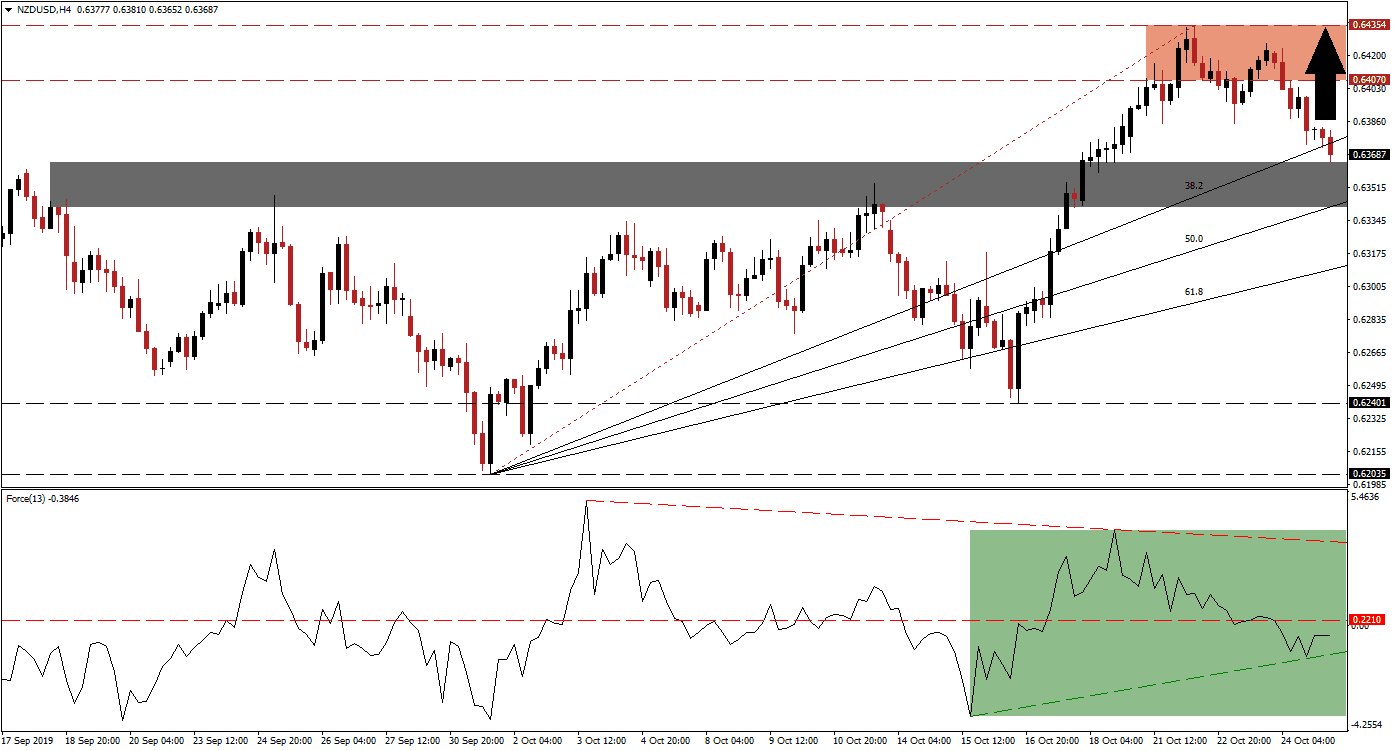

While bullish momentum in the NZD/USD deflated after being rejected by its resistance zone, the longer term fundamental picture points towards an extension of the advance. This currency pair has created a series of higher highs and higher lows which established the uptrend. The current counter-trend correction which took price action below its 38.2 Fibonacci Retracement Fan Support Level, turning it into resistance, and into the top range of its next short-term support zone; the 50.0 Fibonacci Retracement Fan Support Level has just moved into this zone as well. You can learn more about the Fibonacci Retracement Fan here.

The Force Index, a next generation technical indicator, shows the loss in momentum as the NZD/USD reached its resistance zone and started its reversal. This resulted in a breakdown below its horizontal support level in the Force Index, turned it into resistance and pushed it into negative conditions. As price action moved below its 38.2 Fibonacci Retracement Fan Support Level, this technical indicator reversed and an ascending support level was formed as marked by the green rectangle; a breakout above its horizontal resistance level is expected to follow and lead this currency pair back into its resistance zone.

Forex traders should now monitor price action as it reached its short-term support zone which is located between 0.63416 and 0.63648 as marked by the grey rectangle; this zone previously acted as a short-term resistance zone which rejected the NZD/USD on two previous breakout attempts. This currency pair may attempt to challenge its 50.0 Fibonacci Retracement Fan Support Level, but given the current fundamental outlook with a US Fed interest rate cut on the horizon next week, a breakdown below support is currently not expected. You can learn more about a breakdown here.

Following a confirmed breakout in the NZD/USD by the Force Index, the next resistance zone is located between 0.64070 and 0.64354 which is marked by the red rectangle. The end point of the Fibonacci Retracement Fan sequence is located in this zone from where a further breakout would require a fundamental catalyst which may be delivered as early as next week. The next resistance zone awaits this currency pair between 0.65333 and 0.65874 which marks a brief pause from a previous sharp sell-off. A move above the intra-day high of 0.64261, located inside the resistance zone which marks a lower high as the top range of the zone, is likely to result in a breakout and extension of the advance.

NZD/USD Technical Trading Set-Up - Price Action Reversal Scenario

Long Entry @ 0.63600

Take Profit @ 0.64350

Stop Loss @ 0.63350

Upside Potential: 75 pips

Downside Risk: 25 pips

Risk/Reward Ratio: 3.00

A breakdown in the Force Index below its ascending support level may pressure the NZD/USD below its short-term support zone. The ascending 61.8 Fibonacci Retracement Fan Support Level is expected to halt any descend, unless a fundamental catalyst will emerge which can extend a sell-off into its next long-term support zone located between 0.62035 and 0.62401. This should be considered a great long-term buying opportunity.

NZD/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.63150

Take Profit @ 0.62400

Stop Loss @ 0.63450

Downside Potential: 75 pips

Upside Risk: 30 pips

Risk/Reward Ratio: 2.50