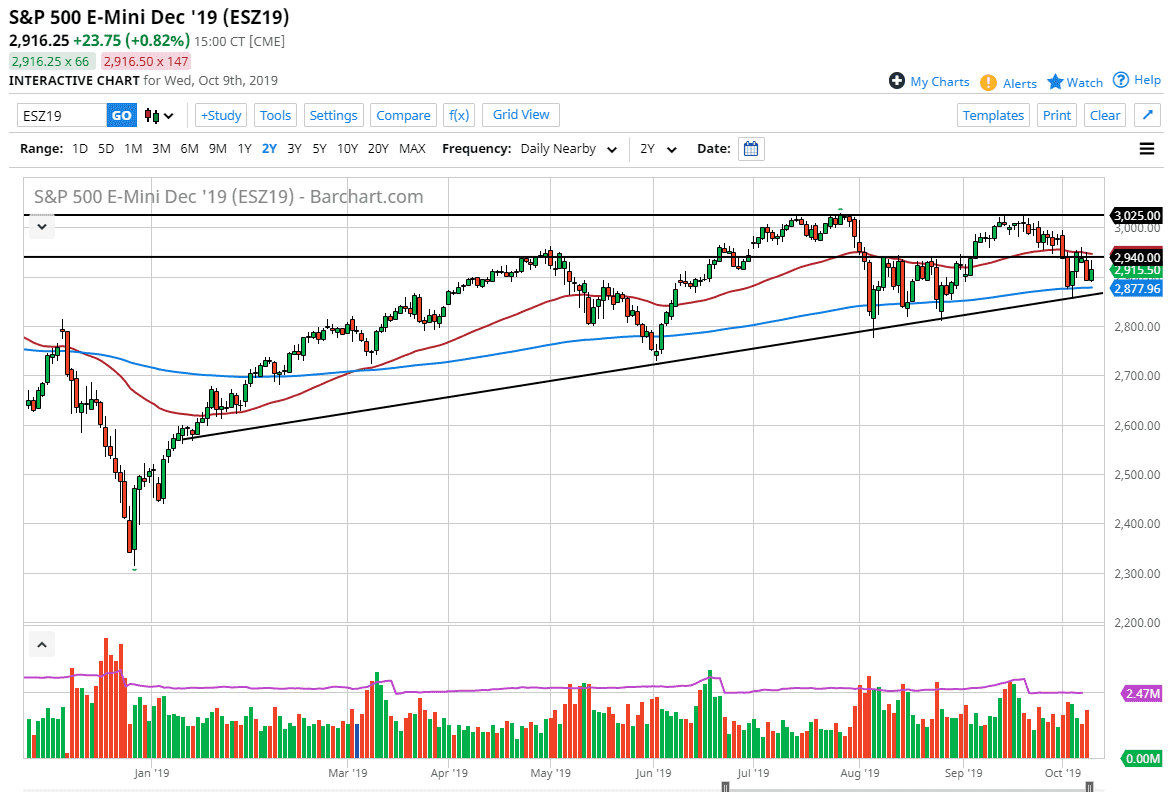

The S&P 500 has rallied a bit during the trading session on Wednesday, as we continue to see a lot of jockeying back and forth. This is a market that has a lot of moving pieces being thrown at it at the same time, so the fact that we are even still in an uptrend is rather impressive. That being said, we continue to see a lot of pressure at the 2940 level, which is an area that has offered quite a bit of interest going back and forth for some time. I think that the market continues to see a lot of back-and-forth and choppy trading as we have the Americans and the Chinese talking over the next couple of days.

To add even more fuel to the fire of choppiness, we are essentially trading between the 50 day EMA and the 200 day EMA, both of which look relatively flat. That just tells you that the market is trying to figure out where to go next. I suspect that the easiest trade is to simply wait for an impulsive candle stick and follow it. I don’t know that we get it on Thursday, and we may not even get it on Friday, because we have earnings season next week. There is a whole host of issues out there just waiting to happen, so it’s likely that what we will see is a lot of volatility, but maybe not a whole lot of real estate being covered.

Looking at this chart, if we were to break down below the 200 day EMA and the uptrend line, then the market is probably going to go looking towards 2800. If the market was to break down below the 2800 level, that could wipe out this market towards the 2700 level, perhaps even lower than that. Alternately, if we can clear the 2940 level on a daily close it’s possible that we could go to the highs again, as we are still very much in that uptrend. I anticipate that there will be a lot of rumors and Tweets out there throwing algorithms into spasms over the next couple of days, and I would make any trading decisions based upon a daily close and would not get caught up into the automated minutia of the minute by minute charts that day traders tend to use.