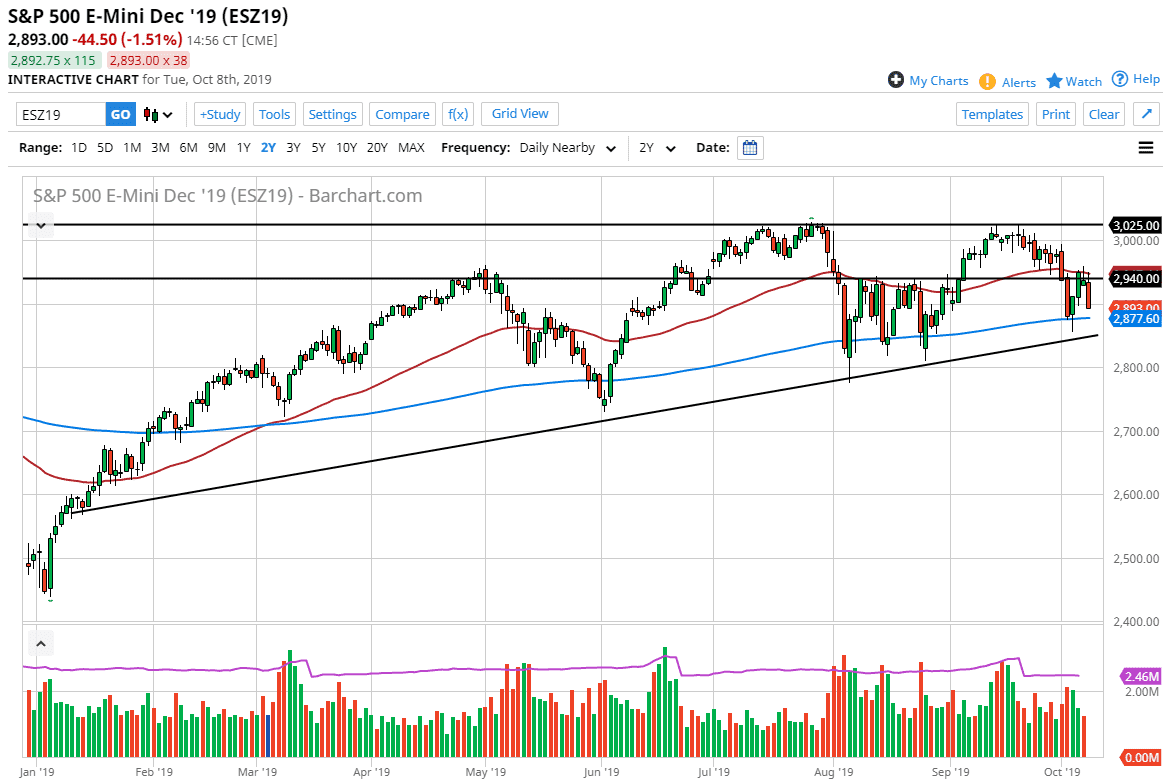

The S&P 500 has initially tried to rally during the trading session at the 2940 level, reaching towards the 50 day EMA. The 50 day EMA started to roll over, and at this point it’s likely that it will continue to offer significant resistance. What’s even more crucial is the fact that the candlestick closed at the very bottom of the day, and that of course is a very negative sign. Beyond that, the 200 day EMA is underneath, which currently sits at the 2877 handle. At this point, not only do we have that but we also have the uptrend line underneath. There are a lot of concerns out there and it makes quite a bit of sense that the S&P 500 continues to struggle.

That being said, the market is rather resilient considering how negative things could be. After all, the US/China trade talks are going on this week and it’s very likely that we are going to be disappointed. At this point, we already start to see sniping back and forth between various members of the United States and Chinese congregations, so at this point it’s almost certain that no deal will be had. Underneath we have the massive support of the 200 day EMA and the uptrend line, so I think there is a significant possibility that we could bounce from here. A break down below the uptrend line though would more than likely send the market towards the 2800 level. If we break down below there, it’s very likely that the market will probably go to the 2700 level.

We have earnings season coming out next week, so it’s very likely that people will start to focus on that after the US/China trade deal falls apart. Ultimately, that will then pick up the ball and drive the market in one direction or the other. At this point, the 3025 level is the all-time high that we will be aiming for we do rally, but in the short term I think what we are likely to see is a lot of choppiness in this general vicinity with a slightly upward tilt. One thing that should be noted though is that the most recent high is that it is lower now, so this could be the start of something rather ugly. The next 48 hours should be rather significant and could determine the next major move.