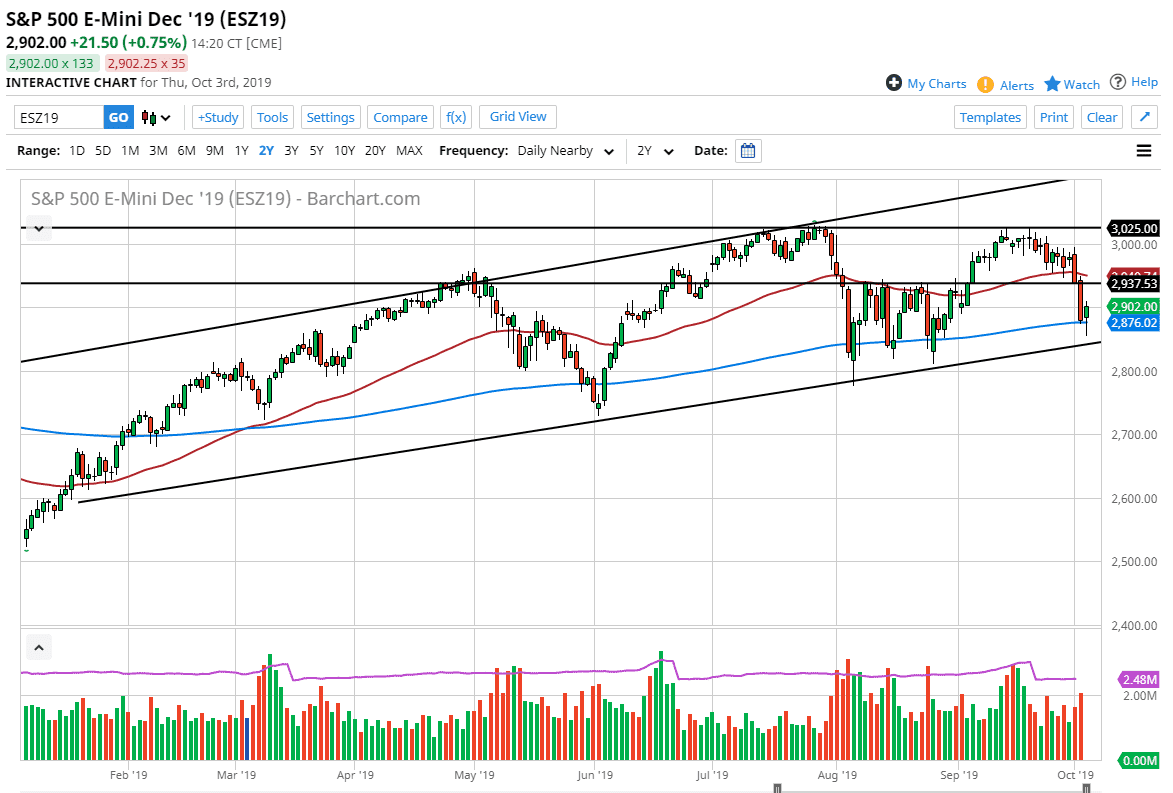

The S&P 500 initially fell during the trading session on Thursday, reaching down below the 200 day EMA which of course is a very important indicator on longer-term charts. Beyond that, there’s a certain amount of psychological importance attached to it as well, and therefore it would have caught a lot of attention. As you can see on the chart, we are also just above an uptrend line in the bullish channel, so as we lineup for the Non-Farm Payroll figures on Friday, this is going to be an interesting session.

At this point, bad news is likely to be good. What I mean by this can be seen during trading on Thursday as the ISM Non-Manufacturing PMI numbers came out lower than anticipated. Because of this, there was an initial short and a “risk off” move, but then again we have turned completely around during the trading session to close closer to the highs. By forming the hammer, I believe that the market is trying to rally based upon bad news now, meaning that stock market community is looking for the Federal Reserve to step in and save them every time bad news comes out.``

Rate cut expectations have been rising for some time, and now we are even talking about a 60% chance of an interest rate cut in December as well. The Federal Reserve has shown itself to be acquiescent to the stock market, so it’s very likely that the stock market is going to start to rally significant based upon the idea of the Federal Reserve having its back. At this point, I think that’s exactly what we are looking at and if the jobs number comes out relatively weak, I would expect an initial push lower, but I would also expect that trend line underneath the hold unless of course the jobs number is absolutely horrific. There is nothing that suggests it will be, and even if it is I suspect it will only be an hour or two before Wall Street convinces itself that the numbers are just an outlier anyway.

To the upside I see the 2940 level as significant resistance, so it may be difficult to break above there. The 50 day EMA is also just above there as well, so there is a natural band of resistance. However, if we can take that out it’s likely that we could go to the 3025 level again.