The S&P 500 has rallied significantly during the trading session on Friday as optimism continues with the trade war situation. The real show is on Wednesday when the Federal Reserve comes out and suggests what is going to do next with monetary policy. The Federal Reserve is expected to cut interest rates next week, and that’s part of what has been fueling stocks going higher. At this point, the market is likely to continue to try to break out, but it probably needs a little bit help.

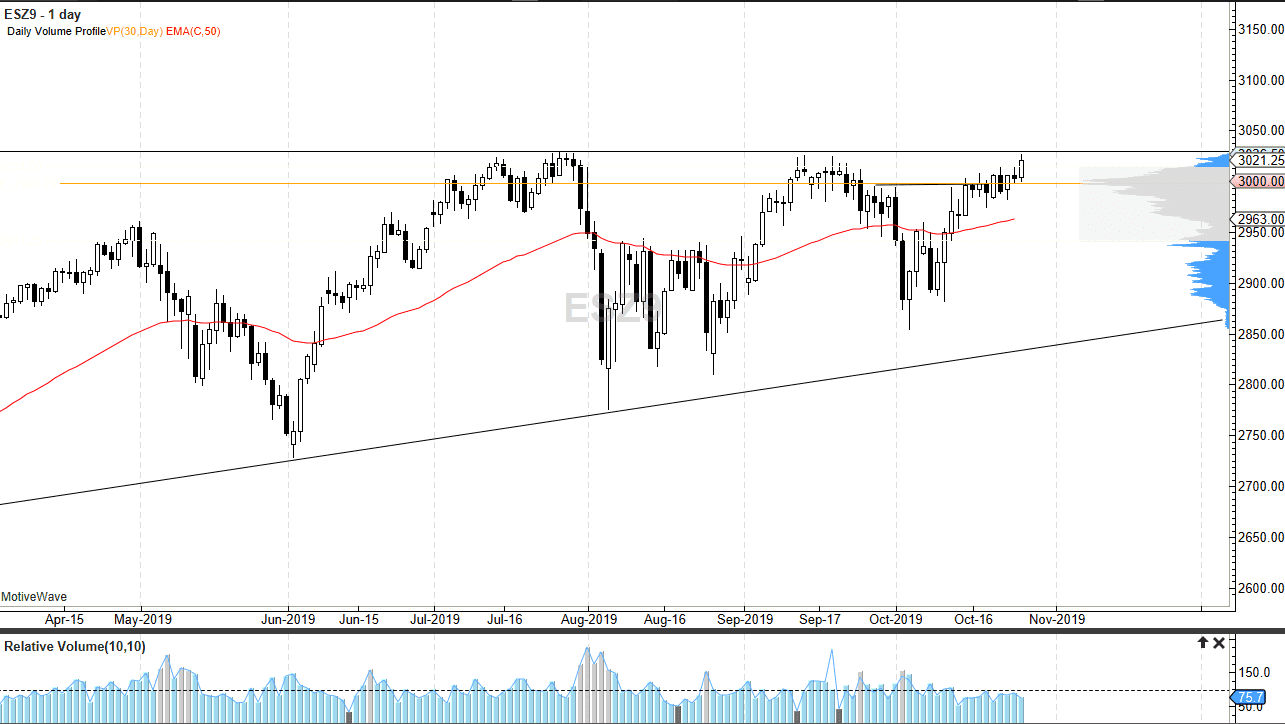

There are a couple of different things it could come in to give help, not the least of which would be the best/China trade situation. At this point in time, the market is starting to pay attention to the US/China trade situation, with perhaps a bit of positive momentum. It’s likely that the market will eventually break out, sending this market to fresh, new highs. I like the idea of buying pullbacks and picking up value at lower levels. This would be especially true at the 3000 had a which is essentially the point of control over the last 90 days, and then of course the 50-day EMA underneath that the 2963 handle.

One thing that is a big problem with the rally on Friday was the fact that most of the leaders were defensive stocks, which doesn’t exactly invoke a lot of confidence. With that being the case, I suspect the pullback is more likely than not, but then value hunters will come back in. Overall, I believe that the market will probably ascend high enough to break out and prove the ascending triangle to be true, and target much higher pricing, perhaps as high as 3200 or so. Short-term pullbacks on the way up will continue to be bought, as this would be a sign of the market breaking out and building up more confidence. A longer-term core position would be built, with short-term pullbacks offering little bits and pieces that you can add to the overall trade. The market is becoming more and more aggressive as far as trying to break out, and therefore it’s only a matter of time before the seller’s finally give way. I anticipate that the meeting on Friday will probably be the catalyst to finally send this market to the upside for the longer-term move.