During the trading on Wednesday, October 2, 2019, financial markets and investors in the forex market are on a date with the first US jobs data today with the announcement of the ADP survey of the change in the number of US non-farm payrolls, amid expectations that the number of new jobs will decline strongly. Prior to that, attention will be given to the announcement of the change in Spanish unemployment and the UK Construction PMI.

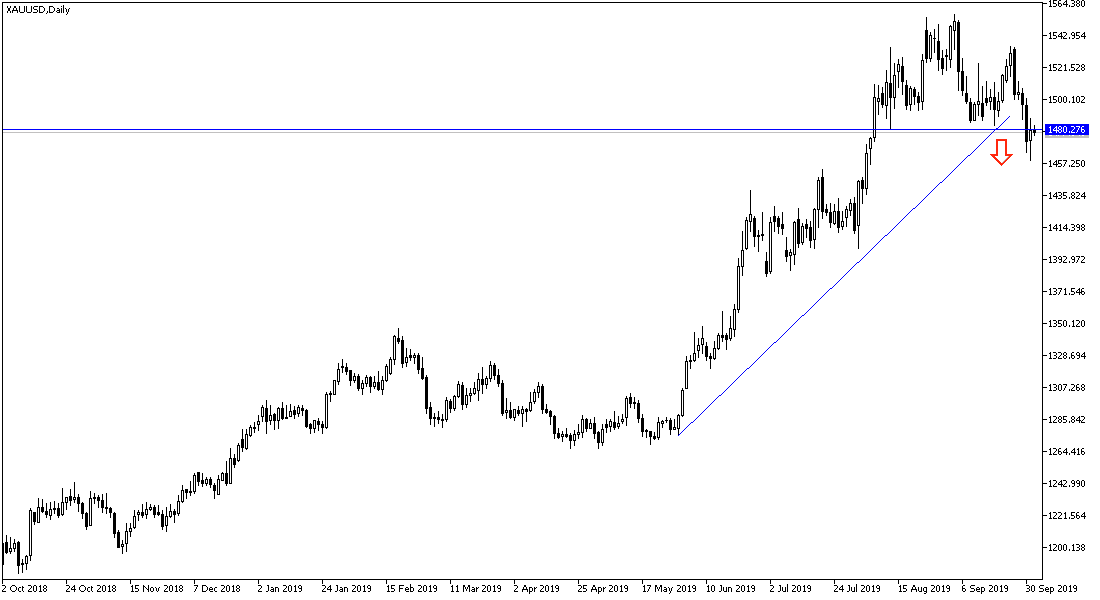

For the performance and movements of global currencies now, the US dollar's gains were temporarily stalled pending the release of the official US employment figures on Friday. As for the single European currency, the Euro is stabilizing around and above the 1.0900 level against the dollar, but remains under constant downward pressure from a slowing Eurozone economy and growing expectations that the European Central Bank may be forced to introduce more stimulus plans. Sterling against the dollar reached the threshold of 1.2200 support, as the outlook for Brexit continues to be blurry and British Prime Minister Boris Johnson seems to be wasting time with unrealistic promises to put the country facing the reality of a no-deal Brexit. The US dollar's gains stalling supported the return of gold price rebound to the 1485 level after falling to the 1460 support. The performance of the Japanese yen will be affected by the consequences of the decision to increase the Japanese sales tax.

In the following lines we will review together the most important trading opportunities to buy or sell the most important currency pairs and gold, which may occur during today's trading based on the expected events and economic data:

Key buying levels:

Buy USD / CAD from the 1.3185 support, target 1.3300 and stop at 1.3100.

Buy GBP / USD from the 1.2190 support, target 1.2450 and stop at 1.2100.

Buy Gold from 1463, target the 1510 resistance and stop at 1450.0.

Buy EUR / USD from 1.0875, target the 1.1065 resistance, and stop at 1.0800.

Key Selling Levels:

Sell USD / CHF from the 1.0020 resistance, target 0.9800 and stop at 1.0100.

Sell USD / CAD from 1.3330, target 1.3100 support and stop at 1.3400.

Sell GBP / USD from 1.2375, target 1.2000 support and stop at 1.2440.