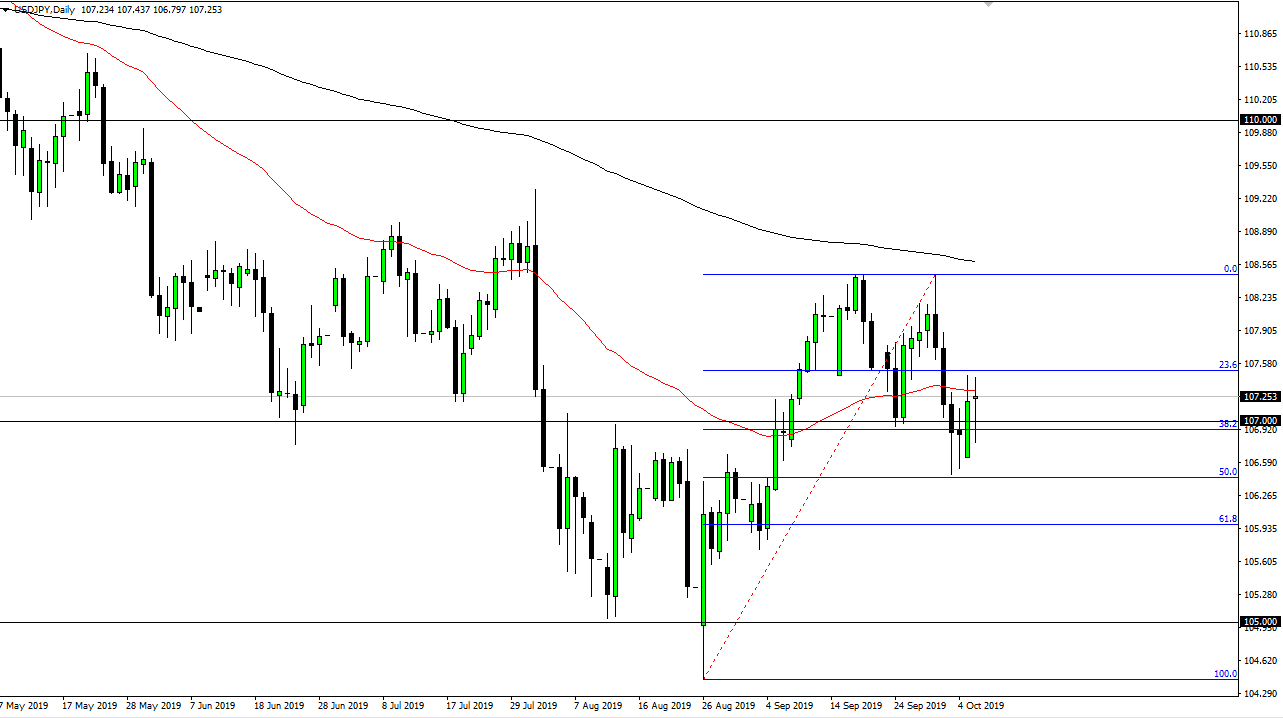

The US dollar has continued to go back and forth during the trading session on Tuesday, showing signs of indecision which makes quite a bit of sense as the risk appetite of the markets continue to be all over the place. The S&P 500 sold off rather drastically, which of course weighs upon this pair. At this point, the pair is turning around to form a bit of a hammer, so if we can break above the top of the hammer, that would in theory be a good sign as not only would you be a structural rally, but it would also be a market moving above the 50 day EMA.

To the upside, this could send the market to the ¥108.50 level, which of course is the most recent high. It is also the scene of the 200 day EMA, which of course will bring in a lot of attention for the longer-term traders. At this point, I would anticipate that area should bring in a lot of sellers and the first signs of exhaustion probably would be a nice selling opportunity if we do in fact find the market reaching towards that area. However, if the market was to break above the 200 day EMA on a daily close, that would be a very bullish sign as well.

Underneath, if we were to break down below the ¥106.50 level, it would crack the 50% Fibonacci retracement level. A break down below there opens up the door to the ¥106 level, which is the 61.8% Fibonacci retracement level. Beyond that, the market opens up the door down to the ¥105 level which of course is psychologically and structurally crucial as we have seen previously. Obviously, with the US/China trade situation all over the place and of course discussions going on this week, it’s obvious that there are a lot of potential headlines out there to throw this market back and forth. The indecisive candle stick for the day suggests that we still don’t know where we want to go yet, and therefore it’s likely that the market needs to find some type of catalyst to make a longer-term nerve, something that I don’t see happening in the short term. At this point, it’s very likely that the market continues to see a lot of volatility, so therefore position sizing should be appropriate as well.