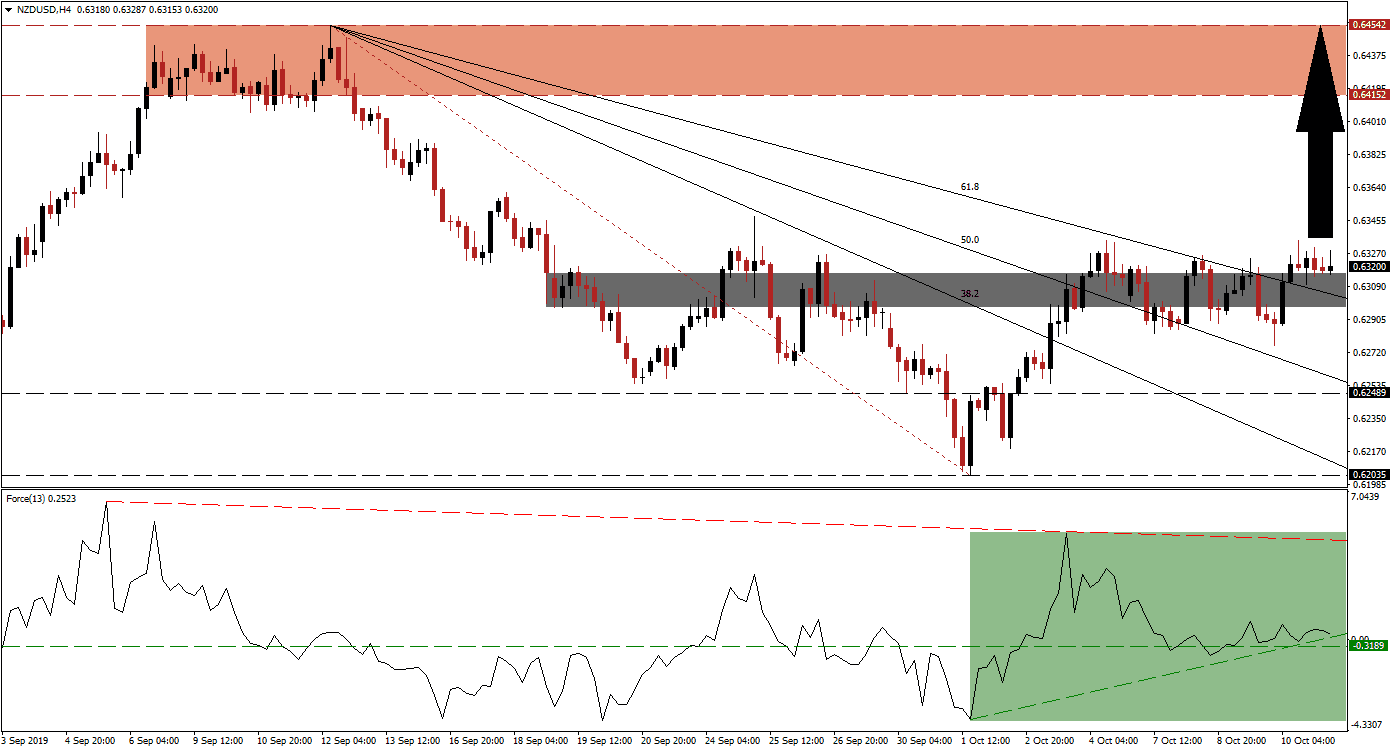

Following plenty on uncertainty about the state of trade talks between the US and China, they will continue into a second day as was originally scheduled. While a complete deal is not possible, a currency pact may be announced as talks conclude today and US President Trump will meet Chinese Vice Premier Liu He at the White House today. Positive sentiment allowed the NZD/USD to complete a breakout above its short-term support zone, despite slight worse-than-expected economic data out of New Zealand. Price action has now pushed through its entire Fibonacci Retracement Fan sequence, turning it from resistance into support.

The Force Index, a next generation technical indicator, confirmed the general increase in bullish momentum as the NZD/USD recovered from extreme oversold conditions. An ascending support level guided the Force Index higher which lifted it above its horizontal resistance level and turned it into support. This technical indicator is also trading in positive conditions which places bulls in charge of price action as marked by the green rectangle. More upside should be expected from this currency pair unless a fundamental development forces a change. You can learn more about the Fibonacci Retracement Fan, the Force Index and the Support Zone here.

Price action has maintained its double breakout, above its short-term support zone as well as above its 61.8 Fibonacci Retracement Fan Resistance Level which now acts as support, and forex traders should monitor the intra-day high of 0.63346. This level marks the current high of the rally which started after the NZD/USD recorded an intra-day low of 0.62035 and a move higher is likely to attract fresh buy orders. The short-term support zone, which was turned into a resistance zone on several occasions due to elevated volatility, is located between 0.62972 and 0.63163 as marked by the grey rectangle. The technical picture suggests more upside following the breakout.

As long as the Force Index will remain above its horizontal support level, the uptrend in the NZD/USD is expected to extend until it will reach its resistance zone. This zone is located between 0.64152 and 0.64542 which is marked by the red rectangle. Positive news flow surrounding today’s final day of trade talks can further support the rally as the New Zealand economy is dependent on China. Longer-term, the US Fed is expected to ease monetary policy further which will result in a higher NZD/USD moving forward. A breakout above its resistance zone is not expected until the next fundamental catalyst emerges. You can learn more about a Breakout, a Breakdown and the Resistance Zone here.

NZD/USD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 0.63200

Take Profit @ 0.64440

Stop Loss @ 0.62850

Upside Potential: 120 pips

Downside Risk: 35 pips

Risk/Reward Ratio: 3.43

This currency pair may retrace back into its 61.8 Fibonacci Retracement Fan Support Level which is located inside its short-term support zone. Should the Force Index move below its horizontal support level and into negative territory, a breakdown in the NZD/USD may follow. This could lead to a full retracement of the rally back into its next support zone which is located between 0.62035 and 0.62489. Any potential reversal into this zone should be considered a very good long-term buying opportunity as fundamentals support a higher NZD/USD moving forward.

NZD/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 0.62700

Take Profit @ 0.62250

Stop Loss @ 0.62900

Downside Potential: 45 pips

Upside Risk: 20 pips

Risk/Reward Ratio: 2.25