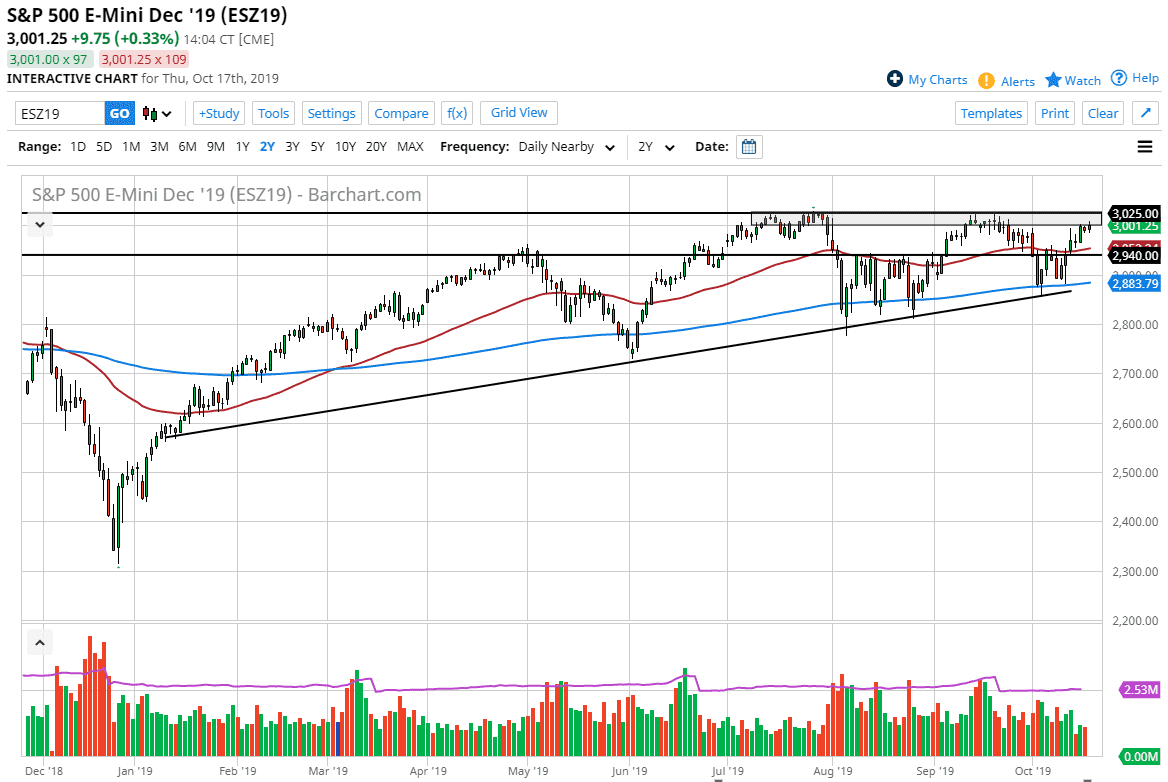

The S&P 500 is going to continue to rally towards the upside but overall it’s likely that there is a lot of resistance extending to the 3025 level. There is a lot of noise between here and there, so I feel that it’s only a matter time before the market breaks down. After all, the 50 day EMA underneath seems to be a bit of “fair value” at this point, just as it has been for some time. At this point, I am a buyer of dips in the S&P 500 because it continues to be the way to trade this market up to this point anyway. A break above the 3025 level does open up the possibility of a move towards the 3100 level which has been my longer-term target for some time.

If we were to break down below the 50 day EMA, then I think that the market probably goes down to the 200 day EMA or the uptrend line underneath there. I do think that this market breaks out because the overall attitude of the S&P 500 has been the epitome of a “buy on the dips” type of market. Ultimately, this is a market that is going through earnings season right now so it’s very likely that the market will eventually back and forth. One thing that seems to be a mainstay in this market is that every time it looks like it’s ready to roll over, buyer stepped in and pick up value.

With the Federal Reserve looking to cut interest rates going forward it’s very likely that will continue to show itself as bullish in the markets. Remember, Wall Street loves the idea of cheaper rates, which means that money is cheap to buy back stocks. All things being equal, this is a market that I fully anticipate seeing the breakout build itself up, and perhaps it will happen during the earnings season. After all, the market may be able to think about earnings for once, instead of the US/China trade situation which of course is fluid. However, it’s only a matter of time before the headlines cause a little bit of pressure to the downside. This is a market that I think continues to be bullish in general, so those headlines that’s in the market back down should be thought of as potential buying opportunities.