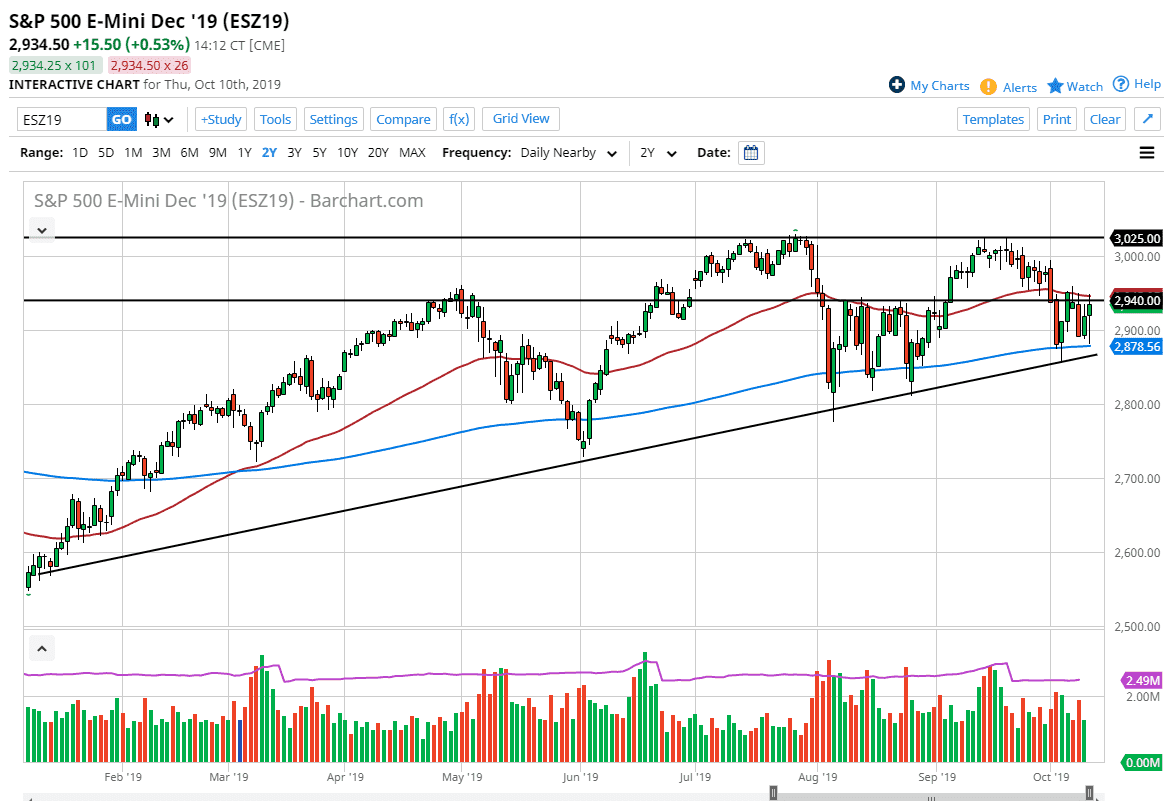

The S&P 500 will of course continue to be volatile as we have the Americans and the Chinese sitting down to talk in Washington DC. It’s hard to tell whether or not this would be a good or bad thing, but the reality is that a comprehensive trade deal is very unlikely to be had. If that is the case, we could get some type of short-term delay in tariffs or anything like that but that is probably going to be short-lived as far as an uptrend move. If we can break above the 50 day EMA on a daily close, then the market is likely to go looking towards the 3000 handle, possibly even the 3025 level after that. With that being the case, expect a lot of noise but that is a clear buying opportunity.

To the downside, if we were to break down from here, the 200 day EMA could come into play and keep this market picked up. The uptrend line also offers plenty of support. The candle stick is rather supportive looking, but at this point it’s only a matter time before some type of headline comes out of the trade negotiations that throws this market in one direction or the other. Needless to say, you are probably better off looking at this market as one that is probably more likely to try to go higher all things being equal, but there is the possibility of negativity creep in and due to the talks disappointing. The real trader probably won’t be seen until the day closes, which could give us a little bit of a “heads up” as to where we are going next.

If we were to break through the uptrend line, that would be extraordinarily negative, reaching down towards the 2800 level. That could kick off something rather ugly as well, considering that the market has been climbing this uptrend line for some time. To the upside, the 3000 level will be the initial target but we need some type of good news to make that happen. Longer-term, we are still in an uptrend, but certainly we have not only to worry about the headlines coming out of the trade negotiations, but at this point we are getting ready to go into earnings season next week. All things being equal, this is a market that should continue to see plenty of volatility in either direction.