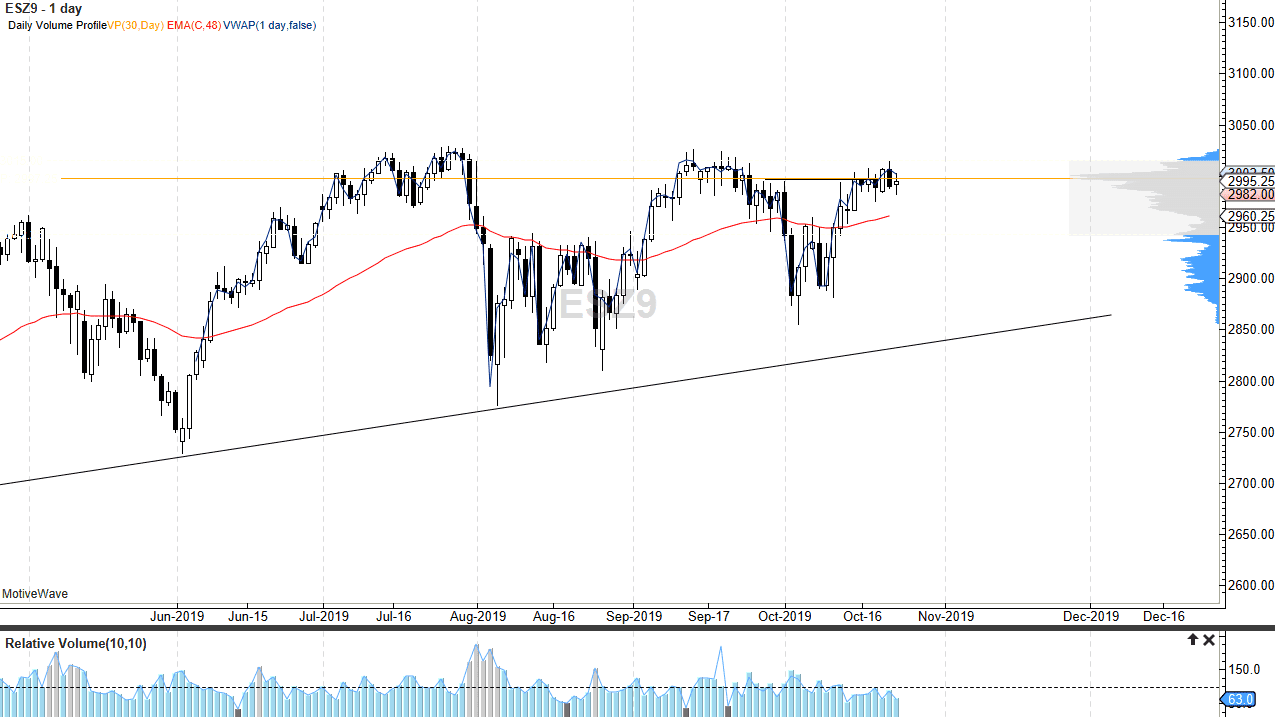

The S&P 500 continues to struggle overall, as although we haven’t broken down, we simply can’t get anywhere to the upside. Looking at the chart it’s easy to see that the area right around the 3000 level continues to attract a lot of attention as we can break above there for any significant move. Beyond that, the volume profile of the last 30 days certainly is spiking there, as the point of control is in that general vicinity. In other words, there has been more trading in the vicinity of 3000 than anything else.

For my money, it makes sense that it happens here, because there is a lot of psychological importance for the markets at these brown figures. We are in the midst of earning seasons which has its influence on the market as well, but it feels as if we are simply “killing time” in this general vicinity as nobody really knows what to do next. If we were to break out above the recent highs at roughly 3025, then the market could really start to take off. I suspect it’s probably just as likely to pull back towards the 50-day EMA given enough time and offer more value yet again. This is a market that will be very choppy back and forth, but I do think that given enough time we will find reason to go higher.

As far as selling is concerned, I think that we would have to break down below the 2900 level, as it would show a significant pullback and perhaps even continuation. I look at most pullbacks is simply an opportunity to pick up bits and pieces of value going forward. In general, I am bullish, but I recognize that like any other market you will need to find products “on sale” were buying. At these extended values and extended valuations, it’s difficult to get overly bullish about the market in general. However, the Federal Reserve will have its say, and once they give the market an idea as to whether they are going to be hawkish or dovish, and therefore it’s likely that a dovish Federal Reserve will be one of the main catalyst to finally throw this market above the recent highs and into the realm of the next leg higher. If you’ve been selling this market, you’ve been losing most of the time and that’s something that’s worth paying attention to.